Why Texas Pacific Land Corp's Stock Skyrocketed 32% in a Quarter: A Deep Dive

Texas Pacific Land Corp (NYSE:TPL), a prominent player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. Despite a minor setback of 2.03% over the past week, the company's stock has risen by an impressive 31.51% over the past quarter. This article aims to provide an in-depth analysis of the factors contributing to this remarkable performance and the company's future prospects.

Stock Performance and Valuation

As of today, Texas Pacific Land Corp boasts a market capitalization of $13.82 billion, with its stock price standing at $1800. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently $1981.95, indicating that the stock is fairly valued. This is a significant shift from three months ago when the GF Value was $2010.2, suggesting that the stock was significantly undervalued at that time.

Company Overview

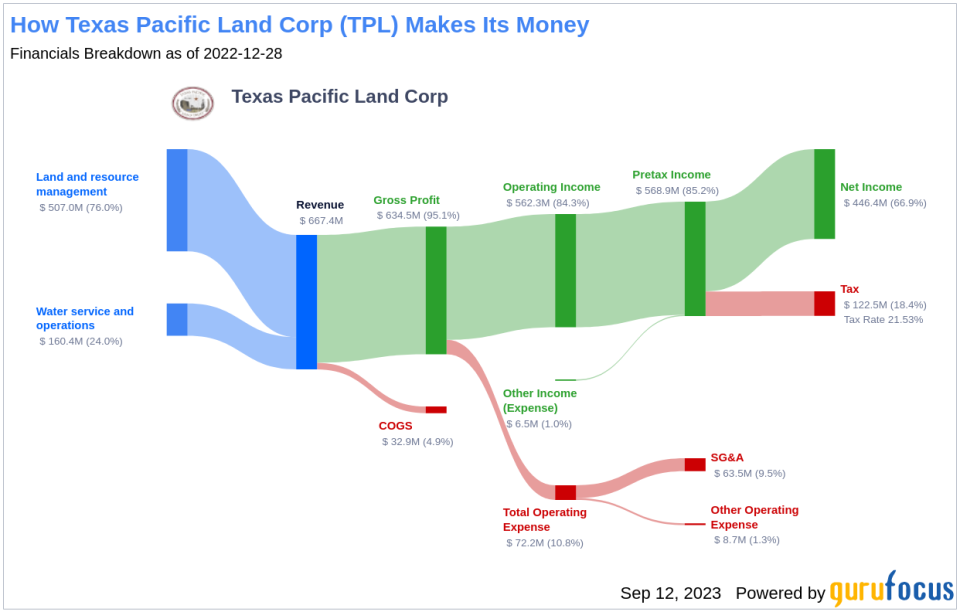

Texas Pacific Land Corp operates primarily in land sales and leases, retaining oil and gas royalties, and overall land management. The company's operations are divided into two segments: Land and Resource Management and Water Service and Operations. The former focuses on managing its oil and gas royalty interest and surface acres across 19 different counties, while the latter includes water sourcing, produced water gathering/treatment/recycling, infrastructure development, produced water disposal, and water tracking/analytics/well testing.

