William Blair Commentary: Our Top 3 Posts in 2019

Rising repo rates, investing in technology outside the technology sector, and equal risk contribution--three disparate topics that were the focus of our three top blog posts of 2019. Check out the key takeaways from each of these posts.

"I received more questions about repo funding in the two days leading up to September 18 than I did in any other market event since the CBOE Volatility Index (VIX) blew up in 2018." - Steve Karasick, Head of Derivatives Trading

Repo Market Recalls the Breakfast Club

The rapid rise in the overnight repo rate on September 16 into September 17 harkened back to a John Hughes movie, with the repo trader playing the role of Judd Nelson in The Breakfast Club.

As Steve Karasick, head of derivatives trading, explains in this post, the Federal Open Market Committee cut the interest rate on excess reserves, and repo rates surged as the combination of corporate tax day and a large Treasury coupon settlement prompted significant funding pressures in the repo market.

Repo traders--the Judd Nelsons of the world--got to work.

But Karasick doesn't think the repo-rate rise is a precursor to a repeat of 2008, when the repo market effectively shut down and kicked off the financial crisis. The market has calmed down, with repo and money-market rates looking a lot closer to where they were on September 13 than where they were on September 18.

Although this is still something to watch--the federal funds rate printed above the 2.25% upper level of the target range before it printed back inside the target range, coming in at 1.90%--Karasick believes it is likely a short-term issue and does not indicate real problems in short-term funding markets.

"In a world of disruption, companies that have built sustainable competitive advantages by being early and/or intentional adopters of technology are an appealing place to seek long-term value creation." -Ken Mcatamney, Portfolio Manager, Equity Team

Bullish on Tech--Especially Outside the Tech Sector

When thinking about technology, asset managers and asset owners have similar concerns and opportunities--both when investing in it and applying it.

But as Ken McAtamney, partner, portfolio manager on the global equity team, explains in this post, technology is less about technology stocks and more about the way disruption affects corporate performance.

Investing in technology companies to gain technology seems obvious, he notes, but is actually less fruitful than you might think and comes with more risk than might be expected.

Key risks to technology companies include government intervention (or a lack thereof) and existential issues that have little to do with technology itself (such as labor displacement, income inequality, and other social pains).

When looking beyond the technology sector, however, McAtamney sees better examples of companies that have built lasting, durable, sustainable competitive advantages by being early and/or intentional adopters of technology.

Domino's Pizza, he says, illustrates this concept well. Early in its development, the company used technology as a differentiator in all aspects of its business; now it's a clear leader in an industry that is rapidly accelerating the pace of technology-led innovation.

McAtamney says these companies, once entrenched, are less likely to be disrupted. Ongoing innovation becomes a self-fulfilling mindset.

"An equal risk contribution approach maximizes the diversification of risk (ex-ante) across portfolio constituents, explicitly trading off the volatility and correlation of the assets." -Peter Carl, Portfolio Manager, Systematic Equity Team

Why Equal Risk Contribution Matters

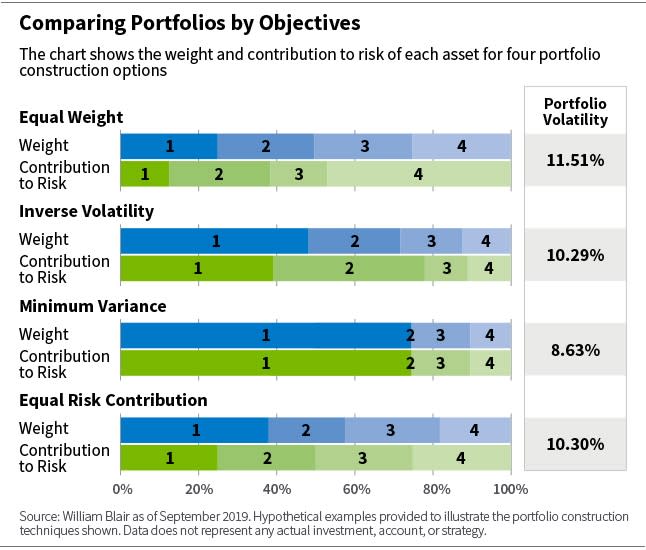

While equal risk contribution is just one of many options for constructing investment portfolios, it offers the opportunity to control volatility risk, and in doing so, improve risk-adjusted returns--making it a compelling option for many investors.

As Peter Carl, portfolio manager on the systematic equity team, explains in this post, an equal risk contribution portfolio (which weights securities so they contribute equally to the risk of a portfolio) results in an allocation similar to that of an equal weight portfolio, but distributes the contribution of risk for each asset equally.

In other words, a portfolio is constructed in which each asset contributes the same amount to the portfolio's volatility. This is analogous to an equal weight portfolio having equal allocation in dollar terms, except an equal risk contribution portfolio has equal weight in volatility terms.

This is attractive, Carl says, because it more robustly applies measures of volatility and correlation to position sizing, and it actively seeks risk diversification of the portfolio--offering investors a unique opportunity to control volatility risk and improve potential risk-adjusted returns.

Steve Karasick is the head of derivatives trading for William Blair Investment Management.Ken McAtamney, partner, is a portfolio manager on William Blair's Global Equity team. Peter Carl is a portfolio manager for William Blair's systematic strategies.

This article first appeared on GuruFocus.