Why You Should Retain Cousins Properties (CUZ) Stock Now

Cousins Properties’ CUZ unmatched portfolio of class A office assets, concentrated in the high-growth markets in the Sun Belt region, positions it well to ride the growth curve. Its capital-recycling efforts and a robust balance sheet augur well. However, a competitive landscape and high supply in the office real estate market are expected to adversely impact Cousins Properties’ pricing power. Also, elevated interest rates add to its concerns.

What’s Aiding It?

With the steady return of the workforce to offices, Cousins Properties has been witnessing a recovery in demand for its highly-quality, well-placed office properties, as evidenced by the rebound in the new leasing volume.

In the nine months ended Sep 30, 2023, Cousins Properties executed 101 leases for a total of 1.2 million square feet of office space, with a weighted average term of 7.7 years. This included 691,232 square feet of new and expansion leases, denoting 55.7% of the total leasing activity.

Given the favorable migration trends and a pro-business environment in the Sun Belt markets, corporate relocations and expansions are likely to continue in the region, boosting demand for CUZ’s properties in the quarters ahead.

Moreover, the company has a well-diversified, high-end tenant roster with less dependence on a single industry. This enables it to enjoy steady revenues over different economic cycles. For 2023, we estimate a year-over-year increase of 6.7% in rental property revenues.

Cousins Properties’ capital-recycling moves to enhance its portfolio quality with trophy assets’ acquisitions and opportunistic developments in high-growth Sun Belt submarkets seem encouraging for long-term growth. It also makes strategic dispositions for a better portfolio mix.

In the last two years, the company sold more than a billion worth of slow-growth assets and redeployed the proceeds for developing and acquiring highly differentiated amenitized properties in Austin, Nashville, Atlanta, Tampa and Charlotte.

CUZ maintains a robust balance sheet position and exited the third quarter of 2023 with cash and cash equivalents of $6.9 million. As of Sep 30, 2023, it had a borrowing capacity of $855.5 million under its $1 billion credit facility. With limited near-term debt maturities and ample financial flexibility, the company is well-positioned to capitalize on future growth opportunities.

Solid dividend payouts are arguably the biggest enticements for REIT shareholders and CUZ has remained committed to that. The company has increased its dividend five times in the last five years, and the five-year annualized dividend growth rate is 20.01%. Given the company’s strong financial position, its dividend payment is likely to be sustainable in the upcoming period. Check Cousins Properties’ dividend history here.

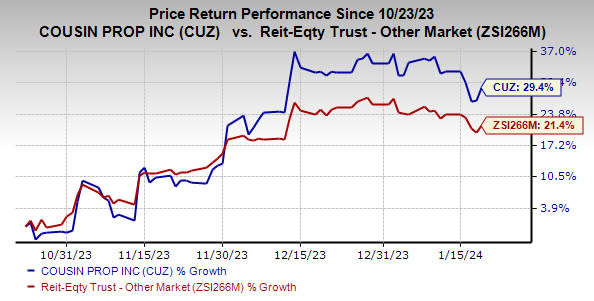

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 29.4% compared with the industry's upside of 21.4%.

Image Source: Zacks Investment Research

What’s Hurting it?

Competition from developers, owners and operators of office properties and other commercial real estate is likely to limit Cousins Properties’ ability to retain tenants at relatively higher rents and dent its pricing power.

Moreover, an anticipated rise in construction activity is poised to augment the supply of new Class A office space in the company's market. Given the competitive landscape, it may become increasingly challenging for it to backfill near-term tenant move-outs, resulting in lesser scope for rent and occupancy growth. Further, given the current macroeconomic uncertainties, it is expected that near-term demand for office spaces will remain choppy.

A high interest rate environment is a concern for Cousins Properties. The company may find it difficult to purchase or develop real estate as borrowing costs will likely be on the higher side due to elevated rates. Moreover, the dividend payout may become less attractive than the yields on fixed-income and money market accounts.

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Host Hotels & Resorts HST and EastGroup Properties EGP, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Host Hotels’ 2023 funds from operations (FFO) per share is pegged at $1.92, suggesting year-over-year growth of 7.3%.

The Zacks Consensus Estimate for EastGroup Properties’ 2023 FFO per share stands at $7.72, indicating an increase of 10.3% from the year-ago reported figure.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report