Willdan Group Inc's Meteoric Rise: Unpacking the 34% Surge in Just 3 Months

Willdan Group Inc (NASDAQ:WLDN), a prominent player in the construction industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 34.03%, from $14.18 to $24.96, with a market cap of $339.331 million. Over the past week, the stock price has seen a gain of 6.68%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of Willdan Group Inc is $34.96, slightly lower than the past GF Value of $35.88. The GF Valuation has shifted from a 'Possible Value Trap, Think Twice' three months ago to 'Modestly Undervalued' today.

Company Overview

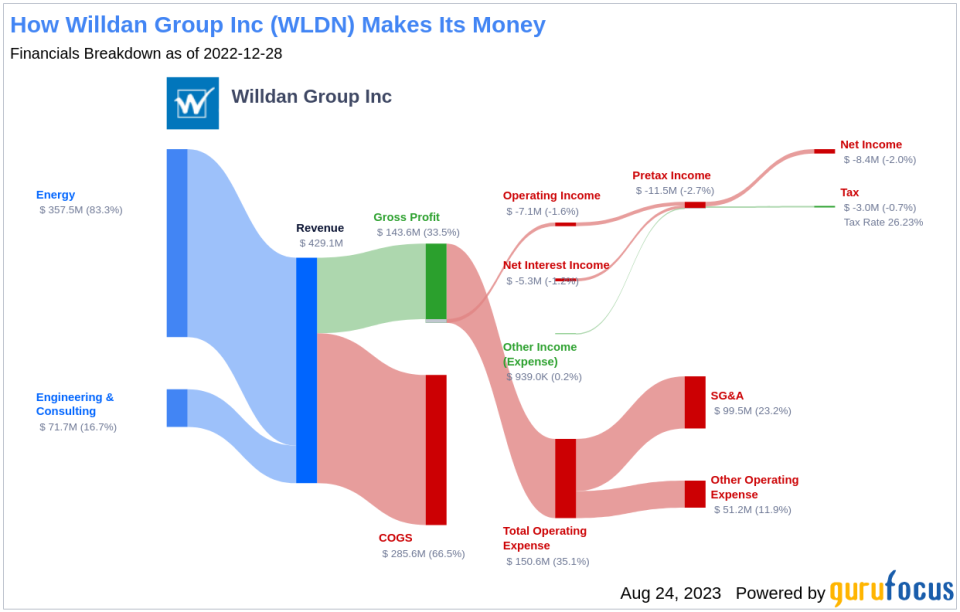

Willdan Group Inc is a provider of professional technical and consulting services to utilities, private industry, and public agencies at all levels of government. The company operates in two business segments: Energy and Engineering and Consulting. The majority of its revenue is derived from the Energy segment, which includes services such as audit and surveys, program design, master planning, benchmarking analyses, design engineering, construction management, performance contracting, installation, advances in software and data analytics, and other services. All of its revenue is derived from the domestic market.

Profitability Analysis

Willdan Group Inc's Profitability Rank is 6/10, indicating a moderate level of profitability compared to other companies in the industry. The company's Operating Margin is 2.26%, better than 33.44% of the companies in the industry. The ROE, ROA, and ROIC are 0.54%, 0.25%, and 1.03% respectively, each better than approximately 30% of the companies in the industry. Over the past 10 years, the company has been profitable for 7 years, better than 42.49% of the companies in the industry.

