WideOpenWest Inc (WOW) Faces Challenges Despite High-Speed Data Revenue Growth

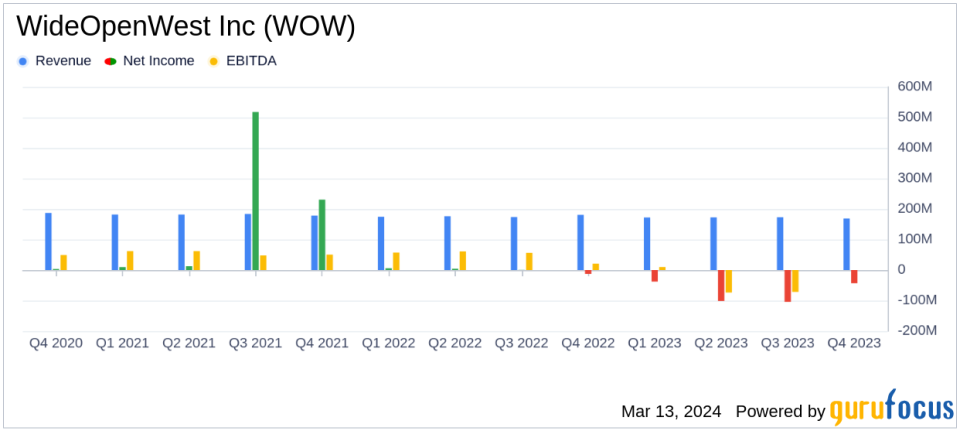

High-Speed Data Revenue: Increased by 4% to $430.4 million in 2023.

Total Revenue: Decreased to $686.7 million for the year, down by $18.2 million from 2022.

Net Loss: Expanded significantly to $287.7 million for the year, compared to $2.5 million in 2022.

Adjusted EBITDA: Slightly decreased to $275.4 million for the year, with a margin of 40.1%.

Subscribers: Total subscribers declined to 504,100 as of December 31, 2023.

Capital Expenditures: Increased by 61% to $268.9 million, reflecting network expansion efforts.

Liquidity and Leverage: Long-term debt stood at $934.5 million with a leverage ratio of 3.3x LTM Adjusted EBITDA.

On March 13, 2024, WideOpenWest Inc (NYSE:WOW), a leading broadband provider, released its 8-K filing, disclosing its financial and operational results for the fourth quarter and full year ended December 31, 2023. The company, which operates in the Telecommunication Services industry, serves a broad customer base with high-speed internet, data, voice, cloud, and cable television services, primarily in the Midwest and Southeast United States.

Financial Performance and Challenges

WOW's financial results for 2023 reflect a mixed performance. While the company achieved a 4% increase in High-Speed Data (HSD) revenue, reaching $430.4 million, it faced a decline in total revenue, which decreased to $686.7 million, down $18.2 million from the previous year. This decline was primarily due to a shift in service offering mix and a reduction in Video and Telephony Revenue Generating Units (RGUs), despite increases in average revenue per unit (ARPU) from rate increases and higher HSD speed tier purchases.

The company's net loss widened significantly to $287.7 million for the year, compared to a net loss of $2.5 million in 2022. This was largely driven by a non-cash impairment charge on intangible assets amounting to $306.8 million. Adjusted EBITDA, a key metric for evaluating a company's operating performance, saw a slight decrease to $275.4 million for the year, with an Adjusted EBITDA Margin of 40.1%.

Operational Highlights and Market Expansion

WOW reported a decrease in total subscribers to 504,100 as of December 31, 2023, which is a reflection of the competitive challenges within the industry. However, the company made significant strides in market expansion, passing an additional 48,400 homes in 2023, including 30,400 in Greenfield markets and 18,000 through Edge-Outs. These initiatives added 7,400 subscribers in 2023, representing a 15.3% total penetration rate across market expansion projects.

Capital Expenditures and Liquidity

Capital expenditures for the year totaled $268.9 million, a substantial increase of 61% compared to the previous year. This increase is primarily related to the company's focus on expanding its network through greenfield initiatives. As of December 31, 2023, WOW's long-term debt and finance lease obligations stood at $934.5 million, with a total net leverage of 3.3x on a Last Twelve Months (LTM) Adjusted EBITDA basis. The company had cash and cash equivalents of $23.4 million and undrawn revolver capacity of $44.3 million, indicating a solid liquidity position to support ongoing operations and expansion efforts.

We continue to make great progress in our expansion markets, passing 48,400 homes in 2023, including nearly 23,000 in the fourth quarter, the most robust quarterly expansion of our network in our 25-year history, which puts us in a strong position to grow our footprint and subscriber base in 2024," said Teresa Elder, WOW!'s CEO.

Our financial results this year continue to reflect the progress we are making as a broadband-first company including full-year HSD revenue growth and an Adjusted EBITDA Margin of 40.1%," said John Rego, WOW!'s CFO.

Conclusion

While WideOpenWest Inc (NYSE:WOW) has demonstrated resilience in its HSD segment, the overall financial performance for 2023 presents challenges, particularly with the expanded net loss due to impairment charges. The company's commitment to market expansion and network growth, as evidenced by increased capital expenditures, positions it for potential growth in the coming years. Investors and stakeholders will be watching closely to see how WOW navigates the competitive landscape and capitalizes on its strategic initiatives to improve its financial health and market position.

For a more detailed analysis of WideOpenWest Inc (NYSE:WOW)'s financial results and operational strategies, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from WideOpenWest Inc for further details.

This article first appeared on GuruFocus.