Is it Wise to Retain Vornado (VNO) Stock in Your Portfolio Now?

Vornado Realty Trust’s VNO premium office assets, strategically situated in sought-after markets like New York, Chicago and San Francisco, are well-positioned to benefit from the high demand for top-tier assets boasting exceptional amenities. Nevertheless, in the near term, the choppy office market conditions amid macroeconomic uncertainty and remote work may reduce the demand for office spaces, which could impact leasing activities. This challenge is further exacerbated by the elevated interest rates, adding to the company's current difficulties.

Vornado's focus on having assets in a few select high-rent, high-barrier-to-entry geographic markets, along with a diversified tenant base that includes several industry bellwethers, is expected to drive steady cash flows and fuel its growth over the long term. Although we expect property rental revenues to be moderate in 2023 and 2024, the metric is estimated to exhibit a 6.2% year-over-year increase in 2025.

The office-using job growth, enhanced space efficiency and the expansion of tech, finance and media firms are set to boost rental revenues in the upcoming periods. New York remains an attractive destination for office occupiers seeking to expand their workspace.

Rents in recently built or excellently revitalized properties, featuring ample amenities in well-connected areas, have surged. Vornado, adept at providing premium office spaces, is poised to capitalize on this emerging trend effectively.

The company is engaged in targeted expansions and divestitures, along with strategic business spin-offs. These strategic divestitures furnish it with the necessary resources to reinvest in advantageous development and revitalization projects. VNO entered into an agreement to dispose of four Manhattan retail properties for $100 million in late July 2023. In the same month, it disposed of The Armory Show in New York for $24.4 million.

Vornado enjoys a strong balance sheet strength. It exited the second quarter of 2023 with $3.2 billion of liquidity. Moreover, VNO has been securing loan refinancing in recent times, enabling it to reduce interest rates on borrowings and extend debt maturities. A flexible financial position will enable it to take advantage of future investment opportunities and fund its development projects.

Analysts also seem optimistic regarding VNO’s growth prospects. The Zacks Consensus Estimate for 2023 and 2024 funds from operations (FFO) per share has been revised marginally upward over the past seven days. Further, VNO currently carries a Zacks Rank #3 (Hold).

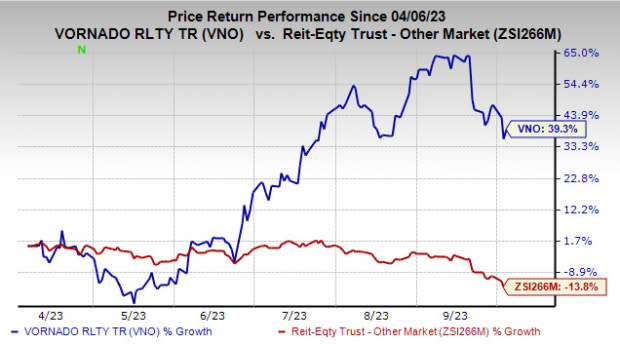

Over the past six months, shares of VNO have rallied 39.3% against the industry's decline of 13.8%.

Image Source: Zacks Investment Research

However, there is choppiness in the office market amid uncertain macroeconomic situation and the continuing remote work arrangement. This is expected to subdue demand for office properties in the near term, subsequently impacting leasing activities.

A hike in interest rates is likely to increase borrowing costs, affecting the company’s ability to purchase or develop real estate. High interest expenses during the second quarter of 2023 marred the company’s FFO per share growth. For 2023, management expects an additional interest expense of roughly 40 cents per share due to rising interest rates. Moreover, with high interest rates in place, the dividend payout might seem to be less attractive than the yields on fixed-income and money market accounts.

Stocks to Consider

Some better-ranked stocks from the REIT sector are Welltower WELL, EastGroup Properties EGP and Americold Realty Trust COLD. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Welltower’s current-year FFO per share has moved marginally northward over the past month to $3.55.

The Zacks Consensus Estimate for EastGroup’s 2023 FFO per share has moved nearly 1% upward in the past two months to $7.63.

The Zacks Consensus Estimate for Americold’s ongoing year’s FFO per share has been raised marginally upward over the past month to $1.26.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vornado Realty Trust (VNO) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Americold Realty Trust Inc. (COLD) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report