Why Vista Outdoor Inc's Stock Skyrocketed 17% in a Quarter

Vista Outdoor Inc (NYSE:VSTO), a prominent player in the Travel & Leisure industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 16.74% over the past quarter, marking a notable gain. As of October 10, 2023, the stock is trading at $32.56, with a market cap of $1.89 billion. Over the past week, the stock has seen a 3.05% gain, further solidifying its strong performance.

Understanding Vista Outdoor Inc's Valuation

According to the GF Value, a metric defined by GuruFocus.com that calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, Vista Outdoor Inc is modestly undervalued. The current GF Value stands at $35.97, compared to the past GF Value of $37.99 three months ago. This consistent undervaluation suggests potential for further growth.

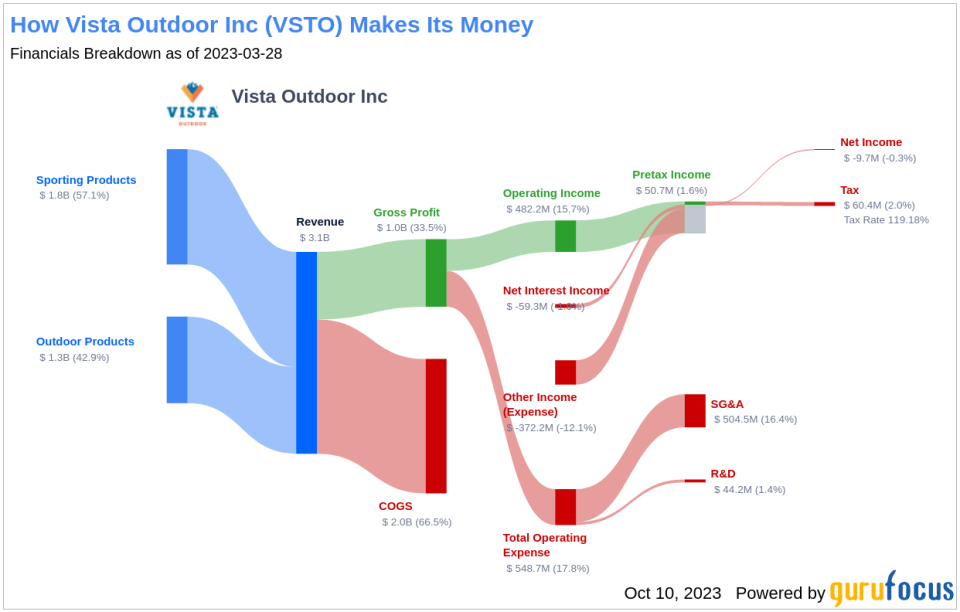

Company Overview: Vista Outdoor Inc

Vista Outdoor Inc is a U.S.-based company that designs, develops, and manufactures outdoor sports and recreation products. The company operates in two segments: Shooting sports and Outdoor products. The Shooting sports segment, which contributes the largest proportion of company revenue, includes ammunition, long guns, and related equipment under brands such as Federal Premium, Blackhawk, and Hoppe's. The Outdoor products segment includes archery and hunting accessories, eyewear, golf products, hydration products, and stand-up paddle boards under brands including CamelBak and Bushnell. The company derives the vast majority of its revenue domestically.

