Why You Should Retain ExlService (EXLS) in Your Portfolio

ExlService Holdings, Inc. EXLS, a leading data analytics and digital solutions firm, partners with clients to boost business outcomes and drive growth. The company leverages deep domain expertise, data, advanced analytics, cloud, artificial intelligence (AI), and Machine Learning (ML) to deliver agile solutions and manage complex operations for top companies across industries like insurance, healthcare, banking, media, and retail.

For third-quarter 2023, revenues are expected to register a 12.3% rise, the Zacks Consensus Estimate of which is currently pegged at $405.61 million. The consensus mark for third-quarter earnings is pegged at 34 cents per share, which indicates growth of 9.7% from the year-ago reported figure.

EXLS has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Factors in Favor

The company's growth strategy includes forming partnerships and making strategic acquisitions. In 2022, it collaborated with Ernst & Young LLP to drive digital transformation in insurance, financial services, and healthcare. EXLS also joined forces with other partners to invest in tech startups through Plug and Play Financial Services Fund I, L.P.

Additionally, in 2022, the company acquired assets from Inbound Media Group, LLC, thus enhancing its digital marketing services in the insurance sector. Also, in 2021, it acquired Clairvoyant, a global firm specializing in data, AI, ML, and cloud services, to strengthen its analytics capabilities and support clients in various industries.

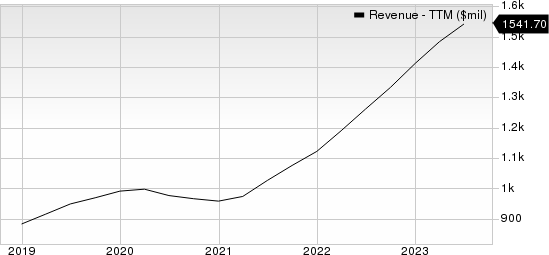

ExlService Holdings, Inc. Revenue (TTM)

ExlService Holdings, Inc. revenue-ttm | ExlService Holdings, Inc. Quote

The company maintains a strategic focus on large markets such as insurance, healthcare, banking, retail, media, and technology, while also exploring opportunities in emerging industries. It is actively expanding the clientele in finance, accounting, and consulting services across all business segments. Equipped with expertise in digital technologies, the company assists clients throughout their digital transformation journey by integrating domain knowledge with data, advanced analytics, cloud computing, AI, and ML. Anticipated demand for its services is expected to demonstrate continuous growth in the upcoming years.

ExlService displays a strong liquidity position. The company’s current ratio at the end of second-quarter 2023 was 2.37 higher than the year-ago figure of 2.11. An increasing current ratio indicates the company is not likely to face any issues meeting its short-term obligations.

Risks

The company relies significantly on a few major clients for a substantial portion of its revenues. Any shift in demand from these key clients, whether due to technological changes, economic factors, or other reasons, could adversely affect the business, financial health, and reputation in the market. In 2022, the top three customers contributed 16.3% to revenues, down from 18.7% in 2021. The top ten customers represented 34.9% of revenues in 2022, a decrease from 38.1% in 2021.

Zacks Rank and Stocks to Consider

EXLS currently carries a Zacks Rank #3 (Hold).

The following better-ranked stocks from the Business Services sector are worth consideration:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9% The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.72 per share, indicating a 14% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings suggests growth of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

ExlService Holdings, Inc. (EXLS) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report