Wolverine Worldwide's (NYSE:WWW) Q4: Beats On Revenue But Full-Year Sales Guidance Misses Expectations

Footwear conglomerate Wolverine Worldwide (NYSE:WWW) reported Q4 FY2023 results topping analysts' expectations , with revenue down 20.8% year on year to $526.7 million. On the other hand, the company's full-year revenue guidance of $1.73 billion at the midpoint came in 12.8% below analysts' estimates. It made a non-GAAP loss of $0.30 per share, down from its loss of $0.15 per share in the same quarter last year.

Is now the time to buy Wolverine Worldwide? Find out by accessing our full research report, it's free.

Wolverine Worldwide (WWW) Q4 FY2023 Highlights:

Revenue: $526.7 million vs analyst estimates of $518.4 million (1.6% beat)

EPS (non-GAAP): -$0.30 vs analyst expectations of -$0.27 (9.7% miss)

Management's revenue guidance for the upcoming financial year 2024 is $1.73 billion at the midpoint, missing analyst estimates by 12.8% and implying -21.8% growth (vs -13.5% in FY2023)

Free Cash Flow of $118.7 million is up from -$43.2 million in the previous quarter

Gross Margin (GAAP): 36.6%, up from 33.7% in the same quarter last year

Market Capitalization: $727.7 million

“We are effectively executing our transformation plan with great pace – having largely completed the stabilization phase of our turnaround,” said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide.

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

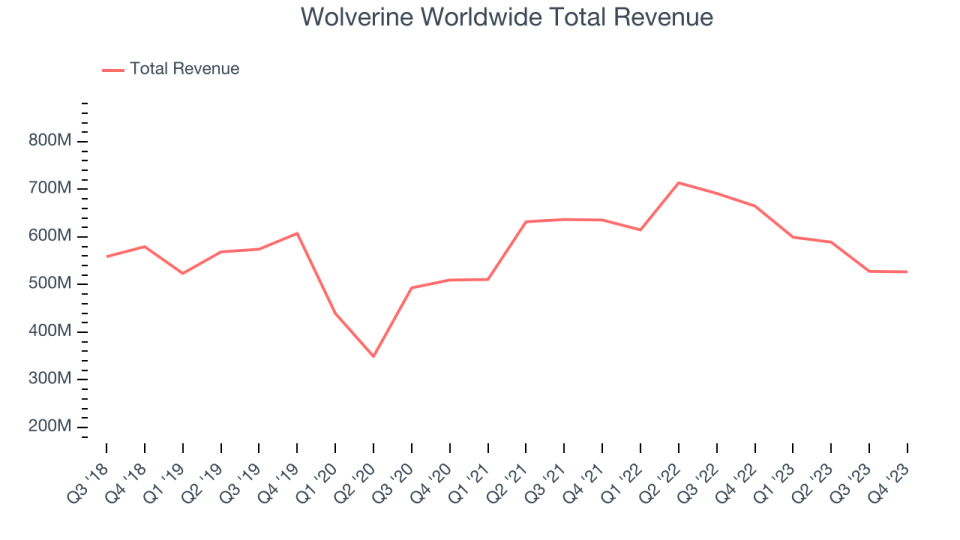

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Wolverine Worldwide's revenue was flat over the last five years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Wolverine Worldwide's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 4.4% over the last two years.

This quarter, Wolverine Worldwide's revenue fell 20.8% year on year to $526.7 million but beat Wall Street's estimates by 1.6%. Looking ahead, Wall Street expects revenue to decline 10.1% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

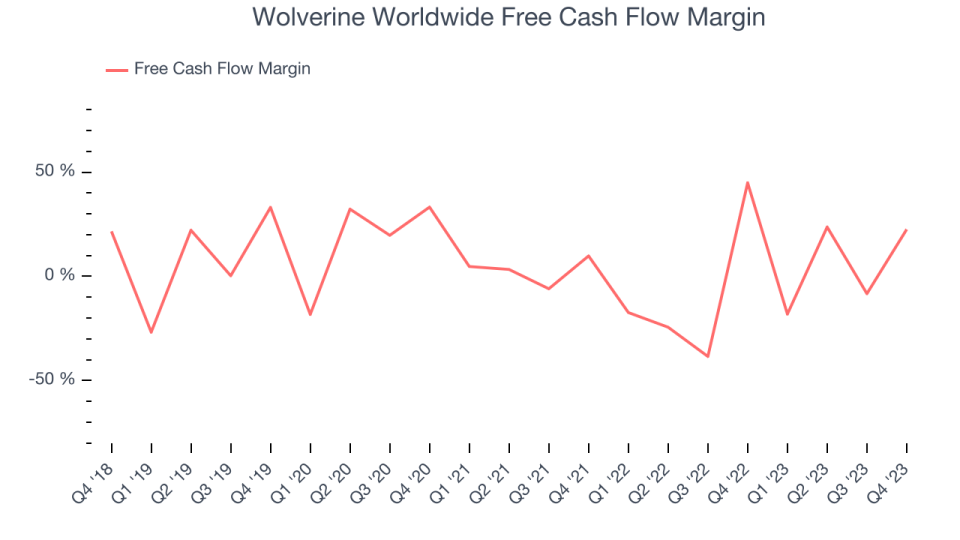

While Wolverine Worldwide posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Wolverine Worldwide's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 2.3%.

Wolverine Worldwide's free cash flow came in at $118.7 million in Q4, equivalent to a 22.5% margin and down 60.2% year on year. Over the next year, analysts predict Wolverine Worldwide's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 4.9% will increase to 7.2%.

Key Takeaways from Wolverine Worldwide's Q4 Results

It was encouraging to see Wolverine Worldwide narrowly top analysts' revenue estimates this quarter as its Work segment generated more sales than expected. On the other hand, its full-year 2024 revenue and EPS guidance missed Wall Street's forecasts.

Recapping the year, Wolverine Worldwide executed its turnaround strategy by divesting many of its brands; Keds in February 2023, its U.S. Leathers business in August 2023, its non-U.S. Leathers business in December 2023, and most recently, Sperry Top-Sider in January 2024. Furthermore, the company transitioned its Hush Puppies North America business into a licensing model in the second half of 2023.

Overall, the results could have been better. The stock is flat after reporting and currently trades at $9.1 per share.

Wolverine Worldwide may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.