Winners And Losers Of Q2: Shutterstock (NYSE:SSTK) Vs The Rest Of The Online Marketplace Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the online marketplace stocks have fared in Q2, starting with Shutterstock (NYSE:SSTK).

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 11 online marketplace stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 0.54%, while on average next quarter revenue guidance was 1.72% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable and online marketplace stocks have not been spared, with share prices down 23.7% since the previous earnings results, on average.

Shutterstock (NYSE:SSTK)

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

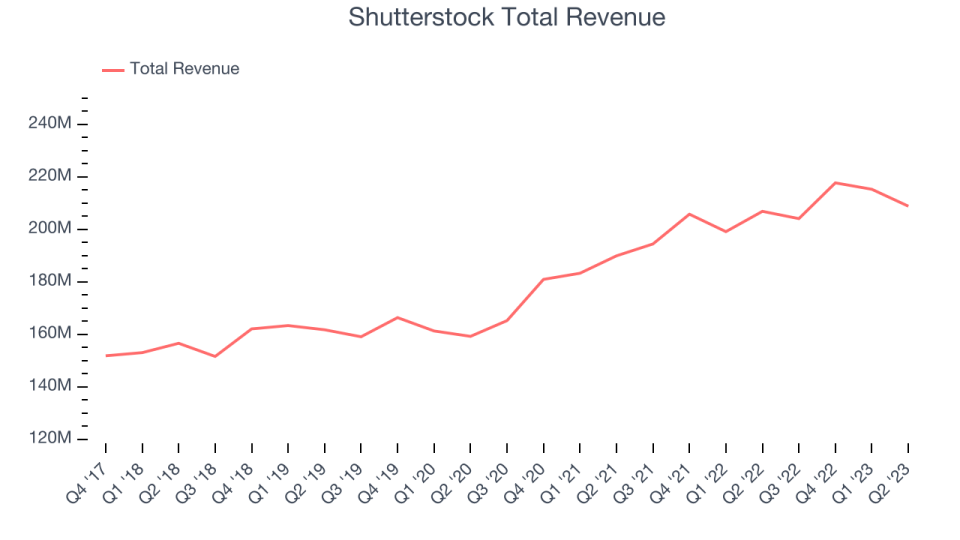

Shutterstock reported revenues of $208.8 million, flat year on year, missing analyst expectations by 2.6%. It was a mixed quarter for the company, with impressive growth in its user base but a miss of analysts' revenue estimates.

Commenting on the company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "I'm pleased to report that, as reflected in our second quarter results and our revised full year outlook, Shutterstock is not only adapting but that it is thriving in this dynamic environment. We recently signed a strategic multi-year content and data partnership with Google, we acquired GIPHY to lead the way in moment marketing and conversational content, and we are embracing a culture of rapid & iterative experimentation when it comes to optimizing our content business. At the same time, having achieved record revenue and adjusted EBITDA on a year-to-date basis, I'm pleased to report that we are increasing our guidance on top and bottom line for the full year 2023."

Shutterstock pulled off the highest full year guidance raise of the whole group. The company reported 0.56 million users, up 51.1% year on year. The stock is down 27.1% since the results and currently trades at $37.52.

Read our full report on Shutterstock here, it's free.

Best Q2: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

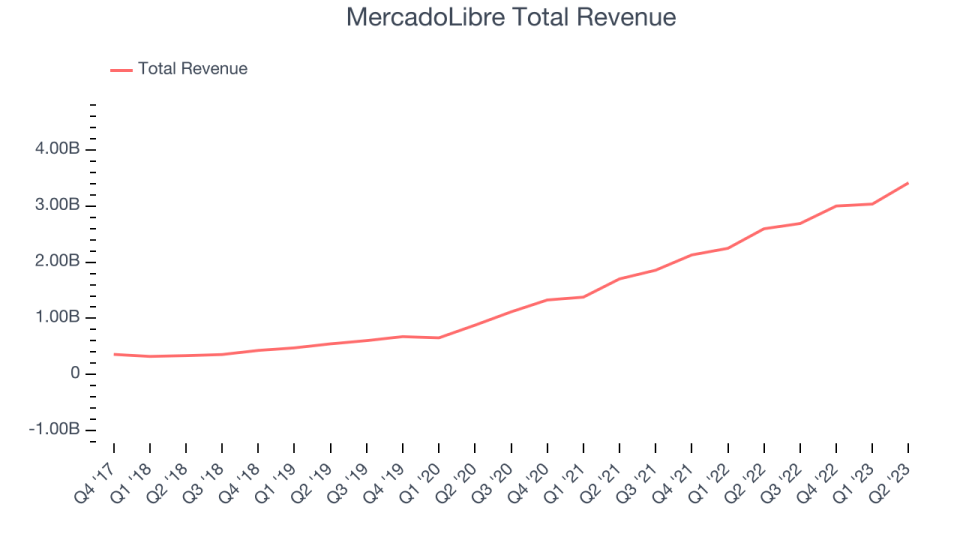

MercadoLibre reported revenues of $3.42 billion, up 31.5% year on year, beating analyst expectations by 4.4%. It was a very strong quarter for the company, with impressive growth in its user base and a decent beat of analysts' revenue estimates.

MercadoLibre achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The company reported 109 million daily active users, up 29.8% year on year. The stock is up 5.91% since the results and currently trades at $1,234.47.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Sea (NYSE:SE)

Founded in 2009 and a publicly traded company since 2017, Sea Limited (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $3.1 billion, up 5.2% year on year, missing analyst expectations by 4.68%. It was a weak quarter for the company, with a decline in its user base and a miss of analysts' revenue estimates.

The stock is down 18.3% since the results and currently trades at $46.38.

Read our full analysis of Sea's results here.

Teladoc (NYSE:TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $652.4 million, up 10.1% year on year, in line with analyst expectations. It was a mixed quarter for the company, with slow revenue growth.

The company reported 85.9 million users, up 6.58% year on year. The stock is down 18.3% since the results and currently trades at $18.63.

Read our full, actionable report on Teladoc here, it's free.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ:ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $628.9 million, up 7.48% year on year, beating analyst expectations by 1.86%. It was a slower quarter for the company, with slow revenue growth and underwhelming revenue guidance for the next quarter.

The company reported 96.3 million active buyers, up 2.45% year on year. The stock is down 33% since the results and currently trades at $64.37.

Read our full, actionable report on Etsy here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned