Why Permian Basin Royalty Trust (NYSE:PBT) Has Zero-Debt On Its Balance Sheet

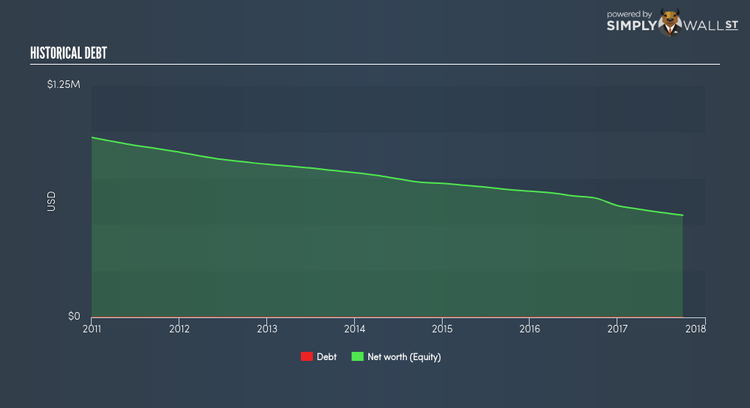

The direct benefit for Permian Basin Royalty Trust (NYSE:PBT), which sports a zero-debt capital structure, to include debt in its capital structure is the reduced cost of capital. However, the trade-off is PBT will have to adhere to stricter debt covenants and have less financial flexibility. While zero-debt makes the due diligence for potential investors less nerve-racking, it poses a new question: how should they assess the financial strength of such companies? I will go over a basic overview of the stock’s financial health, which I believe provides a ballpark estimate of their financial health status. View our latest analysis for Permian Basin Royalty Trust

Is PBT right in choosing financial flexibility over lower cost of capital?

Debt capital generally has lower cost of capital compared to equity funding. However, the trade-off is debtholders’ higher claim on company assets in the event of liquidation and stringent obligations around capital management. The lack of debt on PBT’s balance sheet may be because it does not have access to cheap capital, or it may believe this trade-off is not worth it. Choosing financial flexibility over capital returns make sense if PBT is a high-growth company. A revenue growth in the teens is not considered high-growth. PBT’s revenue growth of 18.52% falls into this range. More capital can help the business grow faster. If PBT is not expecting exceptional future growth, then the decision to avoid may cost shareholders in the long term.

Can PBT pay its short-term liabilities?

Since Permian Basin Royalty Trust doesn’t have any debt on its balance sheet, it doesn’t have any solvency issues, which is a term used to describe the company’s ability to meet its long-term obligations. But another important aspect of financial health is liquidity: the company’s ability to meet short-term obligations, including payments to suppliers and employees. Looking at PBT’s most recent $2.7M liabilities, it appears that the company has maintained a safe level of current assets to meet its obligations, with the current ratio last standing at 1.38x. For oil and gas companies, this ratio is within a sensible range since there’s sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Next Steps:

Are you a shareholder? As a high-growth company, it may be beneficial for PBT to have some financial flexibility, hence zero-debt. Since there is also no concerns around PBT’s liquidity needs, this may be its optimal capital structure for the time being. In the future, its financial position may be different. You should always be researching market expectations for PBT’s future growth.

Are you a potential investor? Permian Basin Royalty Trust is a fast-growing company, making financial flexibility a valuable option for the company. In addition, its high liquidity ensures the company will continue to operate smoothly should unfavourable circumstances arise. In order to build your conviction in the stock, you need to also analyse PBT’s track record. You should continue your analysis by taking a look at PBT’s past performance to conclude on PBT’s financial health.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.