Woodward Inc (WWD) Reports Robust First Quarter Fiscal 2024 Results, Raises Full-Year Guidance

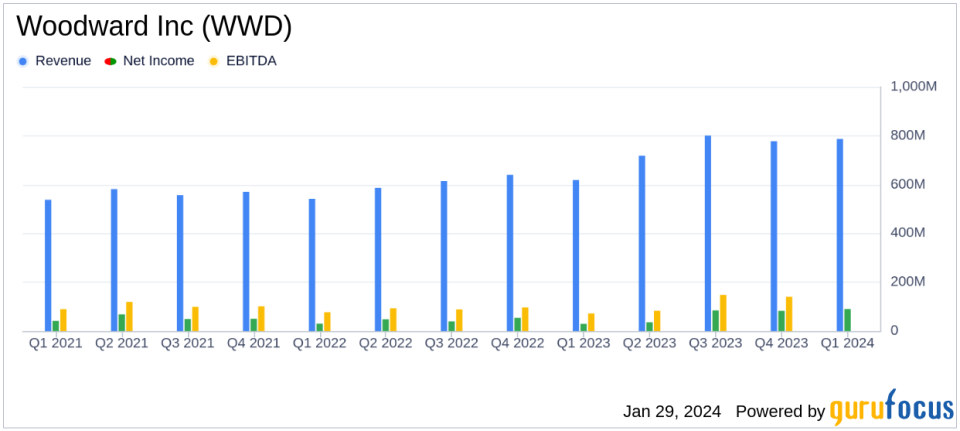

Net Sales: Increased by 27% to $787 million from $619 million in the prior year.

Net Earnings: Rose to $90 million, or $1.46 per share, compared to $30 million, or $0.49 per share.

Free Cash Flow: Improved to $5 million, a significant turnaround from negative $19 million.

Aerospace Segment: Sales grew by 16%, with segment earnings improving to 17.2% of net sales.

Industrial Segment: Sales surged by 46%, with segment earnings at 20.5% of net sales.

Debt-to-EBITDA Leverage: Reduced to 1.3 times EBITDA, down from 2.3 times EBITDA.

Fiscal Year 2024 Guidance: Raised, with adjusted EPS now expected to be between $5.00 and $5.40.

On January 29, 2024, Woodward Inc (NASDAQ:WWD) released its 8-K filing, detailing a strong start to the fiscal year with notable increases in sales and earnings. The company, a global leader in the design, manufacture, and service of control solutions for the aerospace and industrial markets, has seen significant growth in both its Aerospace and Industrial segments, leading to an increase in its full-year guidance.

Performance Highlights and Challenges

Woodward's performance in the first quarter of fiscal 2024 was marked by a 27% increase in net sales, reaching $787 million. This growth was driven by robust demand in both OEM and aftermarket sales in the Aerospace segment, as well as significant expansion in the Industrial segment, particularly from the China on-highway business. Net earnings saw a substantial increase to $90 million, or $1.46 per share, up from $30 million, or $0.49 per share in the prior year. The company's operational improvements and increased demand in key markets contributed to this performance.

Despite these achievements, Woodward faces challenges such as global economic uncertainty, supply chain constraints, and the need to continuously innovate to maintain its competitive edge. These challenges could impact future performance if not managed effectively.

Financial Achievements and Industry Significance

The financial achievements of Woodward are particularly significant within the Aerospace & Defense industry, where long sales cycles and high R&D costs are common. The company's ability to increase sales and earnings while managing costs is indicative of strong operational performance and efficient management. The improvement in free cash flow to $5 million, from a negative position in the previous year, underscores Woodward's enhanced financial stability and ability to invest in future growth.

Financial Metrics and Importance

Key financial metrics from Woodward's earnings report include a 16% increase in Aerospace segment sales and a 46% increase in Industrial segment sales. The company's EBIT was $120 million for the quarter, and the effective tax rate was 17.9%. These metrics are important as they reflect the company's profitability, tax efficiency, and overall financial health. The reduction in debt-to-EBITDA leverage from 2.3 to 1.3 times EBITDA demonstrates Woodward's improved balance sheet and reduced financial risk.

Management Commentary

"We delivered significant sales growth and margin expansion in the first quarter. The strong start to our fiscal year reflects continued positive momentum, including robust end market demand and improved operational performance," stated Chip Blankenship, Chairman and Chief Executive Officer. "Based on our strong performance to date, we are raising our full-year guidance. Our steadfast commitment to growth, operational excellence, and innovation positions Woodward for sustainable long-term success and enhanced shareholder value."

Analysis of Company Performance

Woodward's first-quarter performance reflects a company that is effectively capitalizing on market opportunities and executing its strategic initiatives. The raised guidance for fiscal year 2024 suggests confidence in the company's continued growth trajectory. However, investors should be mindful of the potential risks associated with market volatility and geopolitical uncertainties that could affect future performance.

For a more detailed breakdown of Woodward's financial results and to listen to the investor conference call, please visit the company's website at www.woodward.com.

As Woodward continues to navigate the complex aerospace and industrial markets, its focus on operational excellence and innovation will be key to sustaining its current growth and delivering long-term shareholder value.

Explore the complete 8-K earnings release (here) from Woodward Inc for further details.

This article first appeared on GuruFocus.