Why Is Palo Alto Networks So Cheap?

Palo Alto Networks Inc. (NASDAQ:PANW) shares took a huge hit after its fiscal second-quarter earnings, which were released on Feb. 20. This was probably overdone, so the stock now looks cheap. This analysis will explain why using a simple free cash flow yield model to value its common shares.

The stock fell from $366.16 before the earnings report to a low of $262.01 the next day. It has since recuperated to $316.15 by Wednesday, Feb. 28. But it could still be worth more.

I estimate the stock is worth at least 18% more at over $376 per share. This is based on the company's free cash flow margin guidance, analysts' revenue estimates and a simple FCF yield model.

Palo Alto Networks' FCF and SaaS subscriptions

Palo Alto Networks makes money selling cybersecurity software-as-service modules (slightly over 80% of total revenue) and the rest in hardware and networking products.

For the quarter ending Jan. 31, its revenue was up 19%. Analysts had been expecting slightly less than that. So that should have been a high point for the stock.

But the market's disappointment came when management said its adjusted free cash flow was only $654 million compared to $685 million a year earlier. Moreover, in the prior quarter, its adjusted FCF was much higher at $1.48 billion.

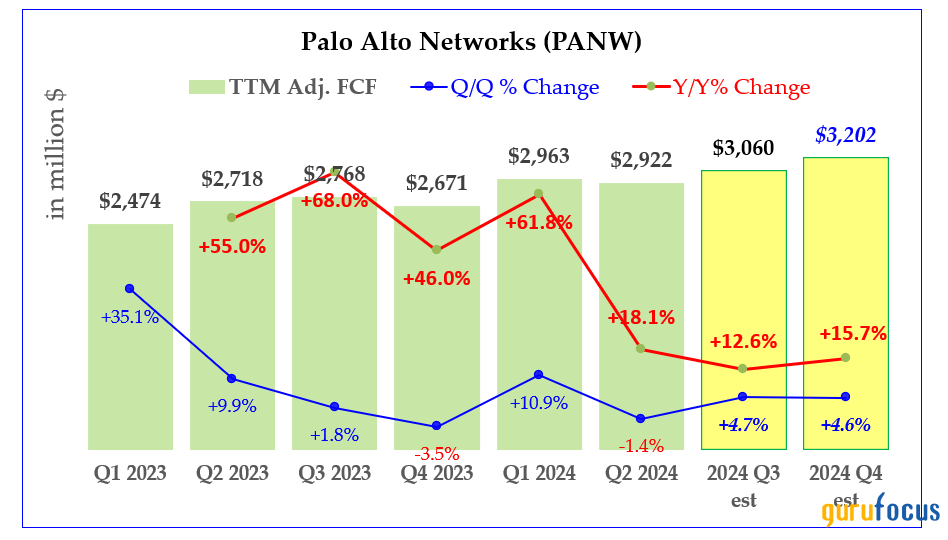

The company's history of quarterly adjusted free cash flow can be seen in the table below. It shows that FCF is very seasonal most of it comes during its fiscal first quarter ending Nov. 30.

Source: Company presentations and Hake estimates.

As a result, it is best to just look at trailing 12-month adjusted free cash flow. This shows that the quarterly changes are mostly negative except for the first fiscal quarter.

But the year-over-year changes in trailing 12-month adjusted FCF is very strong. This can be seen in the chart below. Note that the changes are very stable.

Source: Hake

This is because typically most corporate clients will renew their SaaS subscriptions once a year. The quarterly changes usually relate to new subscriptions.

It turns out most of the company's renewals occur before the end of the calendar year in November. That is because nobody wants to make corporate decisions during December as vacations and travel take over itineraries.

So the bottom line is the company is very profitable on a trailing 12-month basis.