Growth Prospects

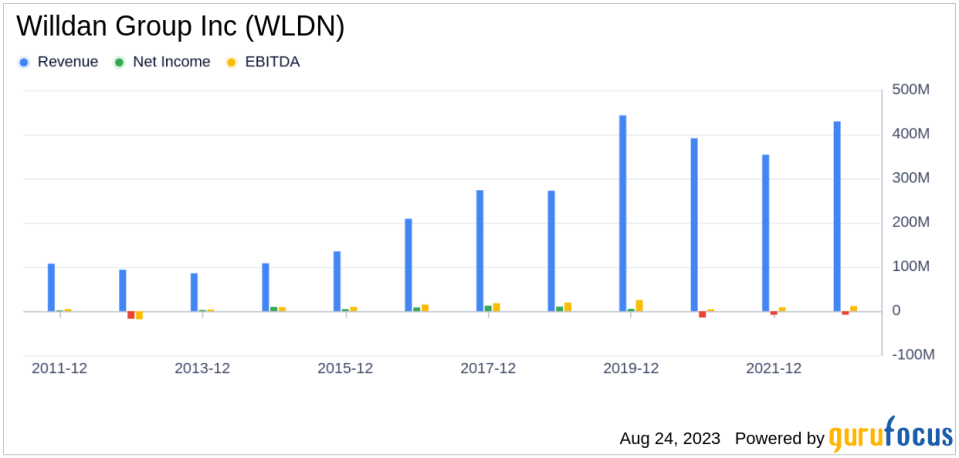

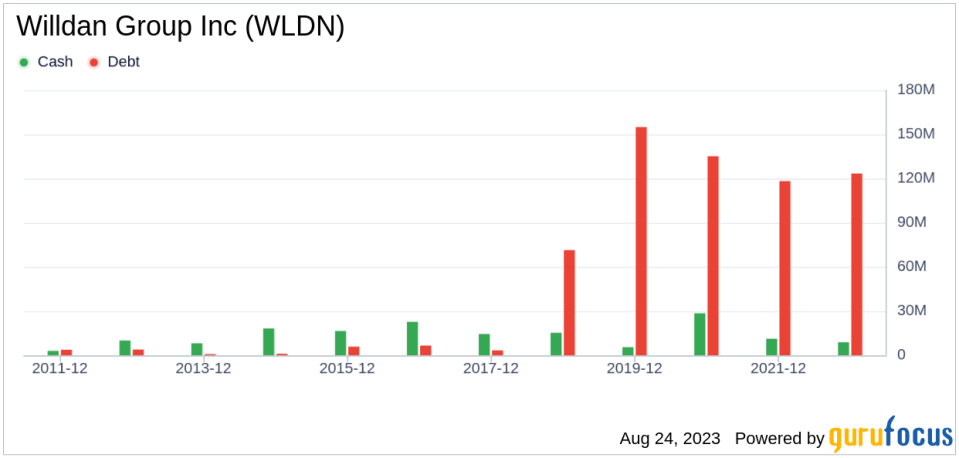

The company's Growth Rank is 3/10, indicating a relatively low growth rate compared to other companies in the industry. The 3-Year Revenue Growth Rate per Share is -4.30%, better than 30.1% of the companies in the industry. However, the 5-Year Revenue Growth Rate per Share is 1.20%, better than 45.5% of the companies in the industry. The company's Total Revenue Growth Rate for the next 3 to 5 years is estimated to be 7.81%, better than 69.95% of the companies in the industry.

Top Holders

The top holder of Willdan Group Inc's stock is Mario Gabelli (Trades, Portfolio), who holds 13,500 shares, accounting for 0.1% of the company's total shares.

Competitors

Willdan Group Inc faces competition from several companies in the construction industry. Limbach Holdings Inc (NASDAQ:LMB) with a market cap of $405.906 million, Matrix Service Co (NASDAQ:MTRX) with a market cap of $208.535 million, and Blink Charging Co (NASDAQ:BLNK) with a market cap of $260.445 million are among the company's main competitors.

Conclusion

In conclusion, Willdan Group Inc has shown a significant surge in its stock price over the past three months. The company's profitability and growth prospects are moderate compared to other companies in the industry. However, the company's stock is currently considered 'Modestly Undervalued', indicating potential for future growth. The company faces competition from several other companies in the construction industry, but its strong market position and growth prospects make it a company to watch in the future.

This article first appeared on GuruFocus.