Wolverine (WWW) to Report Q2 Earnings: What's in the Offing?

Wolverine World Wide, Inc. WWW is expected to report a decrease in its top line from the year-ago quarter’s reported figure when it releases second-quarter 2023 results on Aug 10 before market open. The Zacks Consensus Estimate of $583 million for quarterly revenues suggests a fall of 18.3% from the prior-year quarter’s tally.

The consensus estimate for the quarterly bottom line has been stable in the past 30 days at 20 cents per share. The figure indicates a sharp decline from earnings of 66 cents a share in the year-earlier quarter.

In the trailing four quarters, this Rockford, MI-based player delivered an earnings surprise of 15.1%, on average.

Key Factors to Note

Wolverine has been battling higher selling, general and administrative expenses for a while now. Also, the macro challenges, including foreign currency headwinds and inflationary pressures, are expected to have been deterrents. The company has been witnessing a soft gross margin for quite some time now. These factors are likely to have hurt its performance in the quarter under review.

On its last earnings call, management had forecast revenues of $580 million, reflecting a decline of 13.7% year over year, driven by the challenging trading conditions in the market, across the wholesale and direct-to-consumer channels. For the second quarter, it had expected a gross margin of about 41% and an operating margin of 6%, comprising $23 million of transitory-inventory costs. The company delivered an adjusted gross margin of 43% and an adjusted operating margin of 11% in the year-earlier quarter. Wolverine had envisioned adjusted earnings per share of 20 cents for the second quarter, down from 66 cents per share earned in the year-earlier quarter.

Management had further highlighted the Merrell brand’s revenues to fall in the mid-teens versus the second-quarter 2022 figure, driven by the tough macroeconomic headwinds and year-over-year product flow shifts. It had projected Saucony’s revenues to decline in the mid-single digits and SweatyBetty’s revenues to decrease in the low teens for the second quarter.

On the flip side, Wolverine’s commitment to product innovation and investment in digitization appear encouraging. Management has also been strengthening its direct-to-consumer capabilities. Speed-to-market initiatives, deployment of the digital product development tool and expansion of e-commerce platforms are likely to be other positives. Its international business has also been performing well.

What Our Zacks Model Says

Our proven model doesn’t conclusively predict an earnings beat for Wolverine this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

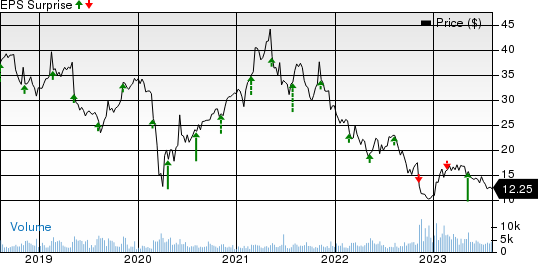

Wolverine World Wide, Inc. Price and EPS Surprise

Wolverine World Wide, Inc. price-eps-surprise | Wolverine World Wide, Inc. Quote

Wolverine has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell), making surprise prediction difficult.

Stocks With the Favorable Combination

Here are three companies, which according to our model, have the right combination of elements to beat on earnings this reporting cycle:

lululemon athletica LULU currently has an Earnings ESP of +0.91% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

LULU is likely to register top-line improvement when it reports second-quarter fiscal 2023 numbers.

The Zacks Consensus Estimate for lululemon athletica’s quarterly revenues is pegged at $2.17 billion, calling for growth of 15.9% from the prior-year quarter’s reported figure. The consensus mark for the quarterly earnings per share is $2.52, which suggests a 14.6% increase from the figure reported in the year-ago fiscal quarter. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

PVH Corp PVH currently has an Earnings ESP of +1.02% and a Zacks Rank of 3. PVH is likely to register top-line growth when it reports second-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.19 million, suggesting a 2.5% rise from the figure reported in the prior-year quarter.

The consensus mark for PVH Corp’s second-quarter earnings is pegged at $1.75 per share, suggesting a 15.9% decline from earnings of $2.08 per share reported in the year-ago quarter. The consensus mark has remained unchanged in the past 30 days. PVH has a trailing four-quarter earnings surprise of 20.4%, on average.

Costco COST currently has an Earnings ESP of +2.07% and a Zacks Rank of 3. COST is likely to register a bottom-line increase when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $4.72 suggests an increase of 12.4% from the year-ago fiscal quarter’s reported number.

Costco’s top line is expected to improve from the prior-year fiscal quarter’s reported number. The Zacks Consensus Estimate for quarterly revenues is pegged at $78.9 billion, suggesting growth of 9.4% from the prior-year fiscal quarter’s reported figure. COST has a trailing four-quarter earnings surprise of 1.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report