Winas (SGX:5CN) Shareholders Received A Total Return Of 43% In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

One of the frustrations of investing is when a stock goes down. But no-one can make money on every call, especially in a declining market. The Winas Limited (SGX:5CN) is down 52% over three years, but the total shareholder return is 43% once you include the dividend. And that total return actually beats the market return of 26%. In the last ninety days we've seen the share price slide 58%.

View our latest analysis for Winas

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Winas became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

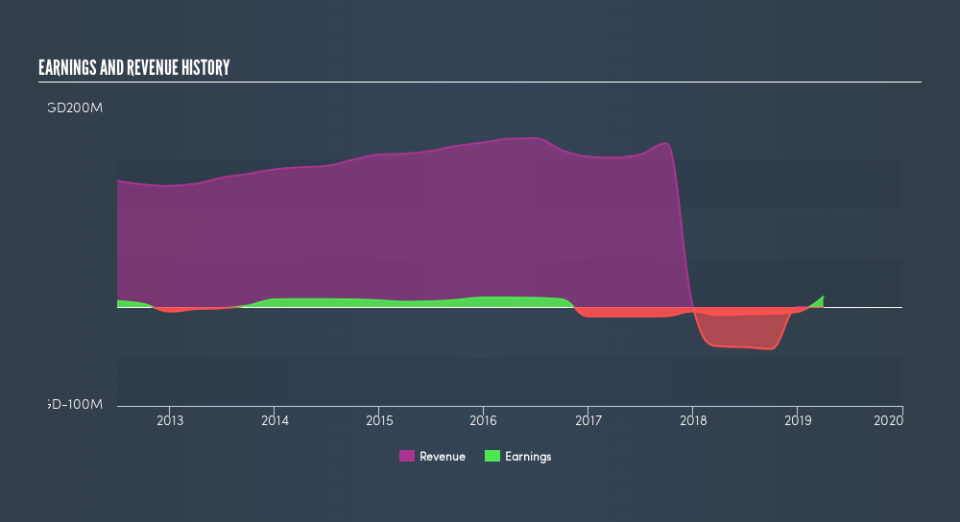

It's quite likely that the declining dividend has caused some investors to sell their shares, pushing the price lower in the process. The revenue decline, at an annual rate of 87% over three years, might be considered salt in the wound.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Winas's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Winas the TSR over the last 3 years was 43%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Winas shareholders have received a total shareholder return of 57% over one year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 15% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Keeping this in mind, a solid next step might be to take a look at Winas's dividend track record. This free interactive graph is a great place to start.

Of course Winas may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.