Winmark Has Upside Potential in Next 5 Years

Winmark Corp. (NASDAQ:WINA) has delivered high returns to its shareholders for nearly two decades. Since 2005, its share price has risen from $20 per share to $370 at the time of writing. This growth translates to an annual compounded rate of return of 16.60% over the past 19 years.

Despite the consistent increase in its share price for nearly two decades, Winmark is still a small-cap company with a market capitalization of only $1.30 billion. In my opinion, the company represents an excellent compounding opportunity for long-term investors at its current price.

The franchise second-hand retailing business

Winmark has a simple business model. It has retailing chains selling second-hand products under a franchise model. The company had 1,295 franchises in the United States and Canada and more than 2,800 territories under several retail brands, including Plato's Closet, Once Upon A Child, Play it Again Sports, Style Encore and Music Go Round. Like any other franchise model, the company takes care of the store concept and marketing and, in return, earns royalty fees based on the net sales of each store operated by its franchisees.

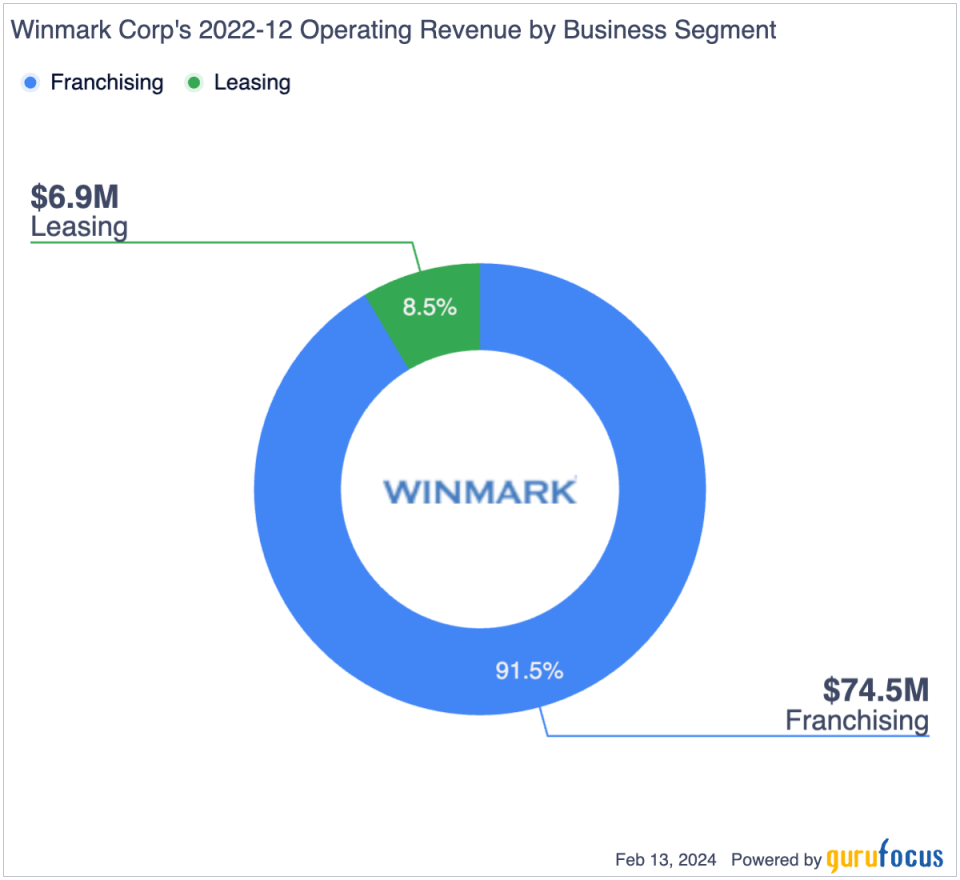

In addition to the franchising business, Winmark has an equipment leasing business. The majority of 2022 revenue, $74.50 million, or 91.5%, was from the franchising business, while the leasing business generated $6.90 million, accounting for only 8.50% of total revenue.

