Why You Should Retain Merit Medical (MMSI) Stock for Now

Merit Medical Systems, Inc. MMSI is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism led by solid third-quarter 2023 performance and its continued spend on research and development (R&D) are expected to contribute further. However, headwinds due to higher consolidation in the healthcare industry and stiff competition persist.

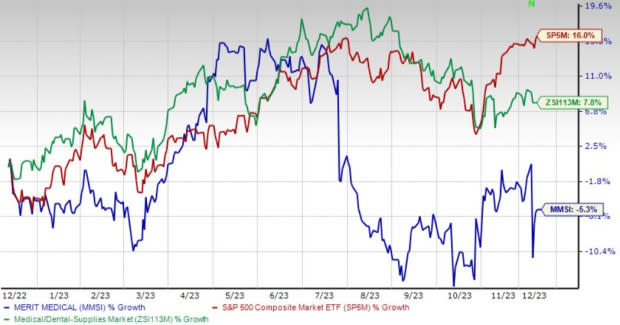

Over the past year, this Zacks Rank #3 (Hold) stock has lost 5.3% against a 7.8% rise of the industry and 16% growth of the S&P 500.

The renowned medical device provider has a market capitalization of $4.03 billion. The company projects 11.5% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 14.4% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Product Portfolio: Merit Medical has continued to gain significant momentum on the back of new products. The company is upbeat about the product pipeline, including radio and electrophysiology products, raising investors’ optimism. In October, the company announced the expansion of its Maestro Microcatheter product line to now include a new longer length for radial embolization procedures.

In September, Merit Medical announced the U.S. commercial release of its Aspira Bottle.

Continued Spend on R&D: Merit Medical’s R&D operations have been central to its historical growth and are believed to be critical to its continued growth. In recent years, the company’s focus on innovation has led to the introduction of several new products, improvements to its existing products, and expansion of its product lines, as well as enhancements and new equipment in its R&D facilities. This raises our optimism.

Strong Q3 Results: Merit Medical’s robust third-quarter 2023 results buoy optimism. The company witnessed a year-over-year uptick in the top and bottom lines. The company also saw revenue growth in both its segments and across all the product categories within its Cardiovascular unit. Robust performances in the United States and outside were also registered. The expansion of both margins bodes well for the stock.

Downsides

Higher Consolidation in the Healthcare Industry: Healthcare costs have risen significantly over the past decade. Thus, to provide healthcare solutions at a cheaper rate and eradicate competition, large-cap MedTech behemoths have started consolidating with mid-cap and small-cap companies. This enables the availability of healthcare products at cheap prices in the market. Per management, such trends compel Merit Medical’s customers to ask for price concessions on its products, which act against the ongoing business strategies. This may also exert a solid downward pressure on the prices of Merit Medical’s products and reduce the customer base.

Stiff Competition: Merit Medical operates in highly competitive markets, where it faces competition from many companies with greater resources. Such resources and market presence may enable the competitors to market competing products more efficiently or at reduced prices to gain market share.

Estimate Trend

Merit Medical is witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 2.8% north to $2.96.

The Zacks Consensus Estimate for the company’s fourth-quarter 2023 revenues is pegged at $314.9 million, suggesting a 7.3% rise from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, DexCom, Inc. DXCM and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 43.7% compared with the industry’s 5.7% rise in the past year.

DexCom, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, with an average of 36.4%.

DexCom’s shares have gained 0.2% against the industry’s 6.2% decline in the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 28.4% against the industry’s 6.2% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report