Workday Inc (WDAY) Reports Strong Fiscal 2024 Fourth Quarter and Full Year Results

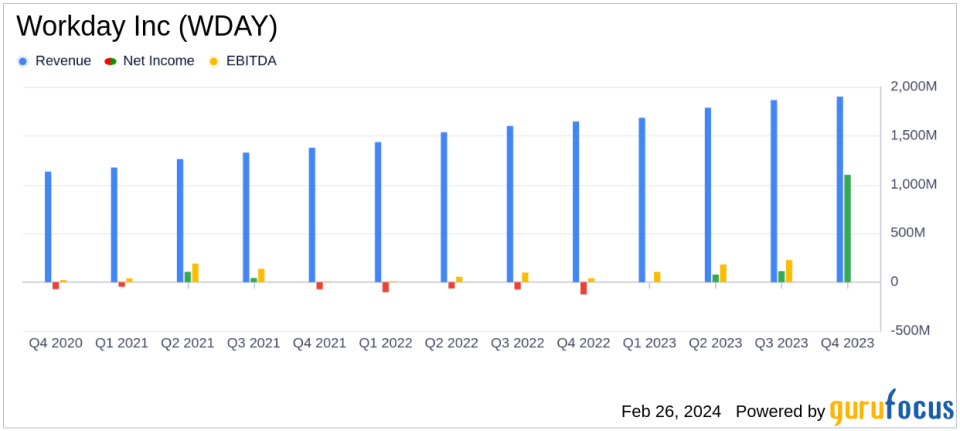

Total Revenues: $1.9 billion in Q4 and $7.3 billion for the full year, marking a 17% year-over-year increase for both.

Subscription Revenues: Grew by 18% in Q4 to $1.8 billion and by 19% for the full year to $6.6 billion.

Operating Cash Flows: Increased by 30% year-over-year to $2.1 billion.

Operating Income: Reported at $79 million in Q4, a significant improvement from a loss in the prior year.

Net Income Per Share: GAAP net income per share was $4.52 (basic) and $4.42 (diluted) in Q4, benefiting from a substantial tax allowance release.

Free Cash Flows: Rose to $1.9 billion, up from $1.3 billion in the previous year.

Stock Repurchase: Workday repurchased approximately 1.8 million shares of Class A common stock for $423 million.

On February 26, 2024, Workday Inc (NASDAQ:WDAY) released its 8-K filing, detailing its fiscal 2024 fourth quarter and full year financial results. The company, known for its cloud-only software solutions in human capital management (HCM), financial management, and business planning, demonstrated robust growth and financial health, with significant increases in subscription revenues and operating cash flows.

Financial Performance and Strategic Highlights

Workday's fiscal fourth quarter saw total revenues reach $1.9 billion, a 17% increase from the same period last year. Subscription revenues, which are a critical indicator of the company's core business strength, were up 18% year over year to $1.8 billion. For the full fiscal year, total revenues were $7.3 billion, also up 17%, with subscription revenues growing by 19% to $6.6 billion.

Operating income for the fourth quarter was reported at $79 million, or 4.1% of revenues, showcasing a remarkable turnaround from the operating loss of $89 million in the prior year's quarter. The full fiscal year's operating income stood at $183 million, or 2.5% of revenues, compared to a loss in the previous year, indicating improved operational efficiency and cost management.

Workday's net income per share showed a significant increase, with GAAP basic and diluted net income per share at $4.52 and $4.42, respectively, for the fourth quarter. This was notably influenced by the release of a $1.1 billion valuation allowance related to U.S. federal and state deferred tax assets. Non-GAAP net income per share for the quarter was $1.60 (basic) and $1.57 (diluted), reflecting a solid performance excluding certain non-operational items.

Challenges and Future Outlook

Despite the strong results, Workday faces challenges inherent in the competitive software industry, such as maintaining innovation, expanding its customer base, and managing operational costs. The company's performance is crucial as it indicates the ability to sustain growth in a rapidly evolving market and to continue delivering value to shareholders.

Looking ahead, Workday's management remains optimistic. CEO Carl Eschenbach commented on the company's momentum and global performance, while CFO Zane Rowe reiterated the fiscal year 2025 subscription revenue guidance of $7.725 billion to $7.775 billion, representing growth of 17% to 18%. The company expects a non-GAAP operating margin of approximately 24.5%, reflecting both growth investments and continued margin expansion.

"Workdays results this quarter are a testament to the strength of our value proposition and the durability of our business," said Carl Eschenbach, CEO, Workday. "Were seeing continued momentum with full platform customer wins and expansions within our base, strengthening international performance, growth of our partner ecosystem, and the seamless execution of nearly 19,000 Workmates across the globe all setting us up for an incredible fiscal year 2025."

Workday's financial achievements, such as the growth in subscription revenues and operating cash flows, are particularly important in the software industry, where recurring revenue models are key indicators of long-term viability and customer retention. The company's ability to generate free cash flow also provides flexibility for strategic investments and shareholder returns.

Balance Sheet and Cash Flow Statements

As of January 31, 2024, Workday reported $7.8 billion in cash, cash equivalents, and marketable securities. The balance sheet remains strong, with total assets of $16.45 billion. The company's cash flows from operating activities were $2.1 billion for the fiscal year, and free cash flows were $1.9 billion, underscoring the company's ability to generate liquidity and fund operations effectively.

In summary, Workday Inc (NASDAQ:WDAY) has presented a robust financial report for the fiscal fourth quarter and full year of 2024, with significant growth in key areas such as subscription revenues and operating cash flows. The company's strategic initiatives and focus on innovation continue to drive its success, positioning it for a promising fiscal year 2025.

For more detailed information, investors and interested parties can access the full earnings report and financial statements through Workday's 8-K filing.

Explore the complete 8-K earnings release (here) from Workday Inc for further details.

This article first appeared on GuruFocus.