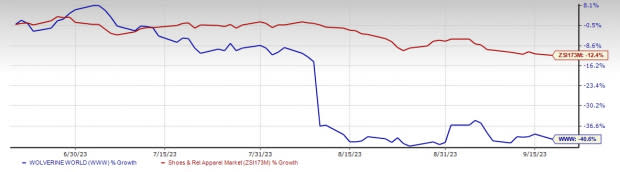

Wolverine (WWW) Stock Plunges 40.6% in 3 Months: Here's Why

Shares of Wolverine World Wide, Inc. WWW have lost 40.6% in the past three months due to several headwinds for a while now. Macroeconomic issues, including inflationary pressures, along with higher costs and other headwinds have been weighing on the company’s performance. On its last reported quarter's earnings call, management highlighted that the trading background is challenging, mainly in the global wholesale channels, and thus, it has lowered its revenue and earnings view for the back half of 2023. Meanwhile, the industry have fallen 12.4% in the same time frame.

Wolverine reported soft results for second-quarter 2023, wherein sales and earnings fell year over year. The company posted second-quarter adjusted earnings of 19 cents a share, missing the Zacks Consensus Estimate of earnings of 20 cents per share. At constant currency, adjusted earnings per share came in at 21 cents. Although revenues came ahead of the consensus estimate, the metric fell 17.4% year over year, driven by lower revenues at most of the segments and brands.

Further, the company’s direct-to-consumer (DTC) unit remains sluggish. DTC revenues were down 20.3% year over year and International revenues decreased 6.2% in constant currency. Coming to segments, Active Group’s revenues dipped 10.5% year over year, while the metric at Work Group tumbled 15.6% to $117.8 million. Revenues at Lifestyle Group and Other fell 38.2% and 47%, respectively.

For 2023, revenues from the ongoing business are now projected to be in the range of $2.26 billion to $2.28 billion, showing a decline of about 10-10.7% year over year. Earnings per share are now envisioned to be between 43 cents and 53 cents and adjusted earnings per share are projected to be in the bracket of 45-55 cents. The company earned $1.41 per share in 2022. For the third quarter of 2023, management projects revenues to be nearly $515 million, which reflects a year-over-year decline of nearly 21%.

What Else?

Recently, Wolverine stated additional steps for the ongoing transformation of its brand portfolio. This comprises the sale of the Hush Puppies intellectual property in China, Hong Kong and Macau, as well as the sale of the Wolverine Leathers business in the United States. These actions are expected to reshape the company’s portfolio and streamline the organization, thus allowing it to grab meaningful opportunities.

Image Source: Zacks Investment Research

The company has inked a deal to sell the Hush Puppies trademarks, patents, copyrights and domains in China, Hong Kong and Macau to the present sublicensee, Beijing Jiaman Dress Co., Ltd., for roughly $58.8 million. Per the transaction, these parties have entered into a License and Cooperation agreement for mutual engagement and brand stewardship of the Hush Puppies brand across the region. This will allow the company to own and operate the Hush Puppies brand in the rest of the world. We note that Wolverine has concluded the sale of the U.S. Wolverine Leathers business to its long-time customer, New Balance, for $6 million. The aforesaid moves follow the recently completed sale of Keds to Designer Brands, Inc., as well as the strategic alternatives process for its Sperry brand.

All the aforesaid moves are expected to reshape Wolverine’s portfolio and drive growth in the future. However, we remain cautious about the Zacks Rank #4 (Sell) company.

Eye These Solid Picks

Some better-ranked companies are Royal Caribbean RCL, lululemon athletica LULU and Ralph Lauren RL.

Royal Caribbean sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share indicates increases of 55.2% and 182.8%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and earnings per share suggests growth of 35.6% and 20.5%, respectively, from the year-ago reported figures. LULU has a trailing four-quarter earnings surprise of 6.8%, on average.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank of 2 at present. RL has a trailing four-quarter earnings surprise of 17.3%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and earnings per share suggests growth of 2.8% and 13.7%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report