Why Tradeweb Markets Inc's Stock Skyrocketed 18% in a Quarter

Tradeweb Markets Inc (NASDAQ:TW), a leading fixed-income trading platform, has seen a significant surge in its stock performance over the past three months. The company's market cap currently stands at $18.53 billion, with its stock price at $87.57. Over the past week, the stock has seen a gain of 6.63%, and over the past three months, it has seen a remarkable gain of 17.95%. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $79.99, up from $78.11 three months ago. This indicates that the stock is currently deemed 'Fairly Valued', an improvement from being 'Modestly Undervalued' three months ago.

Company Overview

Founded in 1998 and headquartered in New York City, Tradeweb Markets operates in the Capital Markets industry. The company primarily provides electronic trading networks that connect broker/dealers, institutional clients, and retail customers. While the company offers trading in a wide variety of products, the bulk of its business is in U.S. and European government debt, mortgage-backed securities, interest-rate swaps, and U.S. and international corporate bonds. The firm also sells fixed-income trading and price data, primarily through a deal with Refinitiv's Eikon service.

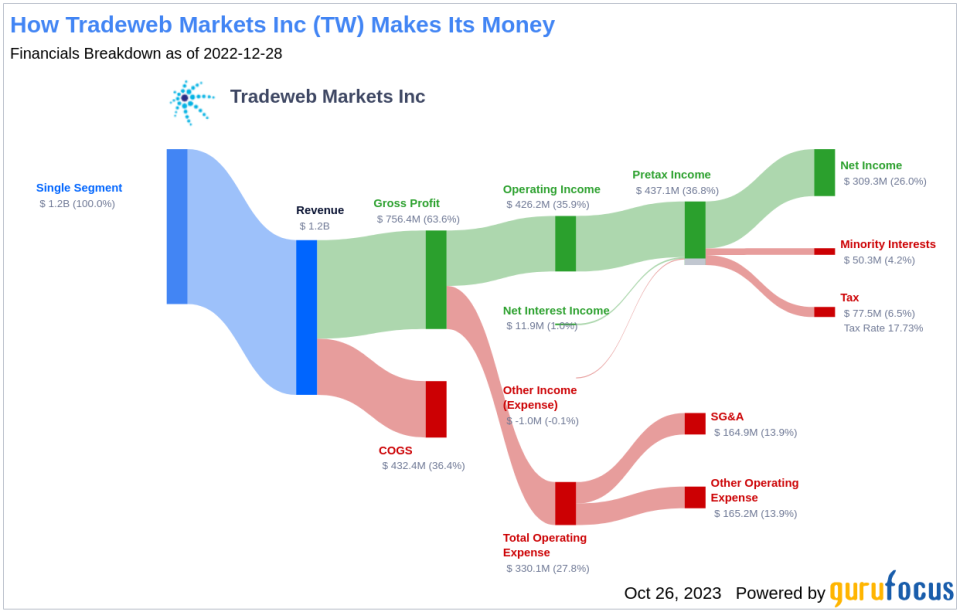

Profitability Analysis

Tradeweb Markets Inc has a Profitability Rank of 8/10, indicating a high level of profitability. The company's Operating Margin is 36.63%, better than 75.31% of companies in the industry. Its ROE is 6.77%, better than 61.85% of companies, and its ROA is 5.38%, better than 78.49% of companies. The company's ROIC is 7.32%, better than 73.32% of companies. Over the past 10 years, the company has been profitable for 7 years, better than 46.44% of companies.

Growth Prospects

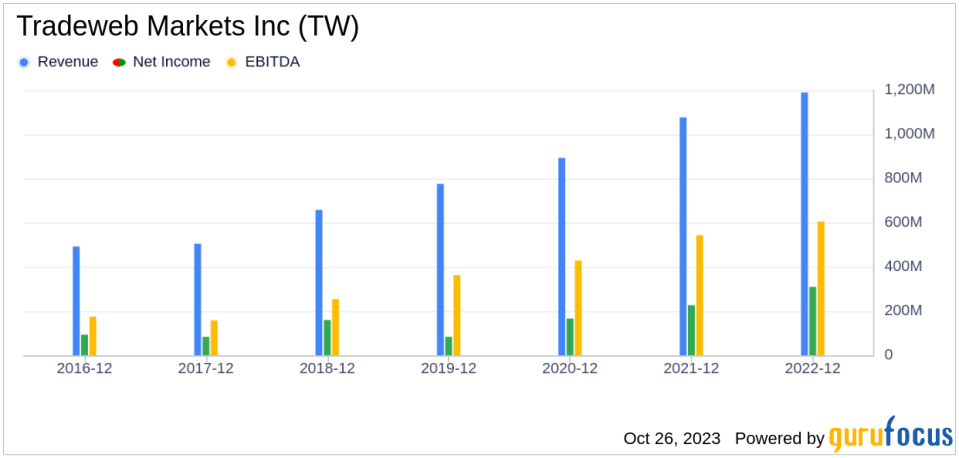

The company's Growth Rank is 8/10, indicating a high level of growth. Its 3-Year Revenue Growth Rate per Share is 4.80%, better than 44.56% of companies, and its 5-Year Revenue Growth Rate per Share is 14.00%, better than 71.15% of companies. The company's future total revenue growth rate is estimated to be 9.25%, better than 73.68% of companies. Its 3-Year EPS without NRI Growth Rate is 22.50%, better than 63.55% of companies, and its 5-Year EPS without NRI Growth Rate is 26.70%, better than 74.04% of companies. The company's future EPS without NRI Growth Rate is estimated to be 11.30%, better than 60.71% of companies.

Major Stock Holders

The top three holders of Tradeweb Markets Inc's stock are PRIMECAP Management (Trades, Portfolio), holding 1,583,475 shares (0.75% of the total shares), Ray Dalio (Trades, Portfolio), holding 741,589 shares (0.35% of the total shares), and Ron Baron (Trades, Portfolio), holding 388,265 shares (0.18% of the total shares).

Competitive Landscape

Tradeweb Markets Inc's main competitors in the Capital Markets industry include XP Inc (NASDAQ:XP) with a market cap of $11.27 billion, LPL Financial Holdings Inc (NASDAQ:LPLA) with a market cap of $16.88 billion, and MarketAxess Holdings Inc (NASDAQ:MKTX) with a market cap of $8.09 billion.

Conclusion

In conclusion, Tradeweb Markets Inc's stock has seen a significant surge over the past three months, with a gain of 17.95%. The company's profitability and growth prospects are strong, and it is currently deemed 'Fairly Valued' according to its GF Value. With its strong performance and positive outlook, Tradeweb Markets Inc's stock presents an interesting opportunity for investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.