Why Nutanix Inc's Stock Skyrocketed 24% in a Quarter: A Deep Dive

Nutanix Inc (NASDAQ:NTNX), a leading player in the software industry, has seen a significant surge in its stock price over the past three months. As of September 22, 2023, the company's stock price stands at $34.89, with a market cap of $8.36 billion. Despite a slight dip of 1.81% over the past week, the stock has seen a robust growth of 24.28% over the past three months. According to the GF Value, a measure defined by GuruFocus.com that calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is fairly valued at $31.63, up from $29.82 three months ago.

Introduction to Nutanix Inc(NASDAQ:NTNX)

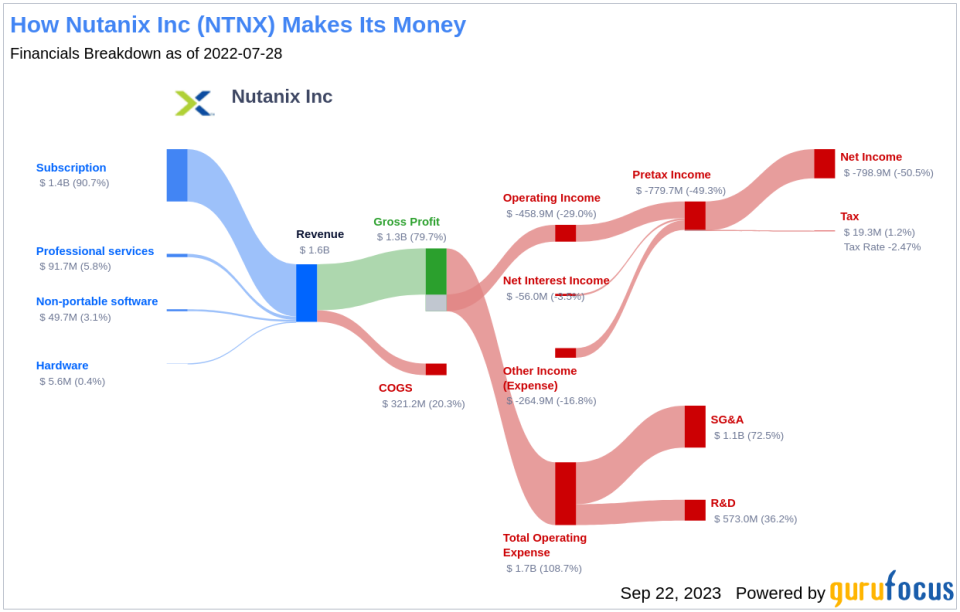

Nutanix Inc is a renowned name in the software industry, providing native hybrid cloud capabilities for businesses. The company's flagship offering, the Enterprise Cloud Platform, is a resilient, software-defined solution that integrates web-scale engineering and consumer-grade design, virtualization, and storage. The majority of Nutanix's revenue comes from the United States, although it also has a significant presence in Europe, the Middle East, Asia Pacific, Africa, and other regions.

Profitability Analysis of Nutanix Inc(NASDAQ:NTNX)

