Here’s Why Texas Instruments Incorporated (TXN) Fell in Q2

Diamond Hill Capital, an investment management company, released its “Select Strategy” second-quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, the strategy outperformed the Russell 3000 Index returning 10.40% net of fees compared to an 8.39% return for the Index. Strength in industrials and healthcare holdings helped the relative performance of the strategy along with discretionary and financials holdings. On the other hand, technology holdings were underweight, which negatively affected the performance during the quarter. Likewise, investments in materials trailed the benchmark and dragged the relative returns. You can check the top 5 holdings of the fund to know its best picks in 2023.

Diamond Hill Select Strategy highlighted stocks like Texas Instruments Incorporated (NASDAQ:TXN) in the second quarter 2023 investor letter. Headquartered in Dallas, Texas, Texas Instruments Incorporated (NASDAQ:TXN) designs and manufactures semiconductors. On September 20, 2023, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $162.10 per share. One-month return of Texas Instruments Incorporated (NASDAQ:TXN) was -2.11%, and its shares lost 0.32% of their value over the last 52 weeks. Texas Instruments Incorporated (NASDAQ:TXN) has a market capitalization of $147.181 billion.

Diamond Hill Select Strategy made the following comment about Texas Instruments Incorporated (NASDAQ:TXN) in its Q2 2023 investor letter:

"Other bottom contributors included SunOpta, Bank of America Corporation and Texas Instruments Incorporated (NASDAQ:TXN). Texas Instruments’ end markets are facing some near-term headwinds where demand is concerned. We expect these trends to be transitory and continue to have a favorable view of the company’s long-term prospects and superior competitive positioning."

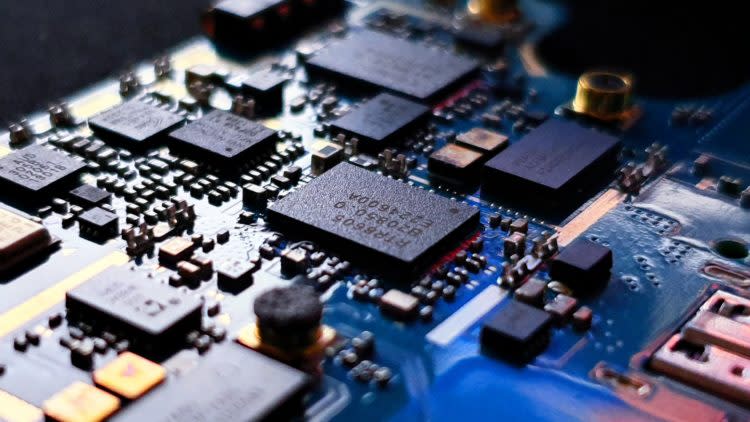

Photo by Yogesh Phuyal on Unsplash

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 56 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of second quarter which was 52 in the previous quarter.

We discussed Texas Instruments Incorporated (NASDAQ:TXN) in another article and shared the list of top semiconductor market share by company. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.