Why Tilray Stock Is Rocketing Higher Today

Shares of Tilray (NASDAQ: TLRY) are making big gains in Friday's trading. The marijuana specialist's share price was up 9.9% as of 12:15 p.m. ET today, according to data from S&P Global Market Intelligence.

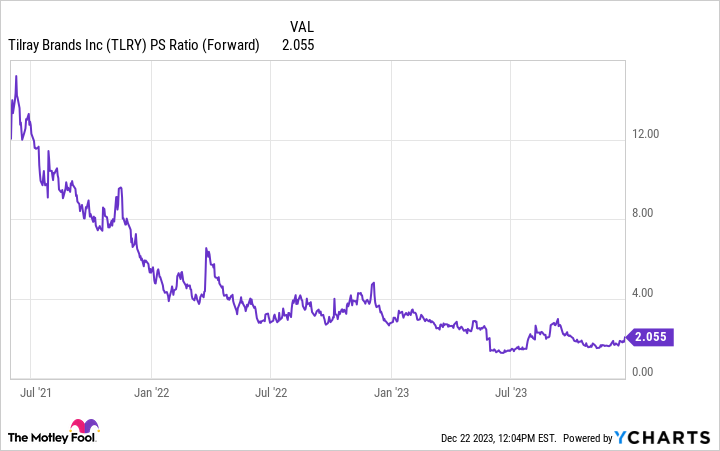

Tilray stock is gaining ground today on the heels of new product announcements and a fresh round of pardons from President Joe Biden for 11 individuals convicted of marijuana-related offenses. Even with the big pop, the company's share price is still down roughly 16% year to date and 93% from its high.

Fresh news has Tilray stock trading in the green

Yesterday, Tilray published a press release announcing two new products in its Chowie Wowie cannabis-infused chocolate brand. The introduction of the new Soft Caramel and Crunchy Praline products suggests that the company continues to see long-term expansion potential in its Chowie Wowie brand.

Chowie Wowie currently stands as the second-best-selling brand within its category in the Canadian market. With prices in the flower-based marijuana market still pressured by high levels of competition and a supply glut, Tilray and other companies in the space are looking to edibles and other alternatives as a way to boost margins.

Besides the new product announcements, Tilray stock also appears to be getting a lift from President Biden's latest round of pardons for individuals convicted of marijuana-related crimes. While the plan for 11 new pardons comes in far below the thousands of pardons that the president issued last October, the move suggests there's a good chance that Biden will advocate for reforming marijuana laws when campaigning for reelection next year.

What comes next for Tilray stock?

Marijuana stocks have struggled in recent years. Some anticipated regulatory breakthroughs in potentially lucrative markets have been slow to arrive, and intense competition has made profits hard to come by.

While Tilray doesn't look exorbitantly valued trading at roughly two times this year's expected sales, the company's ability to shift into delivering consistent profits and long-term earnings growth remains somewhat speculative. Trends do suggest that more geographic markets will see marijuana use decriminalized or legalized, but it remains to be seen if the business' current position in the space will translate into long-term staying power.

While Tilray stock does have the potential to deliver explosive gains from today's prices, the current economics of the business mean that its shares remain a high-risk play.

Should you invest $1,000 in Tilray Brands right now?

Before you buy stock in Tilray Brands, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Tilray Brands wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.

Why Tilray Stock Is Rocketing Higher Today was originally published by The Motley Fool