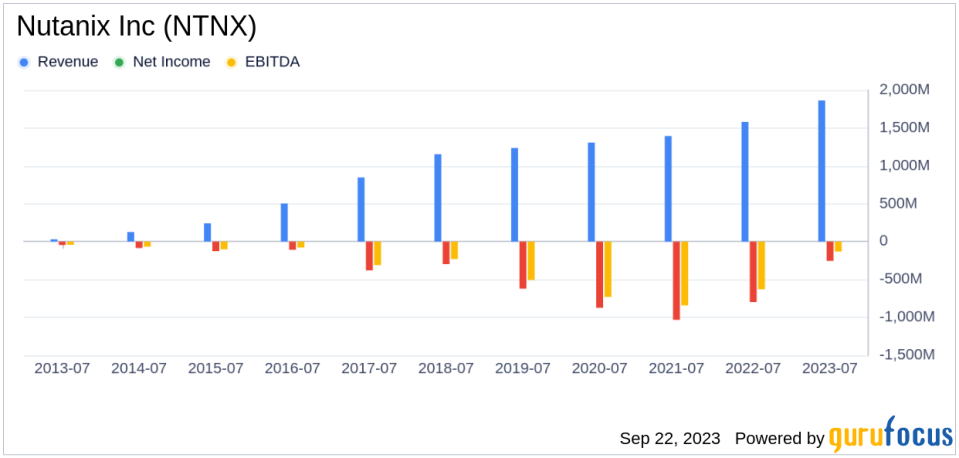

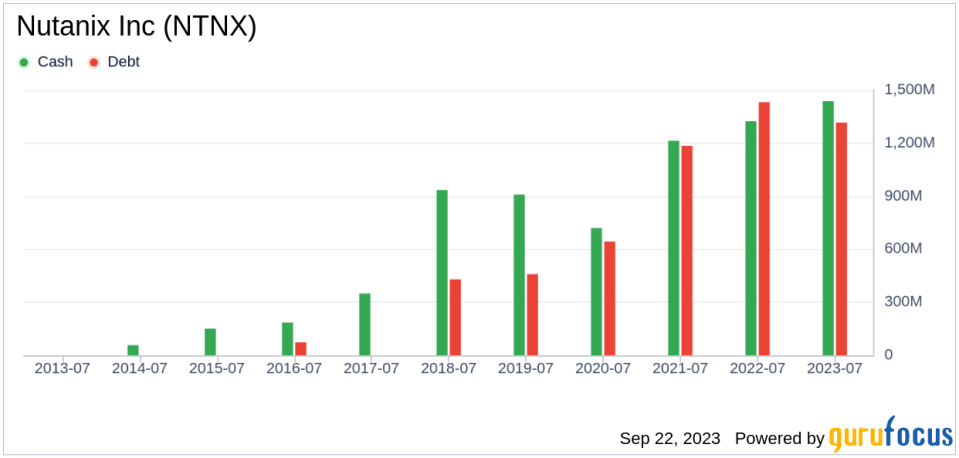

When it comes to profitability, Nutanix Inc's Profitability Rank stands at 2/10 as of July 31, 2023. This rank measures how profitable a company is and how likely the company's business will stay that way. The company's Operating Margin is -11.10%, which is better than 31.58% of the companies in the industry. The ROA is -10.57%, outperforming 29.56% of the companies, and the ROIC is -13.56%, better than 28.15% of the companies.

Growth Prospects of Nutanix Inc(NASDAQ:NTNX)

Nutanix Inc's Growth Rank is 5/10, indicating its growth relative to other companies. The company's 3-Year Revenue Growth Rate per Share is 5.90%, better than 44.84% of the companies, and the 5-Year Revenue Growth Rate per Share is 2.30%, outperforming 36.92% of the companies. The future total revenue growth rate estimate is 13.09%, better than 58.53% of the companies. The 3-Year EPS without NRI Growth Rate is 37.60%, better than 81.97% of the companies, and the 5-Year EPS without NRI Growth Rate is 6.30%, outperforming 38.93% of the companies.

Major Holders of Nutanix Inc(NASDAQ:NTNX) Stock

The top three holders of Nutanix Inc's stock are Al Gore (Trades, Portfolio), holding 16,668,816 shares (7.07%), PRIMECAP Management (Trades, Portfolio), holding 5,505,293 shares (2.34%), and Steven Cohen (Trades, Portfolio), holding 2,573,001 shares (1.09%).

Competitors of Nutanix Inc(NASDAQ:NTNX)

Nutanix Inc faces stiff competition in the software industry. Its main competitors include Engagesmart Inc(NYSE:ESMT) with a market cap of $2.95 billion, Varonis Systems Inc(NASDAQ:VRNS) with a market cap of $3.36 billion, and Appian Corp(NASDAQ:APPN) with a market cap of $3.17 billion.

Conclusion

In conclusion, Nutanix Inc has demonstrated strong growth over the past three months, with its stock price surging by 24.28%. Despite a slight dip over the past week, the company's stock remains fairly valued according to the GF Value. Nutanix's profitability and growth ranks, along with its operating margin, ROA, and ROIC, indicate a promising future for the company in the software industry. With major holders like Al Gore (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), and Steven Cohen (Trades, Portfolio) backing the company, Nutanix is well-positioned to face competition from Engagesmart Inc, Varonis Systems Inc, and Appian Corp.

This article first appeared on GuruFocus.