FCF margins are strong

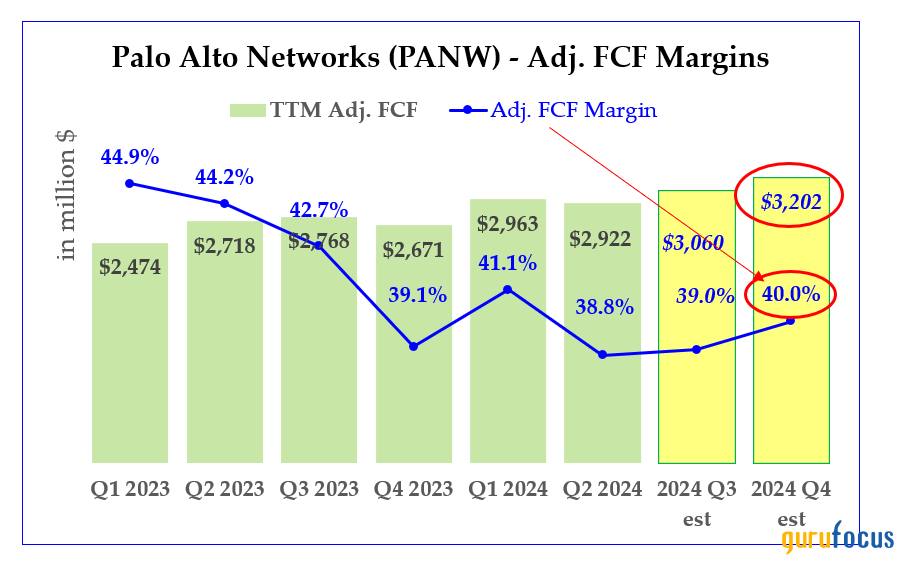

Palo Alto Networks' profitability from a free cash flow margin standpoint (i.e., FCF/revenue) is very high and relatively stable. This can be seen looking at its adjusted free cash flow margins on a trailing 12-month basis.

Source: Hake.

The chart above shows that, although declining, its FCF margins over the past 12 months have been high at around 39% to 45%.

Moreover, management itself said it expects full fiscal year adjusted FCF margins to be between 38% and 39%. I suspect they are being conservative, so I estimated 40% for the fiscal year ending July 31.

Based on analysts' revenue estimate of $8 billion for the year ending July 31, that leads to an estimate, using a 40% FCF margin. of $3.20 billion.

However, if we look at analysts' revenue estimates for $9.16 billion for next year, the average over the next 12 months is about $8.50 billion. Therefore, by the end of calendar 2024, the company will be on a run rate for $8.60 billion in revenue and $3.43 billion in adjusted free cash flow.

We can use that to set a price target for the stock

Setting a price target using FCF yield

One way to value the stock is to assume it pays out its free cash flow as a dividend. For example, if we estimate that one-third of adjusted free cash flow is paid as a dividend, that would be:

1/3 x $3.43 billion (adjusted FCF estimate in the next 12 months) = $1.14 billion

That is because typically tech companies will leave some of its FCF to buy back shares as well as accumulate cash to use in acquisitions or debt reduction.

Palo Alto Networks has no long-term debt and $3.37 billion in cash and securities. As such, it could afford to pay out as much as 50% of adjusted free cash flow as a dividend.

But, just to be conservative, let's say it pays out 35% of the $3.43 billion in estimated free cash flow. That means its dividend will cost the company $1.2 billion (i.e., 0.35 x $3.43 billion).

How will the stock market value this? I submit that the market will give the stock at least a 1% dividend yield. So here is how that works out:

$1.2 billion in dividends / 0.01 = $120 billion market valuation

$120 billion / $101 billion market value today = 19% potential upside

In other words, the stock will be worth at least 19% higher, or $376.22 per share.

Bottom line

The bottom line is Palo Alto Networks has a stable free cash flow outlook. This means the stock can be valued much higher.

In fact, on the upper limit if the stock were to have a 0.80% dividend yield, it could be worth $150 billion (i.e., $1.2 billion/ 0.008), which is 48.50% higher than today's price.

Analysts tend to agree with me. For example, AnaChart, a new sell-side stock analyst site that surveys analysts, shows the average of 38 analysts' price targets is $359.19. That implies an upside of over 13.60% from here.

The bottom line is Palo Alto Networks is likely to retrace its recent tumble.

This article first appeared on GuruFocus.