Why Natera Inc's Stock Skyrocketed 27% in a Quarter: A Deep Dive

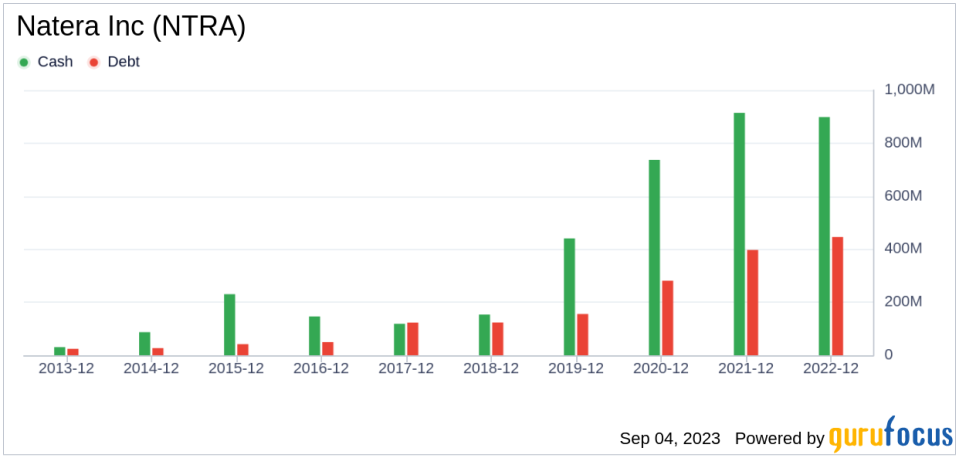

Natera Inc (NASDAQ:NTRA), a leading player in the Medical Diagnostics & Research industry, has seen a significant surge in its stock price over the past quarter. The company's market cap stands at $7.16 billion, with its stock price currently at $62.52. Over the past week, the stock price has seen a gain of 8.96%, and over the past three months, it has risen by an impressive 26.84%. The current GF Value of the company is $86.42, compared to the past GF Value of $92.14 three months ago. According to the GF Valuation, the stock is modestly undervalued, showing an improvement from being significantly undervalued three months ago.

Company Overview

Natera Inc is a diagnostic and research company that leverages proprietary molecular and bioinformatics technology to deliver innovative solutions. The company's key product offerings include the Panorama Non-Invasive Prenatal Test (NIPT), Horizon Carrier Screening (HCS), Signatera molecular residual disease (MRD) test, and Prospera, which assesses organ transplant rejection. These products play a crucial role in detecting chromosomal abnormalities, determining carrier status for severe genetic diseases, and monitoring cancer recurrence, among other applications.