Profitability Analysis

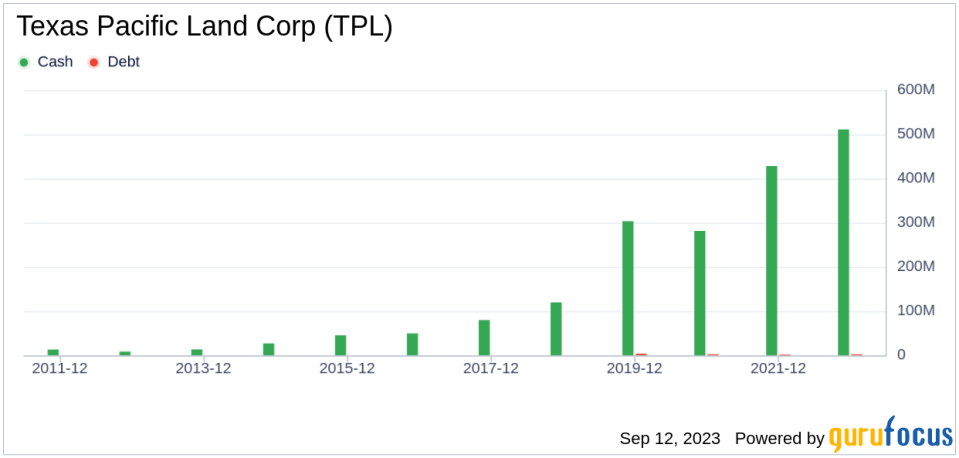

With a Profitability Rank of 10/10, Texas Pacific Land Corp demonstrates a high level of profitability. The company's Operating Margin of 78.60% is better than 97.22% of companies in the industry. Similarly, its ROE of 54.01%, ROA of 47.04%, and ROIC of 121.06% are all higher than the majority of companies in the industry. Furthermore, the company has maintained consistent profitability over the past 10 years, which is better than 99.89% of companies.

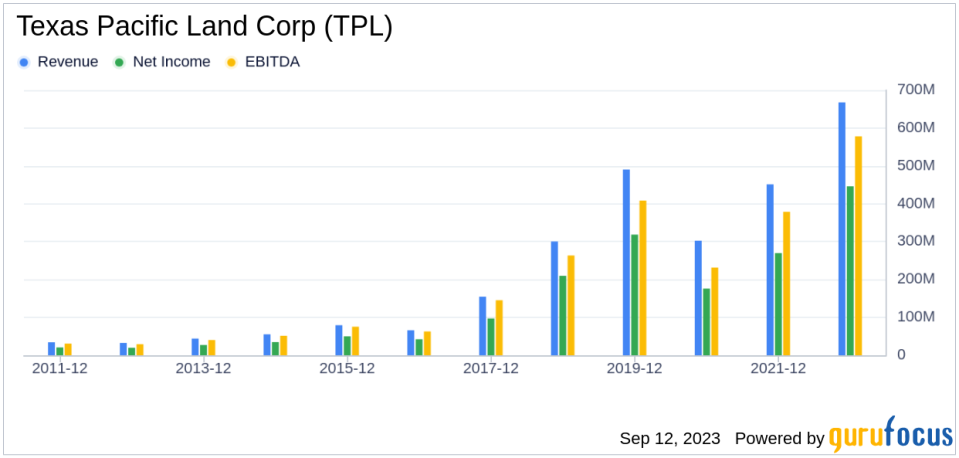

Growth Prospects

Texas Pacific Land Corp's Growth Rank of 10/10 indicates strong growth in terms of revenue and profitability. The company's 3-year and 5-year Revenue Growth Rate per Share are 11.00% and 26.20% respectively. Its future Total Revenue Growth Rate is estimated to be 10.92%. Additionally, the company's 3-year and 5-year EPS without NRI Growth Rates are 12.00% and 25.30% respectively.

Major Stock Holders

The top three holders of Texas Pacific Land Corp's stock are Murray Stahl (Trades, Portfolio), Jim Simons (Trades, Portfolio), and David Rolfe (Trades, Portfolio). Stahl holds the majority of the shares, owning 18.19% of the company's stock, while Simons and Rolfe hold 0.15% and 0.09% respectively.

Competitive Landscape

Texas Pacific Land Corp faces stiff competition from other companies in the Oil & Gas industry. Its main competitors include Marathon Oil Corp (NYSE:MRO) with a market capitalization of $16.24 billion, APA Corp (NASDAQ:APA) with a market cap of $13.53 billion, and Ovintiv Inc (NYSE:OVV) with a market cap of $12.84 billion.

Conclusion

In conclusion, Texas Pacific Land Corp's impressive stock performance, high profitability, strong growth prospects, and competitive position in the Oil & Gas industry make it a compelling investment option. Despite the recent minor setback, the company's stock has shown a significant upward trend over the past quarter, and its future prospects look promising. Investors should keep a close eye on this stock as it continues to navigate the dynamic Oil & Gas industry.

This article first appeared on GuruFocus.