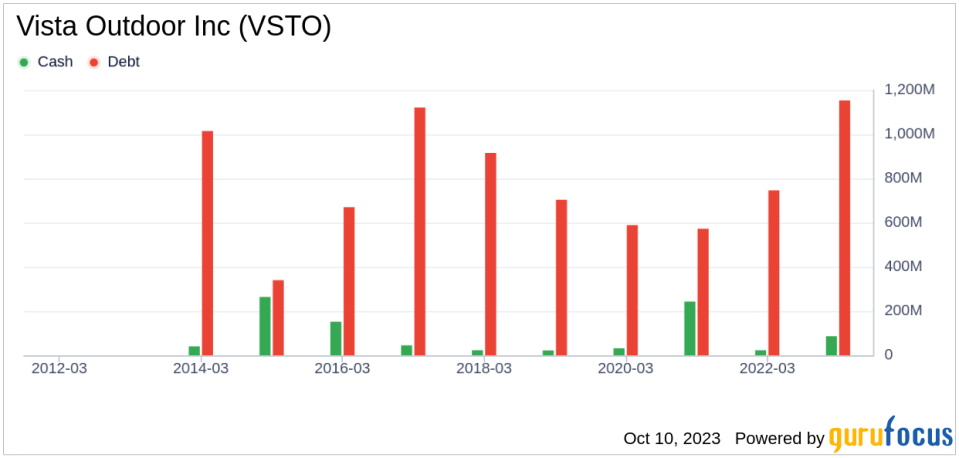

Profitability Analysis of Vista Outdoor Inc

Vista Outdoor Inc has a Profitability Rank of 6/10, indicating a moderate level of profitability. The company's Operating Margin is 13.53%, which is better than 67.94% of companies in the same industry. Despite a negative ROE of -6.13% and ROA of -2.62%, the company boasts a high ROIC of 29.19%. Over the past 10 years, the company has demonstrated profitability for 5 years, better than 36.11% of companies in the industry.

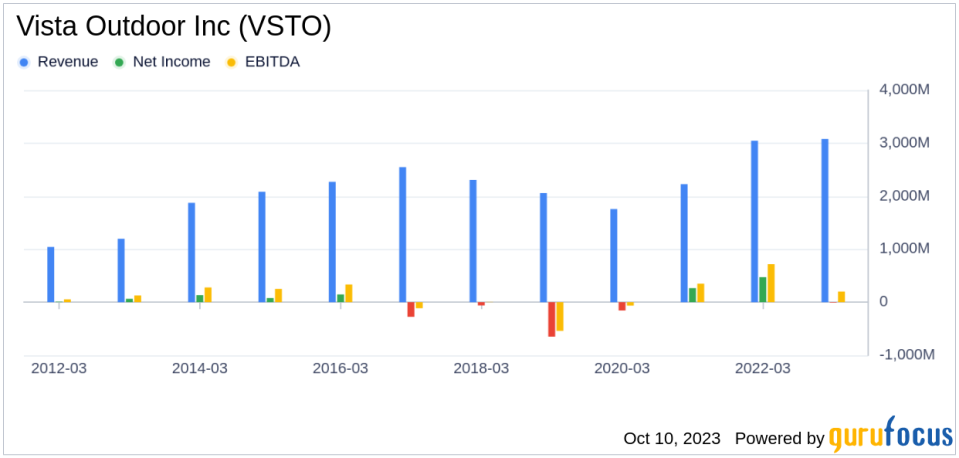

Growth Prospects of Vista Outdoor Inc

The company's Growth Rank stands at 5/10, indicating moderate growth. The 3-Year Revenue Growth Rate per Share is 21.50%, and the 5-Year Revenue Growth Rate per Share is 8.30%. Despite a future total revenue growth rate estimate of -0.18%, the company's 3-Year EPS without NRI Growth Rate is a robust 60.10%.

Major Holders of Vista Outdoor Inc Stock

The top three holders of Vista Outdoor Inc stock are HOTCHKIS & WILEY, Mario Gabelli (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). HOTCHKIS & WILEY holds 410,660 shares, representing 0.71% of the total shares. Mario Gabelli (Trades, Portfolio) holds 306,500 shares, accounting for 0.53% of the total shares. Jefferies Group (Trades, Portfolio) holds 75,254 shares, making up 0.13% of the total shares.

Competitive Landscape

Vista Outdoor Inc faces competition from Six Flags Entertainment Corp(NYSE:SIX), Cedar Fair LP(NYSE:FUN), and Life Time Group Holdings Inc(NYSE:LTH). Six Flags Entertainment Corp has a market cap of $1.92 billion, Cedar Fair LP has a market cap of $1.9 billion, and Life Time Group Holdings Inc has a market cap of $2.96 billion.

Conclusion

In conclusion, Vista Outdoor Inc's stock has shown strong performance, with a 16.74% gain over the past three months. The company's profitability and growth, along with its standing among competitors, make it a potential candidate for value investors. Despite some challenges, the company's consistent undervaluation and robust ROIC suggest potential for further growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.