Williams-Sonoma's (WSM) Stock Up on Q4 Earnings & Revenue Beat

Williams-Sonoma Inc. WSM reported results for the fourth quarter of fiscal 2023 (ended Jan 28, 2024). In the quarter, earnings and net revenues beat the Zacks Consensus Estimate but declined year over year.

The quarterly results reflect low contributions from the company’s reportable brands, including Pottery Barn, West Elm, and Pottery Barn Kids and Teen. The downtrend was driven by ongoing softness in the housing market and geopolitical uncertainties. Also, an increase in occupancy costs, along with employment and general expenses, added to the downtrend.

Nonetheless, Williams-Sonoma’s solid operating model partially offset the headwinds through its full-price selling, supply-chain efficiencies and top-tier customer service. Owing to the operational efficiencies and strong liquidity position, the company hiked its quarterly dividend payment by 26% to 23 cents per share ($1.13 per share annually). The amount will be paid out on May 24, 2024, to shareholders of record as of Apr 19.

Following the earnings release, shares of this multi-channel specialty retailer of premium quality home products moved up 17.8% during the trading hours on Mar 13.

Earnings, Revenue & Comps Discussion

Non-GAAP earnings per share (EPS) of $5.44 surpassed the Zacks Consensus Estimate of $5.06 by 7.5%. However, the metric declined 1.1% from $5.50 reported a year ago.

Net revenues of $2.28 billion topped the consensus mark of $2.21 billion by 3% and decreased 6.9% year over year.

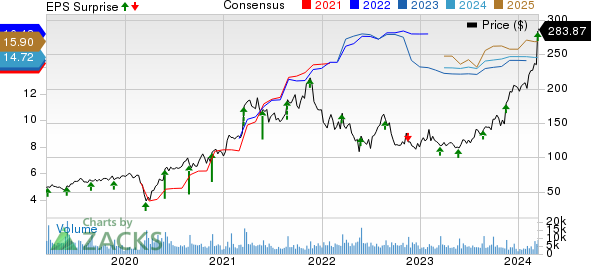

Williams-Sonoma, Inc. Price, Consensus and EPS Surprise

Williams-Sonoma, Inc. price-consensus-eps-surprise-chart | Williams-Sonoma, Inc. Quote

In the fiscal fourth quarter, comps fell 6.8% compared with 0.6% in the year-ago period. Our model predicted comps to decline 7.6% in the quarter.

Comps at West Elm brand decreased 15.3% compared with 10.7% reported in the year-ago quarter. Comps at Pottery Barn dipped 9.6% against a 5.8% rise a year ago. Williams-Sonoma comps increased 1.6% against a 2.5% decline registered in the year-ago quarter. Pottery Barn Kids and Teens registered a comps decline of 2.5% against 4% growth reported in the year-ago quarter.

Operating Highlights

The gross margin was 46%, up 480 basis points (bps) from the year-ago period. The increase was due to higher merchandise margins and lower costs from supply-chain efficiencies, partially offset by a 2.1% year-over-year increase in occupancy costs.

Non-GAAP selling, general and administrative expenses were 25.9% of net revenues (above our projection of 24.4%), reflecting an increase of 460 bps year over year. Furthermore, the non-GAAP operating margin expanded 20 bps from the year-ago period to 20.1% for the quarter.

Sneak Peek at Fiscal 2023

For the fiscal year, Williams-Sonoma reported net revenues of $7.75 billion, down from $8.67 billion reported in fiscal 2022. Non-GAAP EPS of $14.85 was down from $16.54 reported a year ago.

The gross margin in fiscal 2023 was 42.7%, up from 42.4% reported in the prior year. Non-GAAP operating margin contracted 110 bps to 16.4% year over year.

Financials

As of Jan 28, 2024, Williams-Sonoma reported cash and cash equivalents of $1.26 billion, up from $367.3 million in the fiscal 2022 end. Net cash from operating activities totaled $1.68 billion in fiscal 2023 compared with $1.05 billion reported in the comparable period a year ago.

Fiscal 2024 Guidance Unveiled

Williams-Sonoma anticipates fiscal 2024 net revenues to be in the range of -3% to +3%. The company expects its operating margin to be between 16.5% and 16.8%. Comps for the year are expected to be in the range of -4.5% to +1.5%.

Further, for the long term, the company still projects mid-to-high-single-digit annual net revenue growth and an operating margin in the mid-to-high teens.

Zacks Rank & Recent Retail-Wholesale Releases

Williams-Sonoma currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Papa John’s International, Inc. PZZA reported mixed fourth-quarter fiscal 2023 results, with earnings beating the Zacks Consensus Estimate and revenues missing the same. The top and the bottom line increased on a year-over-year basis.

During the fiscal fourth quarter, the company registered benefits from the expansion of the global footprint and enhancements in digital solutions and marketing platforms. Also, it stated improvements in domestic company-owned restaurant-level margins and sequential improvement in U.K. sales with franchisees. The company intends to focus on the Back to Better 2.0 growth initiative and accelerate North American development to drive growth.

Red Robin Gourmet Burgers, Inc. RRGB reported mixed fourth-quarter fiscal 2023 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. The top and the bottom line increased on a year-over-year basis.

The quarter’s results reflect a 4.9% rise in guest checks on the back of a 6.3% increase in menu prices and a 1% increase in discounts. However, the company cited concerns regarding the anticipated reduction in restaurant sales and adjusted EBITDA in 2024 due to the shift back to a 52-week fiscal year and the impact of sale-leaseback transactions on rent expenses.

Cracker Barrel Old Country Store, Inc. CBRL reported second-quarter fiscal 2024 results, with earnings and revenues beating the Zacks Consensus Estimate. The top line increased year over year while the bottom line declined from the year-ago quarter figure.

The uptick in the top line was primarily backed by sequential improvements in traffic. Also, guest experience enhancements and marketing optimizations added to the positives. However, the company stated issues related to margin pressures stemming from labor cost inflation. It expects ongoing margin challenges in the short term, particularly in the upcoming fiscal third quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cracker Barrel Old Country Store, Inc. (CBRL) : Free Stock Analysis Report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

Williams-Sonoma, Inc. (WSM) : Free Stock Analysis Report