Williams-Sonoma (WSM) Hits 52-Week High: What's Driving It?

Williams-Sonoma, Inc. WSM reached a new 52-week high of $157.36 on Sep 25. The stock pulled back to end the trading session at $156.28, up 11.6% from the previous day’s closing price of $140.01.

On Sep 22, the American private equity firm, Leonard Green & Partners, announced that it has increased its ownership stake to 5% in this multi-channel specialty retailer company, which now holds the position of its seventh largest stakeholder. The 5% increase is due to Green Equity Investors IX LP owning 1.27 million shares and Green Equity Investors Side IX LP owning 1.94 million shares of the company. This purchase has most likely induced bullish sentiments among the investors, resulting in the company’s share price to touch a 52-week high.

Stock Performance

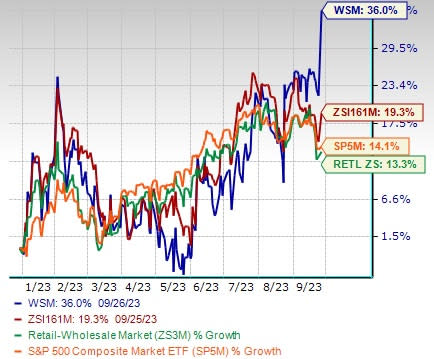

This Zacks Rank #3 (Hold) stock has gained 36% so far this year compared with the Zacks Retail - Home Furnishings industry’s 19.3% growth, the Zacks Retail-Wholesale sector’s increase of 13.3% and S&P 500 Index’s rise of 14.1%.

Image Source: Zacks Investment Research

Earnings estimate for fiscal 2023 has moved up to $13.97 per share from $13.44 per share in the past 60 days. Despite the macroeconomic uncertainties and supply-related risks, the stock portrays a positive trend, indicating robust fundamentals and elevating the expectation of ongoing outperformance in the near term.

What’s Making the Stock Attractive?

E-Commerce Driving Growth: Williams-Sonoma is one of the largest players in e-commerce retailing in the United States. The company’s e-commerce penetration has been increasing, buoyed by its in-house tech platform, rapid experimentation program, content-rich online experience and marketing strategies. WSM's e-commerce penetration stands at about 66%, which is anticipated to gradually increase to 70% over time.

Moreover, the company’s investment in the merchandising of its brands, efficient catalog circulations and digital marketing boosts revenues from the e-commerce channel. In second-quarter fiscal 2023, WSM witnessed positive outcomes from its recently revamped e-commerce website.

Focus on B2B: Williams-Sonoma’s newest division, Williams-Sonoma Inc. Business-to-Business (B2B), has made significant progress since its launch. It has enabled the company to capture market share in the fragmented $80 billion market. The company effectively utilizes its portfolio brands, internal design team, and global sourcing capabilities to offer diverse solutions to B2B customers.

In second-quarter fiscal 2023, the company witnessed 23% sequential growth in its contract business, reflecting its several contracts wins across various industries, including partnerships with Sony in the entertainment sector, the San Antonio Spurs training facility, and multiple properties under various renowned brands. Despite the trade business being affected by the housing market softness, WSM is optimistic about its long-term prospects, observing recent improvements in this segment.

Expansion Initiatives: The company also focuses on expanding its global reach to drive its growth momentum in the coming years. In second-quarter fiscal 2023, WSM unveiled its newly relocated store on Post Road in Westport, CT, demonstrating high productivity by showcasing the company’s diverse product offerings and highlighting its complimentary design services.

The company currently focusing on expanding its business in the Indian market by opening three new stores in September 2023, including the first Potter Barn Kids store. In the future, the company has plans to open additional locations in 2024.

Key Picks

Some better-ranked stocks from the same sector are Amazon.com, Inc. AMZN, BJ's Restaurants, Inc. BJRI and Builders FirstSource, Inc. BLDR.

Amazon currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMZN delivered a trailing four-quarter earnings surprise of 41%, on average. The stock has risen 14.7% in the past year. The Zacks Consensus Estimate for AMZN’s 2023 sales and earnings per share (EPS) indicates growth of 11.1% and 214.1%, respectively, from the prior-year reported levels.

BJ's Restaurants presently sports a Zacks Rank of 1. BJRI delivered a trailing four-quarter earnings surprise of 121.2%, on average. The stock has declined 1.8% in the past year.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS implies rises of 5.5% and 441.2%, respectively, from the year-ago reported numbers.

Builders FirstSource currently sports a Zacks Rank of 1. BLDR has a trailing four-quarter earnings surprise of 52.2%, on average. Shares of the company have rallied 126.7% in the past year.

The Zacks Consensus Estimate for BLDR’s 2023 sales and EPS indicates decline of 23.3% and 26.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Williams-Sonoma, Inc. (WSM) : Free Stock Analysis Report