Winnebago (WGO) Q1 Earnings Miss Estimates, Decline Y/Y

Winnebago WGO delivered adjusted earnings of $1.06 per share for first-quarter fiscal 2024 (ended Nov 25, 2023), missing the Zacks Consensus Estimate of $1.20. The bottom line also fell 48.8% year over year.

The recreational vehicle (“RV”) maker reported revenues of $763 million for the quarter under review, outpacing the Zacks Consensus Estimate of $728 million. The top line, however, fell 19.9% year over year.

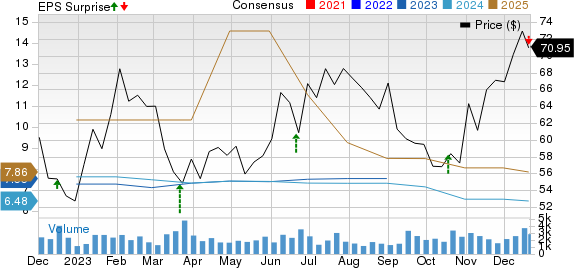

Winnebago Industries, Inc. Price, Consensus and EPS Surprise

Winnebago Industries, Inc. price-consensus-eps-surprise-chart | Winnebago Industries, Inc. Quote

Segmental Performance

Revenues in the Towable RV segment fell 4.8% year over year to $330.8 million, primarily led by a reduction in average selling price. However, the metric surpassed our estimate of $277.5 million due to higher-than-expected total deliveries.

Total deliveries from the Towable RV segment came in at 7,846 units, increasing 9.1% year over year and beating our estimate of 5,641 units. Adjusted EBITDA declined 8.8% to $33.1 million, reflecting deleverage and new product start-up costs. The figure came ahead of our estimate of $29.7 million. The segment’s backlog was $199.8 million (5,290 units), decreasing 54%.

In the reported quarter, revenues in the Motorhome RV segment slid 28% year over year to $334.4 million due to a decline in unit volume. The top line missed our estimate of $339.2 million.

The total deliveries from the Motorhome RV segment came at 1,721 units, down 31.4% year over year but outpacing our estimate of 1,593 units. The segment recorded an adjusted EBITDA of $21.3 million, down 57.6% and lagged our estimate of $25.1 million. The backlog was $545.3 million (3,200 units), down 65.8% from the prior year.

Revenues in the Marine segment were $87.3 million, decreasing 33.5% year over year, primarily due to lower unit sales. The metric also lagged our estimate of $118.9 million due to lower-than-expected deliveries. The total deliveries from the segment came at 1,118 units, down 34.2% year over year and lagged our estimate of 1,428 units.

The Marine segment recorded an adjusted EBITDA of $7.2 million, down 61% year over year and lagging our estimate of $10.2 million. The backlog for the Marine segment was $140.4 million (1,897 units), down 55.9%.

Financials

Winnebago had cash and cash equivalents of $219.6 million as of Nov 25, 2023. Long-term debt (excluding current maturities) increased to $593.1 million from $592.4 million recorded on Aug 26, 2023. The company returned $50 million to shareholders via share repurchases and dividends.

Zacks Rank & Key Picks

Winnebago currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Volvo VLVLY, Stellantis N.V. STLA and BYD Company Limited BYDDY. While VLVLY sports a Zacks Rank #1 (Strong Buy), STLA & BYDDY each carry Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for VLVLY’s 2023 sales and earnings indicates year-over-year growth of 4.2% and 70.6%, respectively. The EPS estimates for 2023 and 2024 have increased 8 cents and 7 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for STLA’s 2023 sales and earnings indicates year-over-year growth of 12.3% and 11.3%, respectively. The EPS estimates for 2023 and 2024 have increased 3 cents and 16 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for BYDDY’s 2023 sales and earnings indicates year-over-year growth of 35.7% and 74.7%, respectively. The EPS estimate for 2024 has increased 10 cents in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report