Wingstop Inc (WING) Soars with Record Sales and Net Income Growth in 2023

Unit Count Increase: 13.0% growth in global restaurant locations.

Domestic Same Store Sales Growth: A significant 18.3% rise in 2023.

System-wide Sales: Jumped 27.1% to $3.5 billion for the fiscal year.

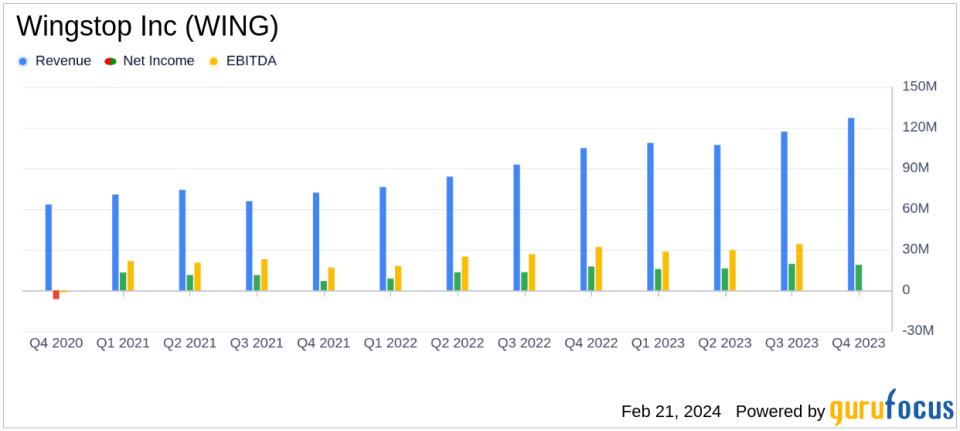

Net Income: Increased by 32.5% to $70.2 million, or $2.35 per diluted share.

Adjusted EBITDA: Grew 36.1% to $146.5 million, reflecting operational efficiency.

Share Repurchase: $125.0 million of common stock repurchased under the ASR Agreement.

On February 21, 2024, Wingstop Inc (NASDAQ:WING) released its 8-K filing, announcing its fiscal fourth quarter and full year 2023 financial results. The company, known for its flavorful chicken wings and strong franchise model, reported a year of record-breaking sales and profit growth, despite a shorter fiscal period compared to the previous year.

Company Overview

Founded in 1994 in Garland, Texas, Wingstop has become a dominant player in the restaurant industry, specializing in bone-in and boneless chicken wings, tenders, and recently, chicken sandwiches. With nearly 2,000 global stores by the end of 2022, Wingstop has established itself as the 40th-largest restaurant chain in the U.S. by system sales. The company's revenue primarily comes from franchise royalties and advertising fees, with a small portion from company-owned stores.

Financial Performance and Challenges

Wingstop's performance in 2023 was marked by a 13.0% increase in unit count, leading to a total of 2,214 worldwide locations. The company's domestic same store sales saw an impressive 18.3% growth, primarily driven by an increase in transactions. This growth is critical as it indicates the brand's strength and customer loyalty in a competitive market. However, such rapid expansion can also present challenges, including market saturation and operational complexities that could impact future profitability.

Financial Achievements

The company's financial achievements in 2023 are particularly noteworthy in the restaurant industry, where competition is fierce and profit margins can be slim. The 27.1% increase in system-wide sales to $3.5 billion underscores Wingstop's successful expansion and operational strategies. Moreover, the 32.5% increase in net income to $70.2 million reflects not only revenue growth but also improved operational efficiency and cost management.

Key Financial Metrics

Wingstop's income statement and balance sheet provide a detailed look at its financial health. The company's total revenue increased by 28.7% to $460.1 million for the fiscal year. Adjusted EBITDA, a measure of profitability, saw a significant increase of 36.1% to $146.5 million. These metrics are important as they demonstrate Wingstop's ability to grow its top line while maintaining profitability.

Management Commentary

"2023 marked the strongest year on record for Wingstop where we achieved 18.3% domestic same store sales growth, driven primarily by transactions, and we delivered an unprecedented 20 consecutive years of domestic same store sales growth," said Michael Skipworth, President and Chief Executive Officer. "The strength of our unit economics were showcased with 255 net new units in 2023, a 13% unit growth rate, and a record level of restaurant development commitments as we enter 2024. We have a proven playbook and I couldnt be more excited by our opportunity to scale Wingstop to more than 7,000 restaurants."

Analysis of Company's Performance

Wingstop's robust performance in 2023 can be attributed to several factors, including its focus on digital sales, which accounted for 67.0% of system-wide sales. The company's strategic initiatives and investments in technology have paid off, enabling it to navigate a challenging economic environment effectively. The share repurchase program also reflects confidence in the company's future and a commitment to delivering shareholder value.

As Wingstop moves into 2024, it forecasts mid-single digit domestic same store sales growth and approximately 270 global net new units. With SG&A expected to be around $108 million and stock-based compensation expense at about $19 million, the company is positioning itself for sustained growth and profitability.

For value investors and potential GuruFocus.com members, Wingstop's strong financial results, strategic expansion, and effective cost management make it a compelling study in successful growth and operational excellence within the restaurant industry.

For more detailed information and analysis on Wingstop Inc (NASDAQ:WING)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Wingstop Inc for further details.

This article first appeared on GuruFocus.