Why Ollie's Bargain Outlet Holdings Inc's Stock Skyrocketed 46% in a Quarter: A Deep Dive

Ollie's Bargain Outlet Holdings Inc (NASDAQ:OLLI) has been making waves in the stock market with its impressive performance. The company's market cap stands at $4.99 billion, with its stock price currently at $80.72. Over the past week, the stock has seen a gain of 13.16%, and over the past three months, it has surged by a remarkable 45.54%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of OLLI is $74.59, compared to its past GF Value of $75.17 three months ago. The stock's GF Valuation has shifted from 'Modestly Undervalued' three months ago to 'Fairly Valued' today.

Unpacking Ollie's Bargain Outlet Holdings Inc

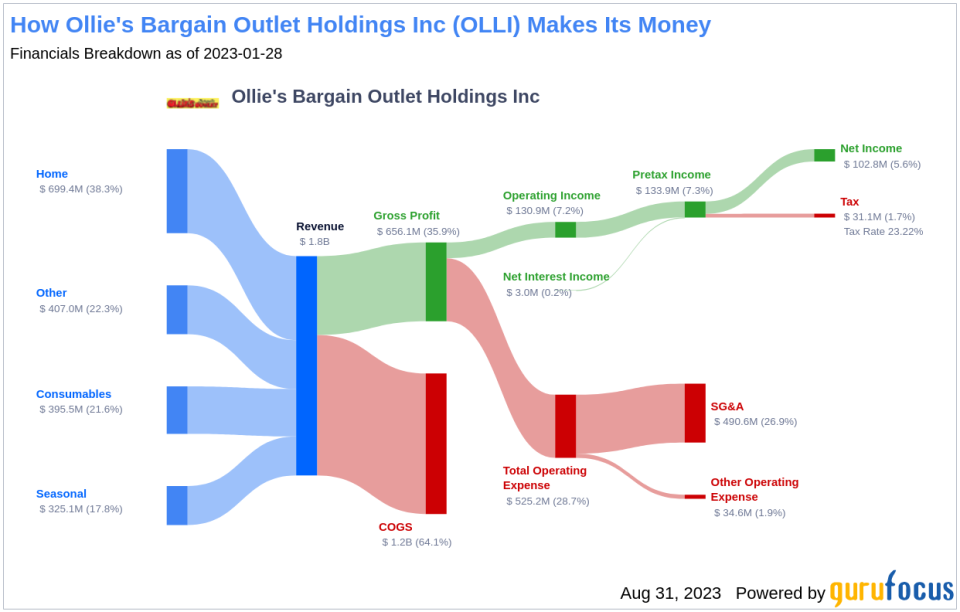

Ollie's Bargain Outlet Holdings Inc operates in the Retail - Defensive industry. The company is a retailer of brand-name merchandise at drastically reduced prices. It offers customers a selection of brand-name products, including housewares, food, books and stationery, bed and bath, floor coverings, toys, and hardware. It operates stores across the Eastern half of the United States. Its differentiated go-to-market strategy is characterized by a unique, fun, and engaging treasure hunt shopping experience, compelling customer value proposition, and witty, humorous in-store signage and advertising campaigns. These attributes have driven rapid growth and strong and consistent store performance for the company.

Profitability Analysis

Ollie's Bargain Outlet Holdings Inc boasts a high Profitability Rank of 8/10, indicating a high level of profitability. The company's Operating Margin is 8.10%, which is better than 86.56% of 305 companies in the same industry. The company's ROE, ROA, and ROIC, which are 9.08%, 5.98%, and 7.09% respectively, indicate strong profitability. These figures are better than 52.01%, 72.22%, and 61.24% of companies in the industry, respectively. The company has also demonstrated consistent profitability over the past 10 years, outperforming 99.67% of 300 companies.

Growth Prospects

The company's Growth Rank of 7/10 indicates strong growth potential. The company's 3-year and 5-year revenue growth rates per share are 10.90% and 12.60% respectively, outperforming 71.87% and 83.21% of companies in the industry. The company's future total revenue growth rate estimate over the next 3 to 5 years is 6.75%, better than 73.44% of 64 companies. However, the company's 3-year and 5-year EPS without NRI growth rates are -8.50% and 0.50% respectively, which are areas that could be improved.

Major Stock Holders

The top three holders of the company's stock are PRIMECAP Management (Trades, Portfolio), Steven Cohen (Trades, Portfolio), and Jeremy Grantham (Trades, Portfolio), who hold 0.88%, 0.77%, and 0.28% of the company's shares respectively.

Competitive Landscape

The company's main competitors in the retail - defensive industry include Pricesmart Inc (NASDAQ:PSMT) with a market cap of $2.53 billion, and Big Lots Inc (NYSE:BIG) with a market cap of $194.614 million.

Conclusion

In conclusion, Ollie's Bargain Outlet Holdings Inc has demonstrated strong stock performance, profitability, and growth potential. The company's unique business model and consistent profitability over the past 10 years have contributed to its impressive stock performance. However, the company's EPS growth rates could be improved. With major stockholders like PRIMECAP Management (Trades, Portfolio), Steven Cohen (Trades, Portfolio), and Jeremy Grantham (Trades, Portfolio), and a competitive position in the retail - defensive industry, Ollie's Bargain Outlet Holdings Inc is well-positioned for future success.

This article first appeared on GuruFocus.