Here’s why Orient Overseas (International) Limited’s (HKG:316) Returns On Capital Matters So Much

Today we are going to look at Orient Overseas (International) Limited (HKG:316) to see whether it might be an attractive investment prospect. Specifically, we’ll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

First, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. And finally, we’ll look at how its current liabilities are impacting its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE is a measure of a company’s yearly pre-tax profit (its return), relative to the capital employed in the business. All else being equal, a better business will have a higher ROCE. In brief, it is a useful tool, but it is not without drawbacks. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since ‘No two businesses are exactly alike.’

How Do You Calculate Return On Capital Employed?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for Orient Overseas (International):

0.0028 = US$92m ÷ (US$9.9b – US$1.6b) (Based on the trailing twelve months to June 2018.)

Therefore, Orient Overseas (International) has an ROCE of 0.3%.

View our latest analysis for Orient Overseas (International)

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

Is Orient Overseas (International)’s ROCE Good?

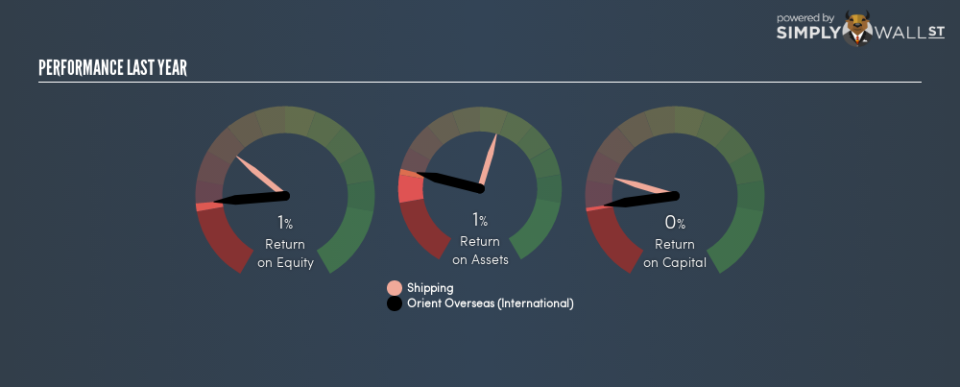

ROCE is commonly used for comparing the performance of similar businesses. We can see Orient Overseas (International)’s ROCE is meaningfully below the Shipping industry average of 3.0%. This could be seen as a negative, as it suggests some competitors may be employing their capital more efficiently. Putting aside Orient Overseas (International)’s performance relative to its industry, its ROCE in absolute terms is poor – considering the risk of owning stocks compared to government bonds. There are potentially more appealing investments elsewhere.

Orient Overseas (International)’s current ROCE of 0.3% is lower than its ROCE in the past, which was 3.1%, 3 years ago. So investors might consider if it has had issues recently.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. ROCE can be misleading for companies in cyclical industries, with returns looking impressive during the boom times, but very weak during the busts. ROCE is, after all, simply a snap shot of a single year. Since the future is so important for investors, you should check out our free report on analyst forecasts for Orient Overseas (International).

Orient Overseas (International)’s Current Liabilities And Their Impact On Its ROCE

Short term (or current) liabilities, are things like supplier invoices, overdrafts, or tax bills that need to be paid within 12 months. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

Orient Overseas (International) has total liabilities of US$1.6b and total assets of US$9.9b. Therefore its current liabilities are equivalent to approximately 16% of its total assets. This is not a high level of current liabilities, which would not boost the ROCE by much.

Our Take On Orient Overseas (International)’s ROCE

That’s not a bad thing, however Orient Overseas (International) has a weak ROCE and may not be an attractive investment. You might be able to find a better buy than Orient Overseas (International). If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

I will like Orient Overseas (International) better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.