Wolverine's (WWW) Q2 Earnings & Revenues Down Y/Y

Wolverine World Wide, Inc. WWW reported results for second-quarter 2023. Both the metrics fell year over year. The company posted second-quarter adjusted earnings of 19 cents a share, missing the consensus estimate of adjusted earnings of 20 cents per share. At constant currency, adjusted earnings per share came in at 21 cents. The company reported adjusted earnings of 65 cents per share.

In the past three months, shares of this Zacks Rank #4 (Sell) company have lost 26.4%, wider than the industry’s 7.7% fall.

Q2 Insights

Revenues of $589.1 million came ahead of the Zacks Consensus Estimate of $583 million but fell 17.4% year over year, driven by lower revenues at most of the segments and brands. Revenues dipped 17.3% in constant currency. Direct-to-consumer revenues of $132.4 million were down 20.3% year over year. WWW’s international business dropped 6.7% to $260.9 million. International revenues decreased 6.2% in constant currency.

Coming to segments, Active Group’s revenues dipped 10.5% year over year to $383.3 million, while the metric at Work Group tumbled 15.6% to $117.8 million. Revenues at Lifestyle Group and Other fell 38.2% and 47%, respectively, to $74.9 million and $13.1 million.

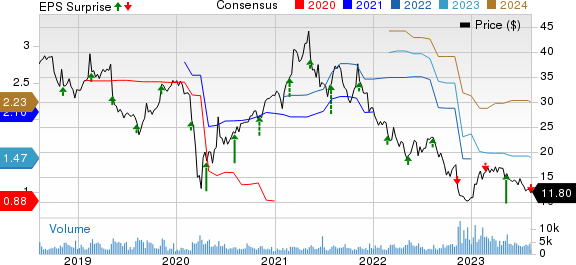

Wolverine World Wide, Inc. Price, Consensus and EPS Surprise

Wolverine World Wide, Inc. price-consensus-eps-surprise-chart | Wolverine World Wide, Inc. Quote

Brand wise, Merrell revenues slipped 15.7% year over year to $176.7 million, Saucony revenues grew 1.6% to $141.7 million, Sperry revenues decreased 23.5% to $57.4 million and Wolverine revenues fell 28.2% to $41.4 million. Sweaty Betty generated revenues of $44 million, down 7.2% year over year.

Margins

Adjusted gross profit was $226.4 million, down 23.2% year over year. Also, the adjusted gross margin contracted 470 basis points year over year to 39.2%.

Adjusted SG&A expenses edged down 11.7% to $192.8 million. Adjusted operating income came in at $33.6 million, down from adjusted operating income of $76.5 million.

Other Financials

Wolverine ended the quarter with cash and cash equivalents of $176.5 million, long-term debt of $718.5 million and stockholders' equity of $366.9 million.

Net debt was $930 million and total liquidity was nearly $370 million at the end of the second quarter. Inventory at the end of the reported quarter was $647.9 million, up 7% from the year-earlier quarter.

During first-half 2023, Wolverine has paid out cash dividends of $16.4 million.

Outlook

Management highlighted that the trading background is challenging, mainly in the global wholesale channels. Thus, it has lowered its revenue and earnings view for the back half. However, the company expects the Profit Improvement Office to generate a minimum of $70 million in savings for 2023. It remains on track to deliver the year-end inventory goal of $520 million. It also has plans to sell at least $50 million of non-core assets in the next months to pay down debt. Net debt is likely to be roughly $850 million by the end of the year.

For 2023, revenues from the ongoing business are now projected in the range of $2.26 billion to $2.28 billion, showing a decline of about 10-10.7% year over year. This is down from $2.53-$2.58 billion guided earlier. Further, the gross margin is likely to be 39.4% and the adjusted gross margin is anticipated to be 40% for the year. It had earlier anticipated the gross margin to be 41.3% and the adjusted gross margin to be 42% for the year.

Operating margin is estimated to be nearly 4.8% and adjusted operating margin is expected to be 5%. Earlier, it projected operating margin to be 8.7% and adjusted operating margin to be 8.5%. The effective tax rate is likely to be 18.2%.

Earnings per share are now envisioned to be between 43 cents and 53 cents and adjusted earnings per share are projected to be in the bracket of 45-55 cents. This guidance includes nearly 11 cents adverse impact of foreign currency exchange rate fluctuations. Previously, management had guided earnings per share of $1.50-$1.70 and adjusted earnings per share of $1.40-$1.60.

Key Picks

Some better-ranked companies are Royal Caribbean RCL, lululemon athletica LULU and Ralph Lauren RL.

Royal Caribbean sports a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates increases of 53.6% and 177.7%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy), at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 17.1% and 18.4%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank of 2 at present. RL has a trailing four-quarter earnings surprise of 17.4%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 3% and 12.8%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report