Why You Should Retain ManpowerGroup (MAN) in Your Portfolio

ManpowerGroup, Inc. MAN has performed well on the bourses in the past three months, gaining 5.3% compared with its industry’s 1.2% increase.

ManpowerGroup is actively investing in technology to enhance operational efficiency and productivity. Thanks to a robust cash position, the company can actively pursue strategic acquisitions and fund growth-oriented projects. Acquisitions play a pivotal role in expanding ManpowerGroup's diverse portfolio and driving top-line growth. The company also maintains a reliable history of consistently paying dividends and repurchasing shares.

Factors Boding Well

Acquisitions will remain the driving force behind ManpowerGroup's revenue growth, with the company actively pursuing global investments. In 2022, it acquired Tingari, a talent solutions company in France. This acquisition is aligned with ManpowerGroup's strategic goal of diversification, driven by a singular objective, which is aiding in the realization of full employment in France and advancing social inclusion.

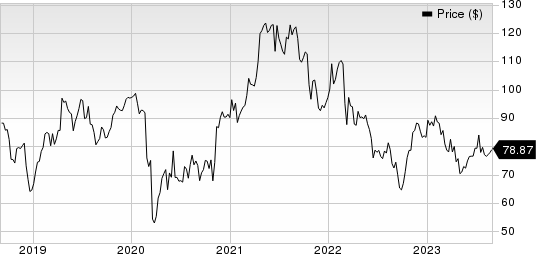

ManpowerGroup Inc. Price

ManpowerGroup Inc. price | ManpowerGroup Inc. Quote

The incorporation of the ettain group into ManpowerGroup in 2021 has expedited the company's plan to broaden its business portfolio by focusing on more lucrative and value-driven services. This strategic move has led to the integration of ettain into ManpowerGroup's Experis division, enhancing its capabilities in serving clients within the Financial Services, Healthcare, and Government sectors.

ManpowerGroup's steadfast focus on delivering value to its shareholders provides a dependable avenue for long-term wealth accumulation. In 2022, it allocated $270 million, while in 2021 and 2020, it allocated $210 million and $264.7 million, respectively, toward share repurchases. Additionally, the company distributed dividends of $139.9 million in 2022, $136.6 million in 2021, and $129.1 million in 2020. These strategic initiatives not only foster investor confidence but also have a favorable impact on earnings per share.

To boost productivity and streamline operations, the firm is undertaking substantial investments in technology. This includes the deployment of front-office systems, the integration of cloud-based and mobile applications, and the improvement of its global technology infrastructure in multiple markets. Furthermore, the company is dedicating resources to digitize its workforce solutions.

ManpowerGroup's current ratio at the end of the June quarter was pegged at 1.21, higher than the current ratio of 1.19 reported at the end of the year-ago quarter. It indicates that the company will not have problems meeting its short-term debt obligations.

Some Threats

ManpowerGroup has a global footprint, operating across 75 countries and territories. This extensive international reach exposes the company to the uncertainties linked to foreign currency exchange rate fluctuations. In 2022, the company derived nearly 82% of its revenues from sources outside the United States, with the majority originating from European markets, and recorded a loss of $11.9 million attributed to foreign exchange movements.

ManpowerGroup is witnessing a rise in its selling, general, and administrative (SG&A) overhead costs. In 2022, the company reported SG&A expenses totaling $2.94 billion, marking a 4.3% increase compared with the previous year. Furthermore, the expansion of expenses due to investments in digital initiatives and restructuring endeavors has the potential to impede the company's bottom-line growth.

MAN holds a Zacks Rank #3 (Hold).

Stocks to Consider

The following stocks from the Business Services sector are worth consideration:

DocuSign DOCU has beaten the Zacks Consensus Estimate in all the four trailing quarters and has an earning surprise of 25.6%. The current consensus estimate for revenues indicates an 8.1% increase from the year-ago figure. The consensus mark for earnings is pegged at $2.52 per share, indicating 24.1% year-over-year growth. DOCU currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRA International CRAI has beaten the Zacks Consensus Estimate in two of the four trailing quarters and missed on two instances, the earning surprise being 5.1%. The current Zacks Consensus Estimate for revenues indicates a 6.6% increase from the year-ago figure. The consensus mark for earnings is pegged at $5.49 per share, indicating a 7.6% year-over-year decline. CRAI holds a Zacks Rank #2 (Buy), at present.

ABM Industries ABM has beaten the Zacks Consensus Estimate in all the four trailing quarters and has an earning surprise of 2.64%. The current consensus estimate for revenues indicates a 3.5% increase from the year-ago figure. The consensus mark for earnings is pegged at $3.51 per share, indicating a 4.1% year-over-year decline. ABM holds a Zacks Rank of 2, at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report