Williams Companies Inc (WMB) Reports Record Financial Results for 2023

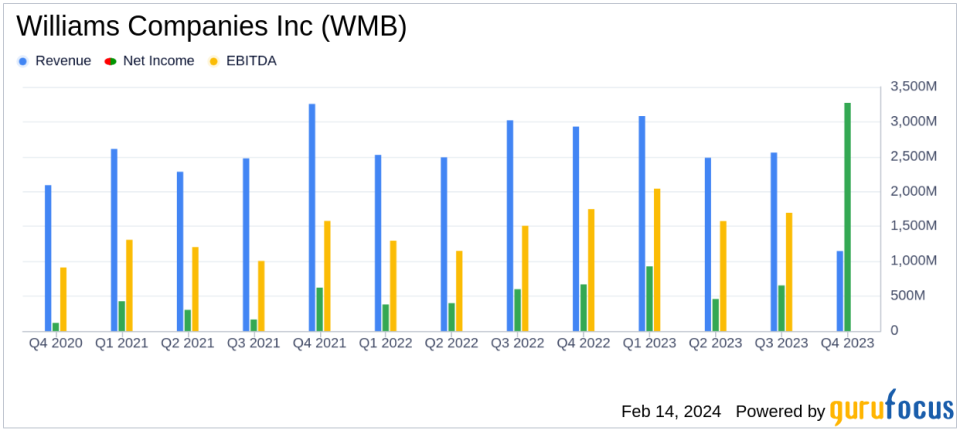

Net Income: GAAP net income surged to $3.273 billion, a 60% increase from 2022.

Adjusted EBITDA: Achieved $6.779 billion, up 6% compared to the previous year.

Cash Flow: Operations generated $6.055 billion in cash flow, marking a 24% rise from 2022.

Dividends: Raised annual dividend by 6.1%, marking the 50th consecutive year of dividend payments.

Growth Projects: Record gathering volumes and contracted transmission capacity highlight ongoing expansion.

2024 Outlook: Adjusted EBITDA guidance set between $6.8 billion and $7.1 billion.

On February 14, 2024, Williams Companies Inc (NYSE:WMB) released its 8-K filing, announcing unaudited financial results for the fourth quarter and full year ended December 31, 2023. The midstream energy company, known for operating significant pipeline systems and natural gas assets, delivered a year of record financial outcomes, underpinned by strategic acquisitions and the successful execution of expansion projects.

Financial Highlights and Operational Achievements

Williams Companies Inc (NYSE:WMB) reported a GAAP net income of $3.273 billion, or $2.68 per diluted share, representing a substantial 60% increase from the previous year. Adjusted net income also saw an uptick, reaching $2.334 billion, or $1.91 per diluted share, up by 5% compared to 2022. The company's Adjusted EBITDA rose to $6.779 billion, a $361 million or 6% increase from the previous year, reflecting the strength of its base business and the impact of recent acquisitions and expansion projects.

The company's cash flow from operations (CFFO) grew significantly to $6.055 billion, marking a 24% rise from the previous year. Available funds from operations (AFFO) also increased to $5.213 billion, up by $295 million or 6%. The dividend coverage ratio stood at a robust 2.39x on an AFFO basis. Williams Companies Inc (NYSE:WMB) achieved record gathering volumes of nearly 18 Bcf/d and contracted transmission capacity of 32.3 Bcf/d, up 6% and 32%, respectively, from 2022.

Strategic Growth and Future Outlook

Looking forward, the company has set an Adjusted EBITDA guidance range of $6.8 billion to $7.1 billion for 2024 and $7.2 billion to $7.6 billion for 2025, indicating an expected 5-year compound annual growth rate (CAGR) of 8%. The leverage ratio ended the year at 3.58x, and the company has raised its dividend by 6.1% to $1.90 annualized, highlighting its commitment to shareholder returns.

Williams Companies Inc (NYSE:WMB) has also made strategic moves to drive additional business growth in 2024-25. These include pre-filing a FERC application for Transco's 1.6 Bcf/d Southeast Supply Enhancement and completing several transmission projects. The company has also acquired a 115-Bcf natural gas storage portfolio, positioning itself as the largest storage owner on the Gulf Coast.

"Our natural gas-focused strategy delivered excellent financial results again in 2023 with contracted transmission capacity, gathering volumes and Adjusted EBITDA surpassing previous highs, demonstrating our ability to grow despite low natural gas prices," said Alan Armstrong, president and chief executive officer of Williams Companies Inc (NYSE:WMB).

Armstrong also highlighted the company's role in supporting the reliability of the U.S. power sector and its commitment to providing natural gas solutions to meet the growing demand for clean energy.

Comprehensive Financial Analysis

The company's financial strength is evident in its income statement, which shows a robust increase in net income and adjusted earnings per share. The balance sheet reflects a solid financial position with an increase in total assets to $52.627 billion, up from $48.433 billion in the previous year. The cash flow statement demonstrates the company's ability to generate significant operational cash flow, which supports its expansion and dividend payment strategy.

Williams Companies Inc (NYSE:WMB)'s performance in 2023 underscores its resilience and strategic agility in the face of industry challenges. The company's focus on expanding its infrastructure and acquiring strategic assets has positioned it for continued growth and success in the evolving energy landscape.

For a detailed analysis of Williams Companies Inc (NYSE:WMB)'s financial results and strategic initiatives, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Williams Companies Inc for further details.

This article first appeared on GuruFocus.