Why Zions Bancorp NA's Stock Skyrocketed 31% in a Quarter: A Deep Dive

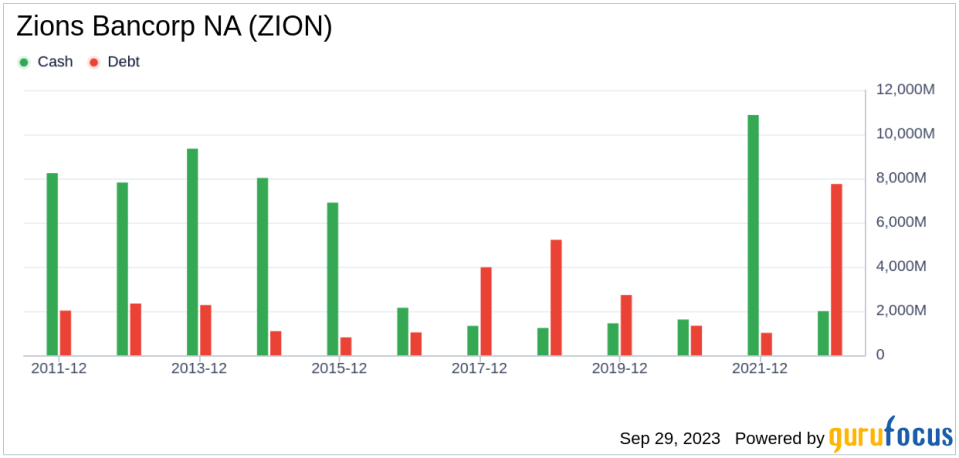

Zions Bancorp NA (NASDAQ:ZION), a regional U.S. bank with a market cap of $5.25 billion, has seen a significant surge in its stock price over the past three months. As of September 29, 2023, the stock price stands at $35.41, marking a 31.20% increase over the past quarter. Over the past week, the stock has also seen a gain of 3.75%. Despite this impressive performance, the stock remains significantly undervalued according to the GF Value, which currently stands at $63.65, slightly down from $64.52 three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates.

Company Overview

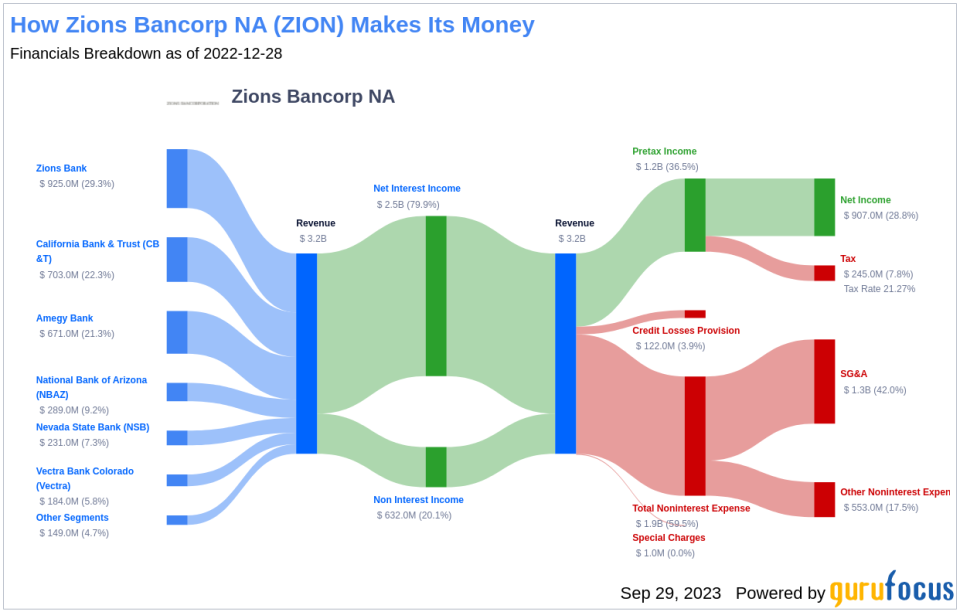

Zions Bancorp NA operates primarily in the Western and Southwestern United States, providing banking services to small and midsize businesses. The bank's core operations span 11 states, with its headquarters located in Salt Lake City. The majority of its loans are focused on commercial and commercial real estate lending.

