Winnebago (WGO) to Report Q2 Earnings: Here's What to Expect

Winnebago WGO is slated to release second-quarter fiscal 2024 results on Mar 21, before market open. The Zacks Consensus Estimate for Winnebago’s fiscal second-quarter earnings per share and revenues is pegged at 91 cents and $710.11 million, respectively.

For the fiscal second quarter, the consensus estimate for WGO’s earnings per share has decreased 10 cents in the past 60 days. Its bottom-line estimates imply a decline of 51.6% from the year-ago reported number.

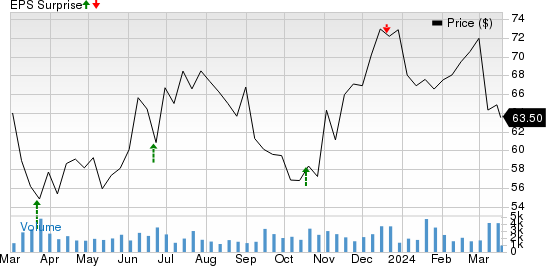

The Zacks Consensus Estimate for Winnebago’s quarterly revenues suggests an 18.1% year-over-year decline. Over the trailing four quarters, it surpassed earnings estimates thrice and missed once, the average surprise being 18.4%. This is depicted in the graph below:

Winnebago Industries, Inc. Price and EPS Surprise

Winnebago Industries, Inc. price-eps-surprise | Winnebago Industries, Inc. Quote

Q1 Highlights

In the first quarter of fiscal 2024, Winnebago’s adjusted earnings per share of $1.06 missed the Zacks Consensus Estimate of $1.20. The bottom line also plunged 48.8% year over year. The company reported net sales of $763 million, outpacing the Zacks Consensus Estimate of $728 million. The top line, however, declined 19.9% year over year.

Factors at Play

Winnebago's Grand Design acquisition has solidified its towable RV offerings, while the buyout of Newmar Corp has enhanced the high-end motorized product lineup. Entering into the marine segment through the Chris-Craft buyout has broadened WGO's market reach. The Barletta acquisition further strengthens the company's position in the marine market, augmenting its network, portfolio and revenues.

The company’s new offerings are reinforcing its market position. The second quarter of fiscal 2024 brings the launch of the next generation Revel and EKKO Motorhomes, with the Revel 44E featuring all-wheel drive, extended season capabilities and a Winnebago power package. The strength of acquisitions and new launches is likely to have bolstered the company’s results in the to-be-reported quarter.

Discouragingly, the company’s gloomy outlook dims its prospects. Winnebago anticipates a sequential decline in profits in the second quarter of fiscal 2024, citing a historical trend of reduced consolidated sales from fiscal first-quarter levels. This decrease is attributed to production utilization during the holiday period, a pattern expected to persist this year. The outlook factors in a seasonal production lull and dealers' focus on minimizing non-current inventory. As a result, WGO expects a sequential decline in sales, adjusted EPS, adjusted EBITDA and adjusted EBITDA margins in the fiscal second quarter.

Here's a sneak peek at the firm’s key revenue projections for the to-be-reported quarter.

Our estimate for quarterly revenues from the Motorhome RV segment is pegged at $272.3 million, suggesting a decline from $403.8 million recorded in the prior-year quarter.

Our estimate for revenues from the Towable RV segment for the fiscal second quarter is pinned at $303.4 million, indicating a decline from $342.5 million recorded in the prior-year period.

Our estimate for quarterly revenues from the Marine segment is pegged at $86.5 million, implying a decline from $112.9 million reported in the prior-year quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Winnebago for the quarter to be reported, as it does not have the right combination of the two key ingredients. A positive Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: Winnebago has an Earnings ESP of -5.79%. This is because the Most Accurate Estimate is pegged at 86 cents, which is lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: WGO currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Releases

THOR Industries, Inc. THO reported earnings per share of 40 cents for the second quarter of fiscal 2024, missing the Zacks Consensus Estimate of 69 cents. The company registered revenues of $2.21 billion for the quarter under review, lagging the Zacks Consensus Estimate of $2.30 billion. The top line declined 5.9% year over year.

As of Jan 31, 2024, Thor had cash and cash equivalents of $340.2 million and long-term debt of $1.39 billion. During the second quarter of fiscal 2024, THO did not repurchase any shares of its common stock.

REV Group, Inc. REVG reported earnings per share of 25 cents for the first quarter of fiscal 2024, surpassing the Zacks Consensus Estimate of 9 cents. The company registered revenues of $586 million for the quarter under review, outpacing the Zacks Consensus Estimate of $577 million.

As of Jan 31, 2024, REV had cash and cash equivalents of $87.9 million. During the first quarter of fiscal 2024, REVG did not repurchase any shares of its common stock.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thor Industries, Inc. (THO) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

REV Group, Inc. (REVG) : Free Stock Analysis Report