Why WestRock Co's Stock Skyrocketed 24% in a Quarter: A Deep Dive

WestRock Co (NYSE:WRK), a leading player in the Packaging & Containers industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $9.16 billion and a price of $35.74, the company's stock has gained 12.20% over the past week and a whopping 23.92% over the past three months. This article aims to provide a comprehensive analysis of the factors contributing to this impressive performance.

Stock Performance and Valuation

WestRock's current GF Value stands at $48.75, down slightly from $49.97 three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Despite the slight decrease in GF Value, the stock is currently considered modestly undervalued, a significant improvement from its previous status as a possible value trap. This suggests that the stock's recent price surge is backed by its intrinsic value, making it an attractive investment opportunity.

Company Overview

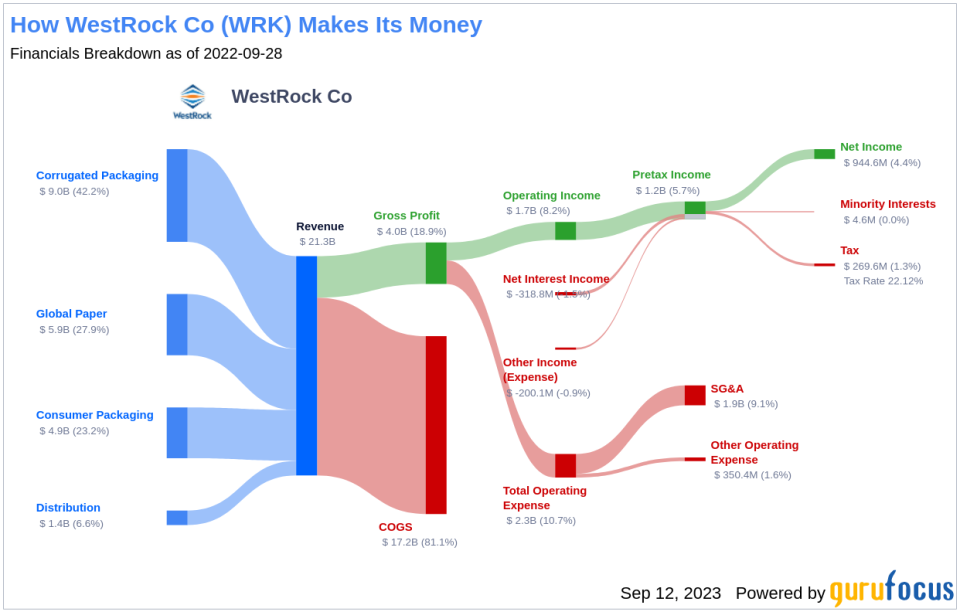

WestRock Co is a prominent manufacturer of corrugated packaging and consumer packaging, including folding cartons and paperboard. Following the merger of RockTenn and MeadWestvaco in 2015, WestRock emerged as the largest North American producer of solid bleached sulfate and the second-largest producer of containerboard, used in the production of shipping containers. The company's strong market position and robust product portfolio have played a crucial role in its impressive stock performance.

Profitability Analysis

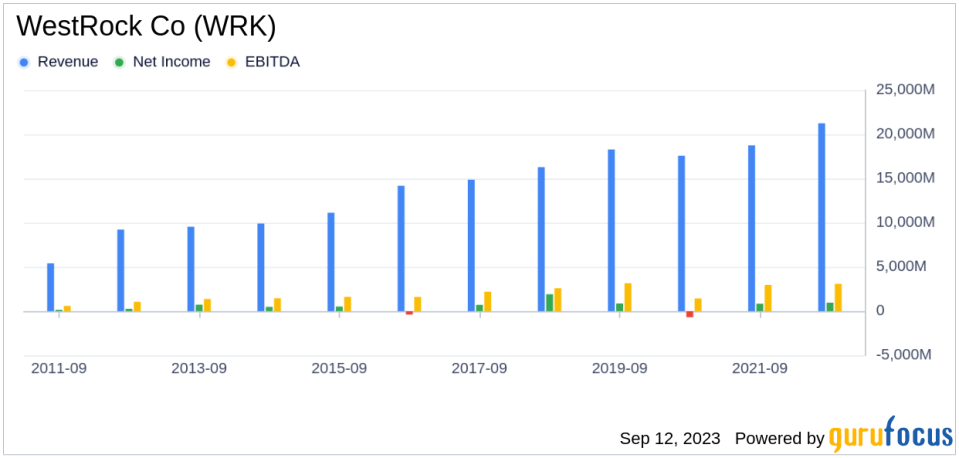

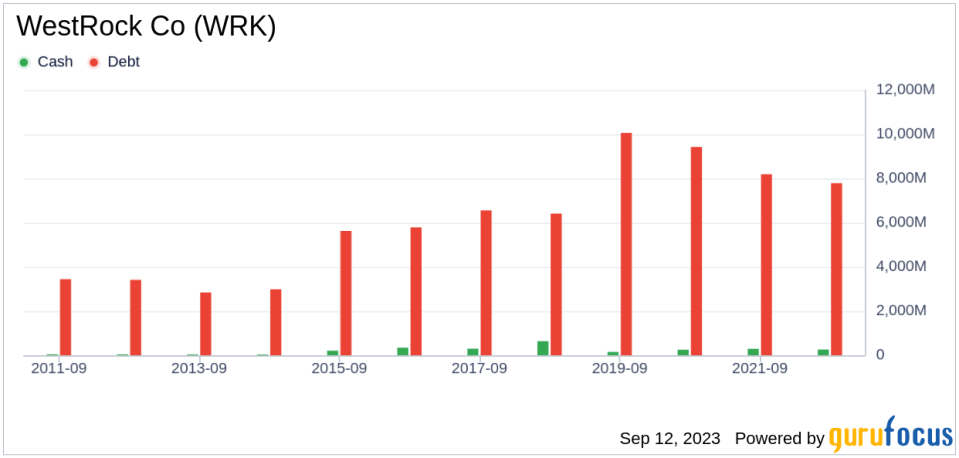

WestRock's Profitability Rank stands at 6/10, indicating a relatively high level of profitability compared to its industry peers. The company's Operating Margin of 6.26% is better than 56.01% of the companies in the industry. However, its ROE and ROA are -13.08% and -4.91% respectively, indicating some room for improvement. The company's ROIC of 5.07% is better than 46.36% of the companies in the industry. Over the past decade, WestRock has maintained profitability for eight years, better than 46.65% of the companies in the industry.

Growth Prospects

WestRock's Growth Rank is 6/10, indicating a solid growth trajectory. The company's 3-Year Revenue Growth Rate per Share of 4.80% and 5-Year Revenue Growth Rate per Share of 5.80% are better than 38.48% and 56.38% of the companies in the industry, respectively. However, the company's future total revenue growth rate is estimated to be -0.04%, while its 3-Year EPS without NRI Growth Rate is 2.70%, both of which are lower than the industry average. Despite these mixed growth indicators, the company's strong market position and robust product portfolio provide a solid foundation for future growth.

Major Stock Holders

WestRock's stock is held by several prominent investors. Sarah Ketterer (Trades, Portfolio) holds the largest number of shares, with 2,111,676 shares, representing 0.82% of the total shares. Robert Olstein (Trades, Portfolio) holds 273,000 shares, accounting for 0.11% of the total shares, while Arnold Van Den Berg (Trades, Portfolio) holds 198,081 shares, representing 0.08% of the total shares.

Competitive Landscape

WestRock faces competition from several companies in the Packaging & Containers industry. Berry Global Group Inc(NYSE:BERY) with a market cap of $7.35 billion, Graphic Packaging Holding Co(NYSE:GPK) with a market cap of $6.72 billion, and Reynolds Consumer Products Inc(NASDAQ:REYN) with a market cap of $5.44 billion are among its top competitors.

Conclusion

In conclusion, WestRock's impressive stock performance can be attributed to its strong market position, robust product portfolio, and solid profitability. Despite some challenges in terms of growth prospects and competition, the company's intrinsic value and the confidence of major investors suggest a promising future. Investors should keep a close eye on WestRock as it continues to navigate the dynamic Packaging & Containers industry.

This article first appeared on GuruFocus.