Winning Energy Stock to Add to Your Portfolio in April

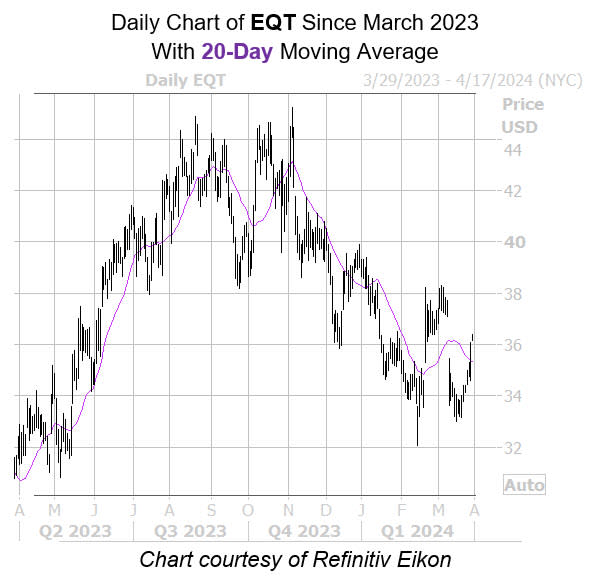

EQT Corp (NYSE:EQT) stock is down 6.7% in 2024, and today received a price-target cut from BMO to $38 from $40. However, the shares have staged a neat bounce off $33, and have cleared their 20-day moving average, a trendline that has alternated between support and resistance in the last 12 months.

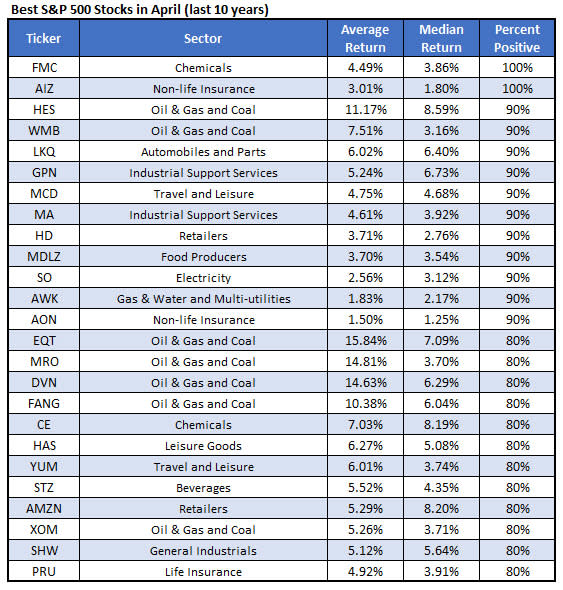

This could be the beginning of a longer-term uptrend for EQT. Per Schaeffer's Senior Quantitative Analyst Rocky White, the equity is the best S&P 500 Index (SPX) name to own in April, and leading the seven oil and gas stocks on the list. The security finished the month higher in eight of the past 10 years, averaging an impressive 15.8% return.

Short interest rose 46% in the last two reporting periods, and now makes up 5.1% of the stock's available float, indicating a short squeeze could fuel additional tailwinds. A round of upgrades could be in store too, considering nearly half of the brokerages in coverage calling it a tepid "hold" or worse.

It's worth noting EQT stock is sporting attractively priced premium at the moment, per its Schaeffer’s Volatility Index (SVI) of 28%, which ranks in the extremely low 8th percentile of its annual range.