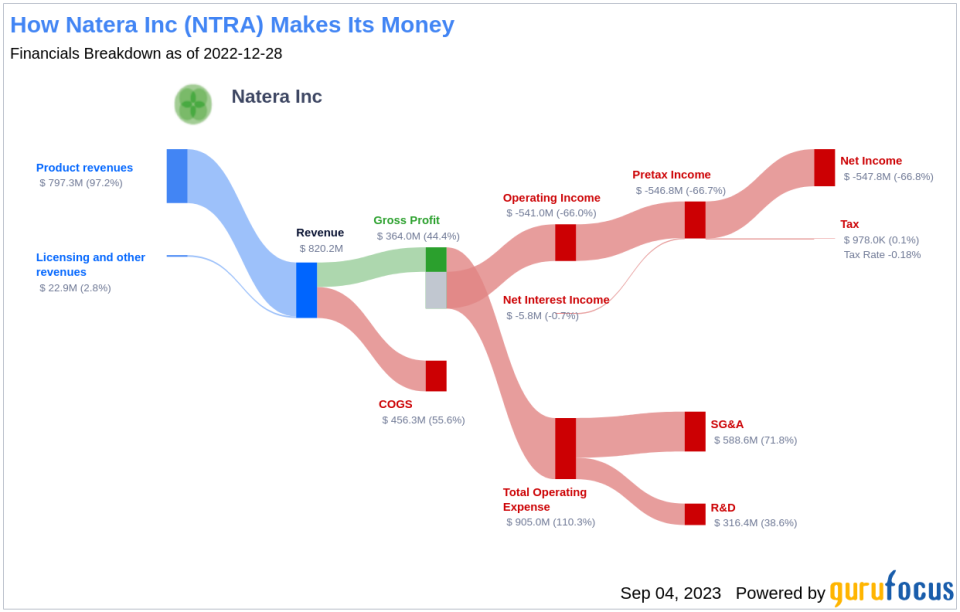

Profitability Analysis

When it comes to profitability, Natera Inc has a Profitability Rank of 3/10 as of 2023-06-30. The company's Operating Margin stands at -54.94%, which is better than 31.25% of the companies in the industry. The ROE is -92.76%, better than 17.35% of the companies, while the ROA is -42.39%, better than 27.85% of the companies. The ROIC is -145.73%, better than 14.41% of the companies.

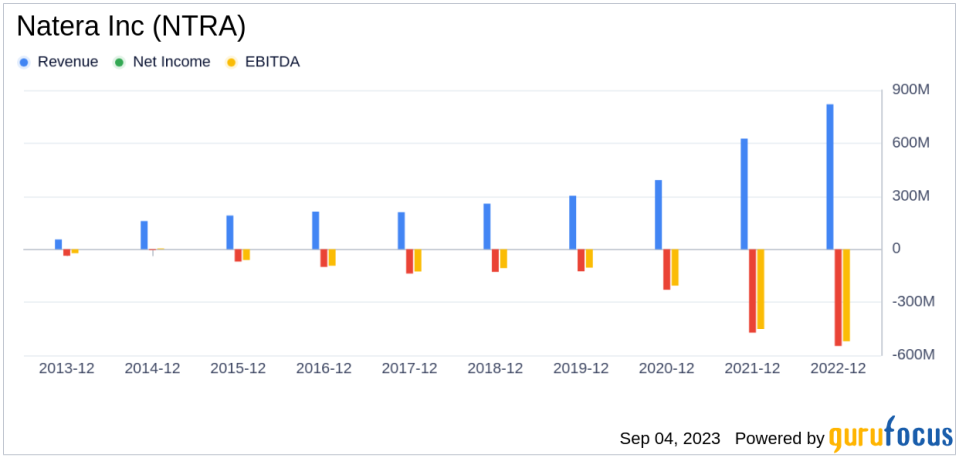

Growth Prospects

Natera Inc's Growth Rank is 7/10, indicating strong growth potential. The company's 3-Year Revenue Growth Rate per Share is 24.20%, better than 75.49% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 16.00%, better than 64.91% of the companies. The company's Total Revenue Growth Rate (Future 3Y To 5Y Est) is projected at 26.72%, better than 91.67% of the companies. However, the 3-Year EPS without NRI Growth Rate is -46.00%, and the 5-Year EPS without NRI Growth Rate is -21.60%, both of which are better than less than 10% of the companies in the industry.

Major Stock Holders

The top three holders of Natera Inc's stock are Stanley Druckenmiller (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio). Druckenmiller holds 893,030 shares, accounting for 0.78% of the total shares. Greenblatt holds 43,964 shares, making up 0.04% of the total shares. Jones holds 16,117 shares, representing 0.01% of the total shares.

Competitive Landscape

Natera Inc operates in a competitive industry, with Guardant Health Inc(NASDAQ:GH), Ortho Clinical Diagnostics Holdings PLC(OCDX), and Neogen Corp(NASDAQ:NEOG) being its top competitors. Guardant Health has a market cap of $4.12 billion, Ortho Clinical Diagnostics has a market cap of $4.19 billion, and Neogen Corp has a market cap of $5.05 billion.

Conclusion

In conclusion, Natera Inc has shown impressive stock performance over the past quarter, with a significant surge in its stock price. The company's profitability and growth prospects are promising, despite the competitive landscape. With major stockholders like Stanley Druckenmiller (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio), the company's future prospects look promising. However, investors should keep an eye on the company's EPS growth rate, which is currently lower than most companies in the industry.

This article first appeared on GuruFocus.