Woodward (WWD) Q4 Earnings & Revenues Beat Estimates, Up Y/Y

Woodward, Inc. WWD reported adjusted net earnings of 84 cents per share for the fourth quarter of fiscal 2022, which increased 2.4% year over year. The bottom line beat the Zacks Consensus Estimate by 16.7%.

Net sales in the fiscal fourth quarter moved up 12% year over year to $640 million due to higher sales in the Aerospace and Industrial segment. The top line beat the consensus estimate by 2.2%.

However, ongoing supply-chain and labor disruptions, and unfavorable foreign currency exchange rates acted as headwinds.

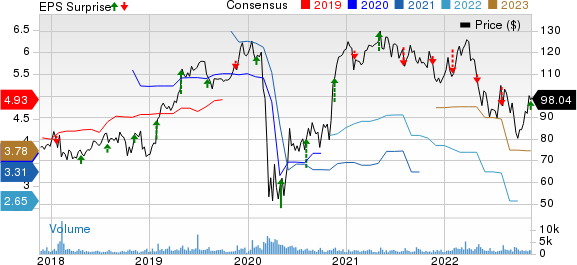

Woodward, Inc. Price, Consensus and EPS Surprise

Woodward, Inc. price-consensus-eps-surprise-chart | Woodward, Inc. Quote

Segment Results

Aerospace: Net sales were $408 million, up 8% year over year. The upside can be attributed to higher commercial OEM (up 24% year over year) and commercial aftermarket sales (up 34% year over year), resulting from improving passenger traffic and fleet utilization. Continued softness in defense OEM and aftermarket sales due to lower guided weapons sale and supply-chain disruptions were headwinds.

The segment’s earnings were $63 million, down from $66 million in the year-ago quarter. The downside was caused by increasing material and labour costs, and supply-chain constraints which offset higher sales volume.

Industrial: Net sales totaled $232 million, up 20% from the prior-year quarter. Higher marine sales from continued utilization of the in-service fleet and solid industrial turbomachinery sales resulted in this upside which was partly offset by unfavorable forex movement.

The segment’s earnings were $21 million, unchanged from the year-ago quarter, mainly due to net inflationary impacts on material and labour costs, and increasing costs due to supply-chain disruptions and training of new hires.

Other Details

Total costs and expenses increased to $582.3 million, up 14.4% year over year. Adjusted EBITDA came in at $92.9 million compared with $106.1 million in the year-ago quarter.

Cash Flow & Liquidity

As of Sep 30, Woodward had $107.8 million in cash and cash equivalents with $709.8 million of long-term debt (less the current portion).

For the fiscal year, Woodward generated $193.6 million of net cash from operating activities, compared with $464.7 million a year ago. Free cash flow for the same period came in at $141 million compared with $427 million in the prior-year period. The downtick was mainly caused by increased working capital due to production delays from supply-chain constraints.

Woodward repurchased shares worth $473 million in the fiscal 2022. In January 2022, the company authorized a new $800 million two-year stock repurchase program, reinforcing its financial position and positive outlook. The company has $354 million remaining under the share repurchase authorization.

Fiscal 2023 Overview

For fiscal 2023, net sales are now expected to be between $2.6 billion and $2.75 billion.

The Aerospace segment’s revenues are expected to increase between 14% and 19%, while the Industrial segment’s revenues are expected to remain flat to increase 5%.

Free cash flow is projected to be between $200 million and $250 million. Earnings are likely to be in the range of $3.15-$3.60 per share.

Zacks Rank & Stocks to Consider

Woodward currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Arista Networks ANET, Blackbaud BLKB and Jabil JBL. Arista Networks and Jabil currently sport a Zacks Rank #1 (Strong Buy) while Blackbaud carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2022 earnings is pegged at $4.35 per share, up 7.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 2.4% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2022 earnings is pegged at $2.59 per share, up 1.6% in the past 60 days. The long-term earnings growth rate is anticipated to be 4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.9%. Shares of BLKB have declined 30.7% in the past year.

The Zacks Consensus Estimate for Jabil’s fiscal 2023 earnings is pegged at $8.18 per share, rising 3.8% in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 9.3%. Shares of JBL have increased 8.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research