Why Ncino Inc's Stock Skyrocketed 21% in a Quarter: A Deep Dive

Ncino Inc (NASDAQ:NCNO), a leading provider of cloud-based software for financial institutions, has seen a significant surge in its stock price over the past quarter. The company's stock has gained 15.41% over the past week and a remarkable 21.12% over the past three months. This impressive performance is reflected in the company's GF Value, which currently stands at $73.28, indicating that the stock is significantly undervalued. This is a notable change from the past GF Value of $88.12, which suggested a possible value trap. This article will delve into the factors contributing to Ncino's stock performance and evaluate its potential as an investment opportunity.

Company Overview

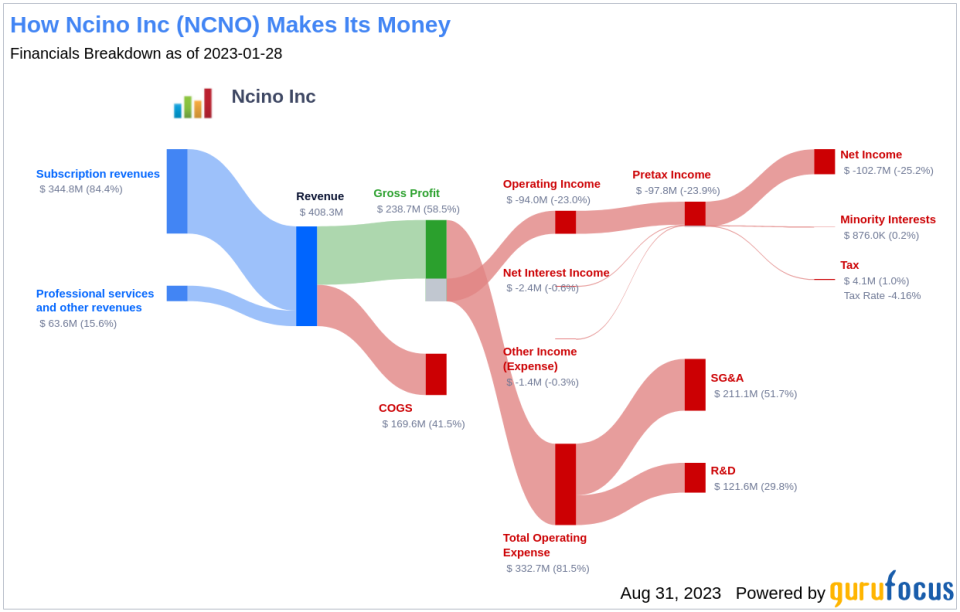

Ncino Inc operates in the software industry, providing cloud-based solutions that digitize, automate, and streamline complex processes for financial institutions. The company's software utilizes data analytics and artificial intelligence to enable financial institutions to onboard new clients, manage loans, open deposit accounts, and ensure regulatory compliance more effectively. Ncino generates the majority of its revenue from subscription services, primarily in the United States.

Profitability Analysis

Despite its impressive stock performance, Ncino's profitability rank stands at 3/10, indicating a relatively low level of profitability. The company's operating margin is -17.63%, which is better than 28.35% of companies in the industry. Its ROE and ROA are -8.05% and -6.38% respectively, outperforming 35.37% and 35.63% of companies in the industry. The ROIC of -6.22% is better than 36.18% of companies in the industry.

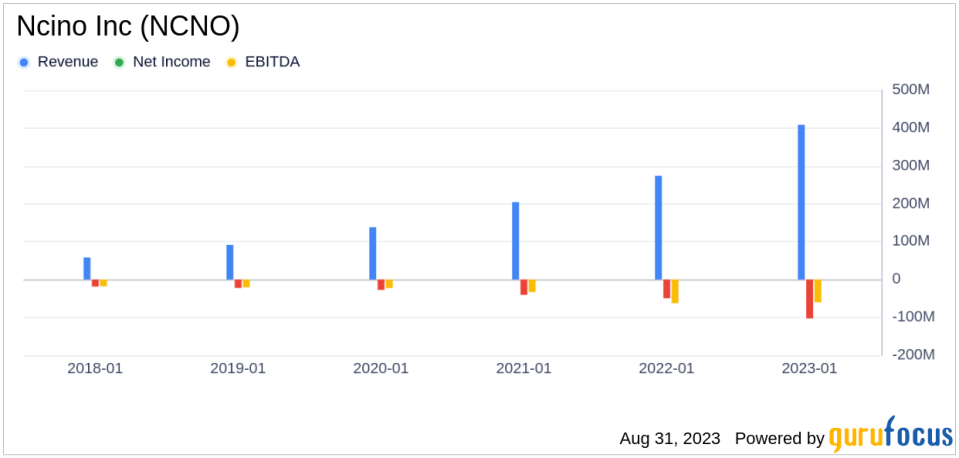

Growth Prospects

Ncino's growth rank is 8/10, indicating a high level of growth. The company's 3-year and 5-year revenue growth rates per share are 33.80% and 41.60% respectively, outperforming 86.99% and 94.98% of companies in the industry. However, its 3-year and 5-year EPS without NRI growth rates are -44.50% and -33.30% respectively, which are better than only 11.65% and 4.74% of companies in the industry.

Top Holders

The top three holders of Ncino's stock are Jim Simons (Trades, Portfolio), Chuck Royce (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio), holding 53,000, 26,897, and 9,630 shares respectively. These holdings represent 0.05%, 0.02%, and 0.01% of the company's shares.

Competitive Landscape

Ncino faces competition from several companies in the software industry. Its main competitors include Sprinklr Inc (NYSE:CXM) with a market cap of $4.04 billion, Forge Global Holdings Inc (NYSE:FRGE) with a market cap of $431.359 million, and Jamf Holding Corp (NASDAQ:JAMF) with a market cap of $2.12 billion.

Conclusion

In conclusion, Ncino's stock has performed impressively over the past quarter, gaining 21.12%. Despite its low profitability rank, the company's high growth rank and the significant undervaluation of its stock suggest potential investment value. However, investors should consider the company's competitive landscape and its profitability and growth metrics before making an investment decision.

This article first appeared on GuruFocus.