Growing operating performance with impressive ROIC

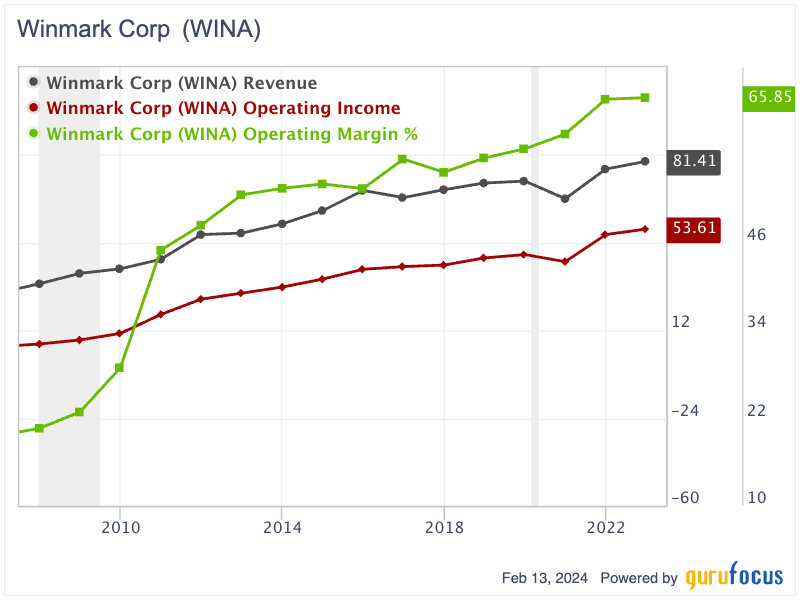

Over the past 15 years, Winmark has demonstrated a consistently upward trend in both revenue and operating income. Its revenue surged from $31.20 million in 2007 to $81.40 million in 2022, while operating income climbed from $6.40 million to $53.60 million within the same timeframe. During this period, Winmark's revenue saw declines in only two years, specifically 2016 and 2020, with operating income experiencing a decrease solely in 2020. The drop in revenue for 2016 can largely be attributed to the downturn in the leasing business, stemming from reduced equipment sales to customers, despite the franchising business still witnessing growth that year. The simultaneous decline in both revenue and operating income in 2020 was primarily due to the impact of the Covid-19 pandemic.

Thanks to its franchise business model, Winmark has enjoyed remarkable profitability, highlighted by an extraordinary and consistently increasing operating margin that grew from nearly 20.62% in 2007 to an impressive 65.85% in 2022. The company's primary operating costs are attributed to selling, general and administrative expenses. The significant improvement in margins can be attributed to the economies of scale achieved through the growing number of franchisees over the years.

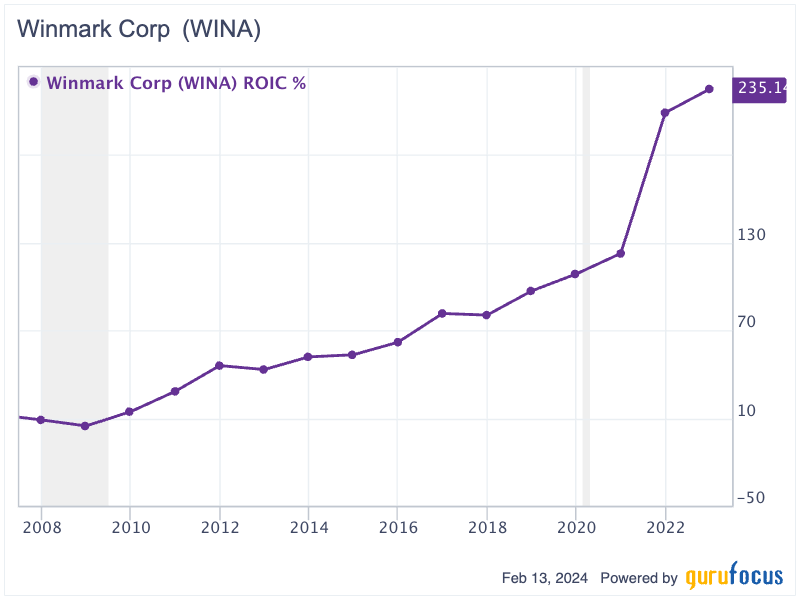

Furthermore, the asset-light franchise business model has enabled Winmark to generate an increasing and exceptionally high return on invested capital. Starting at a modest 8.80% in 2007, the company's ROIC has shown a steady upward trajectory over the years. In 2019, Winmark achieved a significant milestone when its ROIC exceeded three digits for the first time, reaching 108.6%, and it continued to climb, reaching an impressive 235% in 2022.

Solid financial health

Winmark has a manageable leverage level. As of September, it had more than $40.50 million in cash and cash equivalents, while the interest-bearing debt stood at $70.10 million. Thus, this resulted in a net debt of $29.60 million. However, what might concern investors is the significant shareholders' equity deficit of $34.56 million. At first glance, the shareholders' equity deficit, caused by the retained earnings (accumulated deficit) of nearly $41 million, seems to give the wrong impression that the company has accumulated large losses over the years. However, it is important to understand the retained earnings in the company's financial statements include cash dividends and the repurchase of its own stocks over the years. This demonstrates management's commitment to returning cash to its shareholders, indicating the apparent deficits in retained earnings are the result of deliberate capital return strategies rather than operational struggles.