Profitability Analysis

As of June 30, 2023, Zions Bancorp NA's Profitability Rank stands at 6/10, indicating a relatively high level of profitability compared to its industry peers. The company's Return on Equity (ROE) is 17.13%, better than 83.17% of the 1456 companies in the Banks industry. Its Return on Assets (ROA) is 1.00%, better than 52.19% of the 1460 companies in the same industry. Furthermore, Zions Bancorp NA has maintained profitability for the past 10 years, outperforming 99.93% of the 1461 companies in the industry.

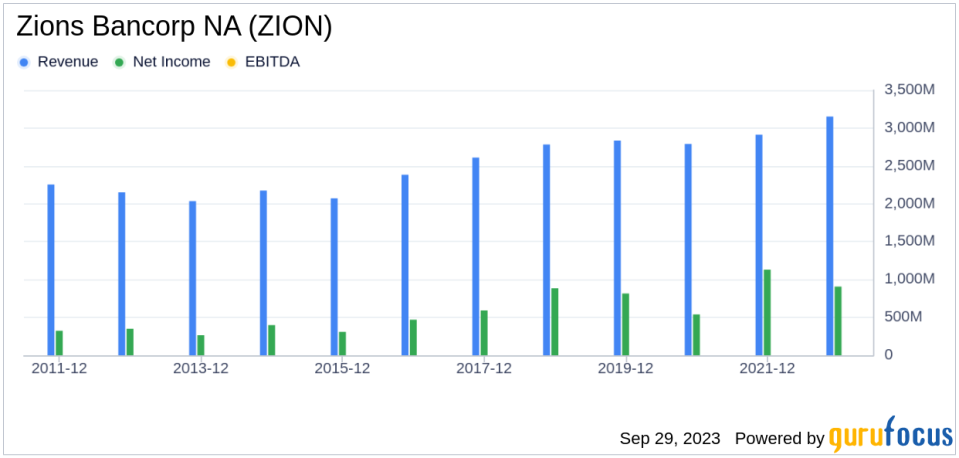

Growth Prospects

Zions Bancorp NA's Growth Rank is currently 4/10. The company's 3-year and 5-year revenue growth rate per share are 11.30% and 10.90% respectively, outperforming a significant portion of its industry peers. However, the company's future total revenue growth rate estimate over a 3-year to 5-year period is a modest 0.37%. The company's 3-year and 5-year EPS without NRI growth rates are 11.70% and 16.10% respectively, while the future estimate stands at -6.90%.

Major Stock Holders

Among the top holders of Zions Bancorp NA's stock are Jim Simons (Trades, Portfolio), who holds 671,795 shares (0.45% of the total shares), Louis Moore Bacon (Trades, Portfolio), who holds 477,771 shares (0.32% of the total shares), and Joel Greenblatt (Trades, Portfolio), who holds 11,336 shares (0.01% of the total shares).

Competitive Landscape

Zions Bancorp NA operates in a competitive industry, with key competitors including Prosperity Bancshares Inc(NYSE:PB) with a stock market cap of $5.15 billion, Pinnacle Financial Partners Inc(NASDAQ:PNFP) with a stock market cap of $5.16 billion, and SouthState Corp(NASDAQ:SSB) with a stock market cap of $5.16 billion.

Conclusion

In conclusion, Zions Bancorp NA has demonstrated strong performance in recent months, with a significant surge in its stock price. Despite this, the stock remains significantly undervalued according to the GF Value. The company has a strong profitability rank and has maintained profitability for the past decade. However, its growth rank is relatively low, and future growth estimates are modest. The company faces stiff competition in the Banks industry, but its strong performance and profitability may make it an attractive option for investors.

This article first appeared on GuruFocus.