Why You Should Retain American International (AIG) Stock Now

American International Group, Inc. AIG is well-poised to grow due to strong Global Commercial business, improving net investment income and new business growth.

AIG continues to benefit from strong performance in its General Insurance business and the strengthening of insurance rates. Moreover, divestitures are helping the company to streamline its business and enhance capital allocation.

AIG is a leading global insurance organization providing a wide range of property casualty insurance, life insurance, retirement solutions and other financial services.

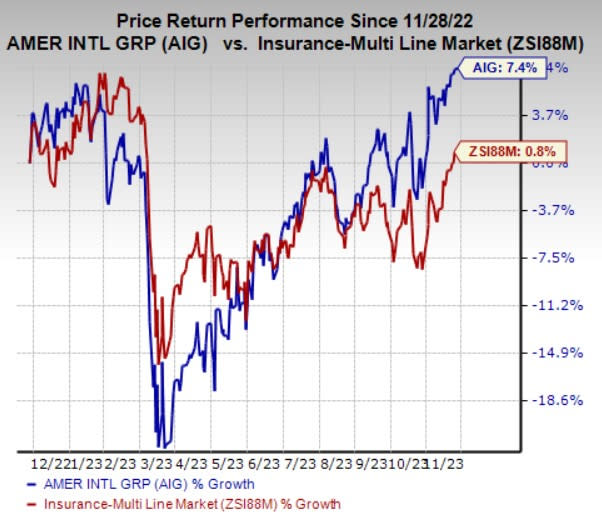

Zacks Rank & Price Performance

American International currently carries a Zacks Rank #3 (Hold). In the past year, the stock has gained 7.4% compared with the industry’s growth of 0.8%.

Image Source: Zacks Investment Research

Rising Estimates

The Zacks Consensus Estimate for AIG’s 2023 earnings per share is pegged at $6.63, indicating a 45.7% increase from the year-ago reported figure of $4.55. The Zacks Consensus Estimate for AIG’s 2023 revenues is pegged at $48.7 billion, indicating a 7.4% increase from the year-ago reported figure of $45.4 billion.

The company beat earnings estimates in each of the last four quarters, the average surprise being 11.5%.

Business Tailwinds

A significant portion of AIG’s total revenues comes from premiums, which is expected to grow further due to strong performance in commercial lines and rate increases contributing to higher pricing. Our estimate for 2023 operating revenues suggests 7.4% year-over-year growth.

The General Insurance segment accounted for 57.7% of total revenues in the first nine months of 2023.This segment delivered strong results in the third quarter due to the improving performance of Lexington and Global Commercial businesses. North America Commercial is expected to aid the results of this business segment due to strong growth in net premiums thanks to Lexington and Retail Property. Strong retention, rate increases and new businesses have been the key drivers for the Lexington business.

Total net investment income increased 25.3% year over year in the first nine months of 2023. A high-interest rate environment should provide an impetus to growth in net investment income. In order to take advantage of higher interest rates, AIG has repositioned its General Insurance portfolio to gain higher yields but remains careful about maintaining credit quality and duration. This is likely to result in higher net investment income in 2023.

The company is delivering well on its objective to deliver 10% plus adjusted return on capital employed. Separation and deconsolidation of Corebridge, underwriting excellence, debt reduction and dividend increases should further help the company realize its objectives.

The company rewarded its shareholders with $785 million in repurchases and dividends worth $254 million in the third quarter, reflecting its balanced capital management strategy. This implies that the company’s shares are a good buy for investors looking for returns in the form of dividends.

However, AIG’s high leverage is a concern. The company exited the third quarter with short-term and long-term debt of $21.3 billion, while the cash balance was $2 billion. We expect interest expenses to rise 8.6% in 2023. American International’s net debt-to-capital of 6.2% at the end of the third quarter was significantly higher than the industry’s average. Nevertheless, we believe that a systematic and strategic plan of action will drive growth in the long term.

Stocks to Consider

Some better-ranked stocks in the insurance space include Arch Capital Group Ltd. ACGL, Aflac Incorporated AFL and Chubb Limited CB. Arch Capital currently sports a Zacks Rank #1 (Strong Buy), while Aflac and Chubb carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Arch Capital’s earnings surpassed estimates in each of the last four quarters, the average surprise being 35.2%. The Zacks Consensus Estimate for ACGL’s 2023 earnings and revenues indicates a rise of 58.1% and 32.6%, respectively, from the year-ago actuals. The consensus mark for ACGL’s 2023 earnings has moved 11% north in the past 30 days.

The bottom line of Aflac beat estimates in each of the trailing four quarters, the average beat being 14.5%. The Zacks Consensus Estimate for AFL’s 2023 earnings indicates a rise of 18.2% from the year-ago tally. The consensus mark for AFL’s 2023 earnings has moved 4.7% north in the past 30 days.

Chubb’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 6.5%. The Zacks Consensus Estimate for CB’s 2023 earnings indicates a rise of 25.9%, while the same for revenues suggests an improvement of 10.6% from the respective year-ago actuals. The consensus mark for CB’s 2023 earnings has moved 1.2% north in the past 30 days.

Shares of Arch Capital, Aflac and Chubb have gained 47.5%, 17.1% and 5.4%, respectively, in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report