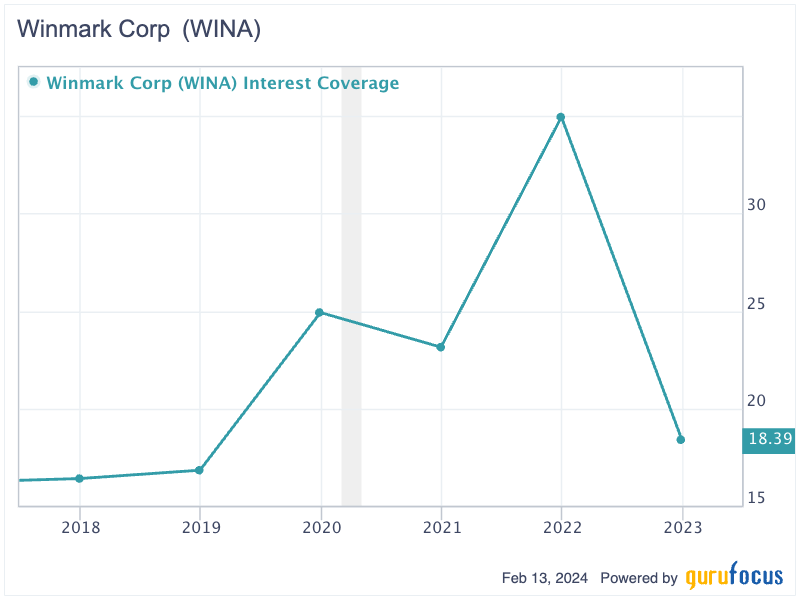

Over the past five years, Winmark's interest coverage ratio has consistently been high, ranging between 16.83 and 34.95, and settling at 18.40% in 2022. This range demonstrates the company's robust capacity to fulfill its interest and debt obligations, showcasing strong financial health in terms of servicing its debt.

Potential upside in the next five years

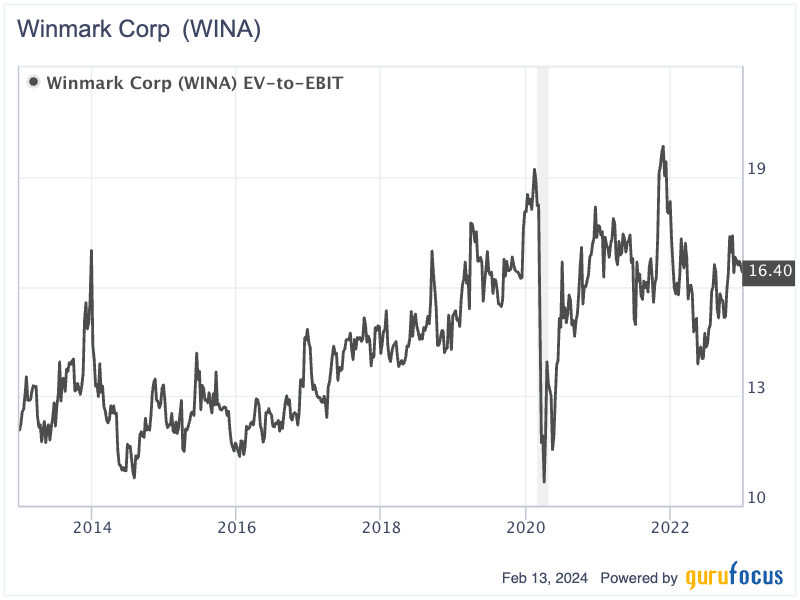

Over the past decade, Winmark's enterprise value/Ebit ratio oscillated within a reasonable range of 10.65 to 19.84. At the time of writing, it is valued at around 16.40 times Ebit, a bit higher than its 10-year average valuation of 14.40.

Assuming Winmark continues its historical trend of growing its operating income at an annual rate of 15%, its projected operating income for 2027 would reach $107.80 million. The continued increase in the company's market capitalization is likely to attract more attention from a broader range of investors, which could, in turn, elevate its valuation multiples. If its EBIT multiple expands to 25, Winmark's enterprise value could reach $2.70 billion by 2027, representing a potential 100% upside over the next five years.

The bottom line

Winmark's business model, focused on franchising second-hand retailing businesses, has not only delivered significant revenue and operating income growth, but has also achieved an extraordinary operating margin and return on invested capital, showcasing the efficiency and profitability of its operations. The company's solid financial health, characterized by manageable leverage and a high interest coverage ratio, positions it as an attractive investment with a potential 100% upside in the next five years.

This analysis underscores Winmark's compelling case as a robust compounding opportunity for long-term investors, promising continued growth and financial strength in the years to come.

This article first appeared on GuruFocus.