Why Trinet Group Inc's Stock Skyrocketed 13% in a Quarter

Trinet Group Inc (NYSE:TNET), a prominent player in the Business Services industry, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $5.67 billion, with its stock price currently at $112.38. Over the past week, the stock has experienced a 7.14% decrease, but this is overshadowed by a substantial 12.84% increase over the past three months. According to the GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is fairly valued both currently and three months ago, with a GF Value of $101.38 and a past GF Value of $98.87 respectively.

Company Overview

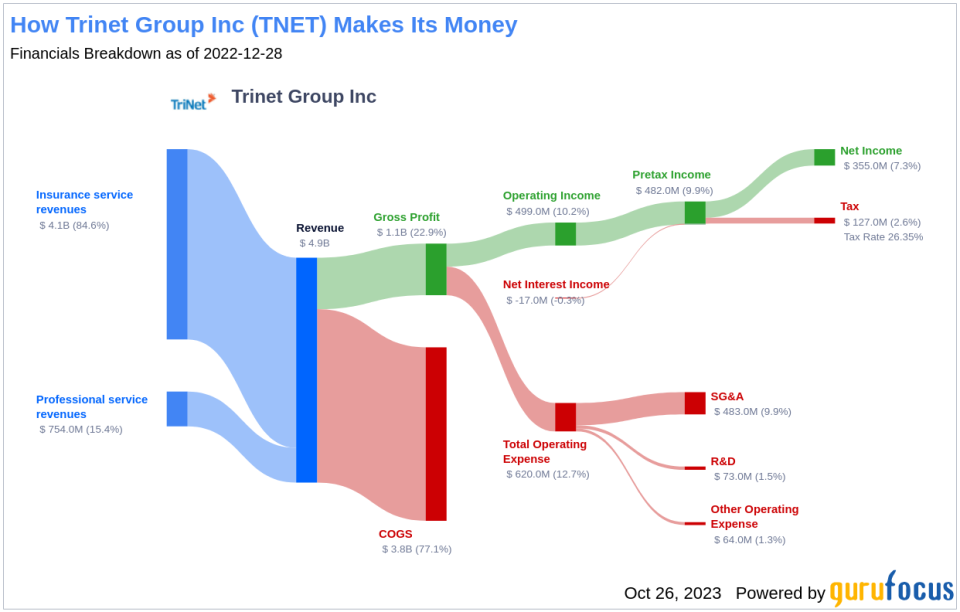

Trinet Group Inc operates in the Business Services industry, providing outsourced payroll and human capital management solutions for small and midsize businesses. The company operates under a professional employer organization model, acting as the employer of record for administrative and regulatory purposes for clients' employees. Clients leverage Trinet's scale and expertise to access competitive employee benefits, share employment risk liability, access compliance support, and outsource mission-critical day-to-day HR functions such as payroll and tax administration. Following the acquisition of Zenefits and Clarus R+D in 2022, Trinet derives the minority of its revenue from self-service HCM software and R&D tax credit services.

Profitability Analysis

Trinet Group Inc boasts a high Profitability Rank of 9/10, indicating a high level of profitability. The company's Operating Margin stands at 8.98%, better than 62.41% of companies in the industry. Its ROE is 41.00%, ROA is 10.22%, and ROIC is 21.96%, all of which are better than the majority of companies in the industry. The company has consistently demonstrated profitability over the past 10 years, better than 99.9% of companies.

Growth Prospects

Trinet Group Inc has a strong Growth Rank of 10/10, indicating robust growth. The company's 3-year and 5-year revenue growth rates per share are 12.00% and 10.80% respectively, better than the majority of companies in the industry. Its future total revenue growth rate estimate is 5.66%, better than 44.12% of companies. The company's 3-year and 5-year EPS without NRI growth rates are 23.30% and 19.70% respectively, and its future EPS without NRI growth rate estimate is 4.89%.

Major Stock Holders

The top three holders of Trinet Group Inc's stock are Jim Simons (Trades, Portfolio), holding 75300 shares (0.13%), Joel Greenblatt (Trades, Portfolio), holding 6498 shares (0.01%), and Steven Cohen (Trades, Portfolio), holding 326 shares (0%).

Competitive Landscape

Trinet Group Inc faces competition from Kanzhun Ltd (NASDAQ:BZ) with a market cap of $6.52 billion, Robert Half Inc (NYSE:RHI) with a market cap of $7.83 billion, and ManpowerGroup Inc (NYSE:MAN) with a market cap of $3.44 billion.

Conclusion

In conclusion, Trinet Group Inc's stock performance, business model, profitability, growth, holders, and competitors all contribute to its current market position. The company's stock has seen a significant surge over the past three months, and its profitability and growth ranks indicate a strong potential for value investors. However, investors should also consider the competitive landscape and the company's recent stock price decrease.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.