Why Sunoco LP's Stock Skyrocketed 20% in a Quarter: A Deep Dive

Over the past week, Sunoco LP (NYSE:SUN) has seen a significant increase in its stock price, with an 8.24% gain. This trend continues the company's strong performance over the past three months, during which the stock price has risen by 20.25%. Currently, Sunoco LP has a market cap of $4.32 billion and a stock price of $51.39. The GF Value of the stock is $53.74, indicating that the stock is fairly valued. This is consistent with the GF Value three months ago, which was $45.03. The GF Valuation, which compares the price and GF Value, also suggests that the stock was fairly valued both currently and three months ago.

Introduction to Sunoco LP

Sunoco LP is a leading player in the Oil & Gas industry. Formed in June 2012 by Susser Holdings Corporation, Sunoco LP is an independent motor fuel distributor in Texas and among the distributors of Valero and Chevron branded motor fuel in the United States. The company operates approximately 580 retail convenience stores under its proprietary Stripes convenience store brand, mainly in growing Texas markets. Sunoco LP competes mainly with other independent motor fuel distributors and is subject to various federal, state, and local environmental laws and regulations.

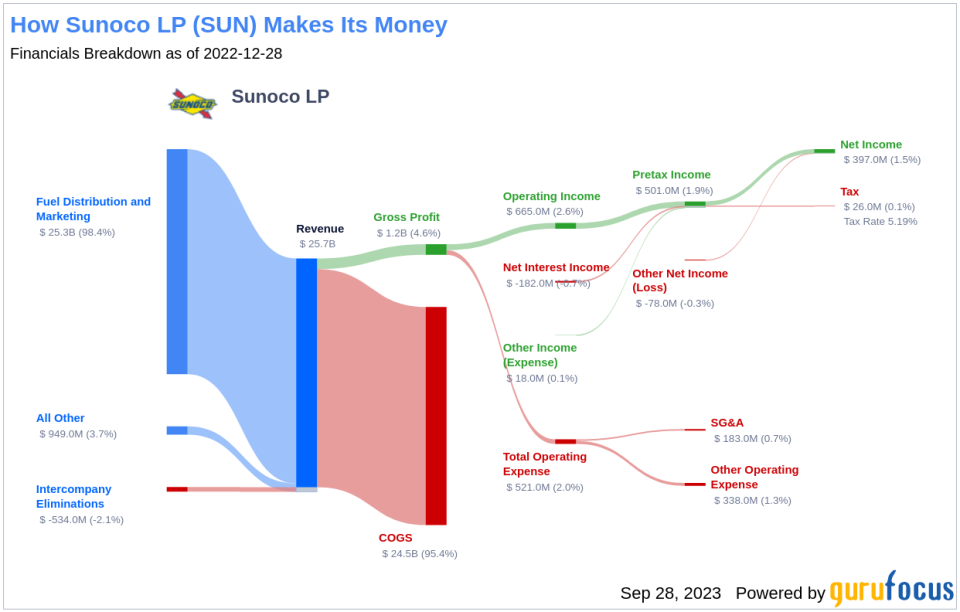

Profitability Analysis

As of June 30, 2023, Sunoco LP has a Profitability Rank of 7/10, indicating a strong profitability performance. The company's operating margin of 2.40% is better than 34.04% of 984 companies in the same industry. Sunoco LP's ROE of 25.11%, ROA of 3.65%, and ROIC of 9.82% are better than 78.66%, 54.68%, and 67.98% of companies in the industry, respectively. Over the past 10 years, the company has demonstrated profitability for 7 years, outperforming 68.23% of 960 companies.

Growth Prospects

Sunoco LP's Growth Rank is 8/10, suggesting strong growth potential. The company's 3-year and 5-year revenue growth rates per share are 15.20% and 13.50% respectively, outperforming 60.21% and 74.02% of companies in the industry. Furthermore, the company's 3-year EPS without NRI growth rate is 18.40%, better than 45.11% of 696 companies.

Competitive Landscape

Sunoco LP operates in a competitive industry with key players such as CVR Energy Inc (NYSE:CVI) with a market cap of $3.56 billion, PBF Energy Inc (NYSE:PBF) with a market cap of $6.82 billion, and Renewable Energy Group Inc (REGI) with a market cap of $3.11 billion.

Conclusion

In conclusion, Sunoco LP's stock performance over the past three months has been impressive, with a 20.25% gain. The company's strong profitability and growth prospects, coupled with a fair valuation, make it an attractive investment. However, investors should also consider the competitive landscape and regulatory environment in which the company operates.

This article first appeared on GuruFocus.