Will Winnebago (WGO) Upset Investors This Earnings Season?

Winnebago Industries WGO is scheduled to release first-quarter fiscal 2024 results on Dec 20, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at $1.25 and $738.6 million, respectively.

The Zacks Consensus Estimate for Winnebago’s fiscal first-quarter earnings per share has been revised downward by 17 cents in the past 60 days. The bottom-line projection implies a year-over-year decline of 40%. The Zacks Consensus Estimate for revenues also suggests a year-over-year contraction of 22.4%.

One of the leading recreational vehicle (RV) manufacturers in the world, Winnebago, posted better-than-expected earnings for the last reported quarter on higher-than-anticipated EBITDA from Towable RV and Marine segments. The bottom line, however, plunged 47.4% year over year.

The company surpassed the Zacks Consensus Estimate in the trailing four quarters, the average being 24.6%. However, things aren’t looking rosy for the quarter-to-be reported.

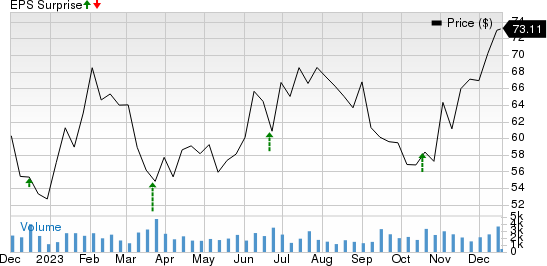

Winnebago Industries, Inc. Price and EPS Surprise

Winnebago Industries, Inc. price-eps-surprise | Winnebago Industries, Inc. Quote

Factors at Play

High interest rates are likely to have acted as spoilsport for Winnebago, which belongs to a highly cyclical industry. Customers are being prompted to reduce or put off discretionary expenses, thereby resulting in a decline in backlog orders for Winnebago, which might negatively impact revenues. In the last reported quarter, the company's backlog for the Towable RV, Motorhome RV and Marine segments reflected a year-over-year decline of 64%, 60% and 38%, respectively. As it is, WGO expects the first half of fiscal 2024 to be particularly challenging.

Manufacturing inefficiencies, logistical constraints, a tough labor market and inflationary input cost pressure might have weighed on margins. Also, Winnebago has been witnessing increasing selling, general and distribution expenses as a percent of revenues over the past several quarters. The trend is expected to have continued, thereby limiting the operating profits of the firm.

Discouragingly, our forecast for Motorhome RV, Towable RV and Marine deliveries indicates a decline of 36%, 21% and 16%, respectively. We expect adjusted EBITDA for Motorhome RV, Towable RV and Marine units to be $25.1 million, $29.7 million and $10.2 million, which implies a year-over-year contraction of 50%, 18.3% and 44.9%, respectively.

What Does Our Model Say?

Our proven model does not conclusively predict an earnings beat for Winnebago in the to-be-reported quarter, as it doesn’t have the right combination of the two key ingredients. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That’s not the case here.

Earnings ESP: WGO has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is on par with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Winnebago currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

What Did Thor’s Latest Quarterly Report Unveil?

Thor Industries, Inc. THO reported earnings of 99 cents per share for first-quarter fiscal 2024 (ended Oct 31, 2023), which surpassed the Zacks Consensus Estimate of 87 cents. The bottom line tumbled 60.9% from the year-ago quarter’s earnings of $2.53 per share. The company registered revenues of $2,500.8 million for the quarter under review, lagging the Zacks Consensus Estimate of $2,510.4 million. The top line declined 19.5% year over year.

As of Oct 31, 2023, Thor had cash and cash equivalents of $425.8 million and long-term debt of $1,271.9 million. During the first quarter of fiscal 2024, THO repurchased $30 million of common stock at an average price of $91.61. Thor has reaffirmed its full-year guidance for fiscal 2024. It projects its full-year consolidated net sales in the range of $10.5-$11 billion. The consolidated gross profit margin is expected to be in the range of 14.5-15%. Earnings per share are expected to be in the range of $6.25-$7.25.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thor Industries, Inc. (THO) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report