Workday Has Strong Fundamentals, but Its Stock Is Priced to Perfection

Workday Inc.'s (NASDAQ:WDAY) stock outperformed both the S&P 500 and the Nasdaq 100 in 2023 and has already gained 6.50% in value in 2024. The company's management has thus far executed exceptionally well on its business priorities, growing both its revenue and profitability. While the company is now focusing on driving growth by expanding its market penetration internationally while building out its artificial intelligence capabilities on the platform, I believe the stock has fully priced in future growth expectations in its valuation, leaving little to no upside from current levels.

About Workday

Workday is a cloud-based software company that provides enterprise-level software solutions for financial management, spend management, human capital management, planning and analytics. The company's primary focus is to deliver an integrated system that enables their customers to plan, execute, analyze and improve their business operations. Workday primarily targets medium- to large businesses globally across different industries.

In terms of its business model, Workday derives its revenue from a combination of subscription services and professional services. Subscription services primarily consist of recurring fees customers pay to access Workday's cloud applications. The fees are typically based on the number of users, modules and scale of usage. On the other hand, Professional services revenue include fees for deployment services, optimization services and training.

The good: International market expansion, early renewals and expanding margins

Workday's management is focused on international expansion to drive accelerated growth. As per its latest investor presentation, the company estimates its total addressable market at $142 billion in 2023. The TAM is calculated by summing up the sizes of the following markets: human capital management at $58 billion and financial management at $84 billion.

Should the company reach its revenue target of $7.25 billion in 2024, it would mean it has penetrated 5% of its market share. As per the company's Investor Day presentation, it still has approximately 50% of Fortune 500 and 75% of Global 2000 companies that remain under its target market to expand into.

Moving forward, the company aims to spearhead its growth trajectory by expanding internationally with a specific focus in Europe, the Middle East and Africa as it estimates its international TAM to be close to $80 billion, more than half of its total TAM in 2023. As of the third-quarter 2024 earnings call, international revenue grew 17% year over year to $462 million, making it 25% of total revenue. The growth has accelerated since the second quarter, where international revenue had increased 15% over the prior year.

Looking ahead, I believe international revenue will become a larger growth driver. Over the course of Workday's history, most of its revenue has come from the U.S. However, the growth rate in the region has since slowed as the industry has matured. Hence, I believe that successful international expansion will drive the next phase of the company's growth acceleration as it continues to drive deeper market penetration. Furthermore, I am pleased to see management has already taken proactive steps to expand its partner ecosystem overseas, as it will be crucial for sustaining profitable growth in a highly competitive cloud services market.

Workday's subscription backlog is also growing with earlier renewals, supporting its growth thesis. The company exceeded its top and bottom lines in the third quarter by 1.1% and 8.5%, respectively. The company saw its revenue grow 17% to $1.87 billion, with subscription revenue growing 18% globally. While management has guided for revenue growth of 17% for the full year to $7.25 billion, I believe the real reason investors have gotten optimistic is the company's 12-month subscription backlog grew 22% year over year in the third quarter and is expected to grow 19% in the fourth quarter, faster than subscription revenue growth.

An increase in backlog is a reflection of customers renewing their contracts ahead of expiration and thus serves as a positive indicator for the projected growth rate in subscription revenue for the upcoming fiscal year. I believe these activities not only allowed management to raise their full-year guidance, but also provided an early outlook for the next fiscal year, projecting 17% to 18% subscription growth coupled with margin expansion.

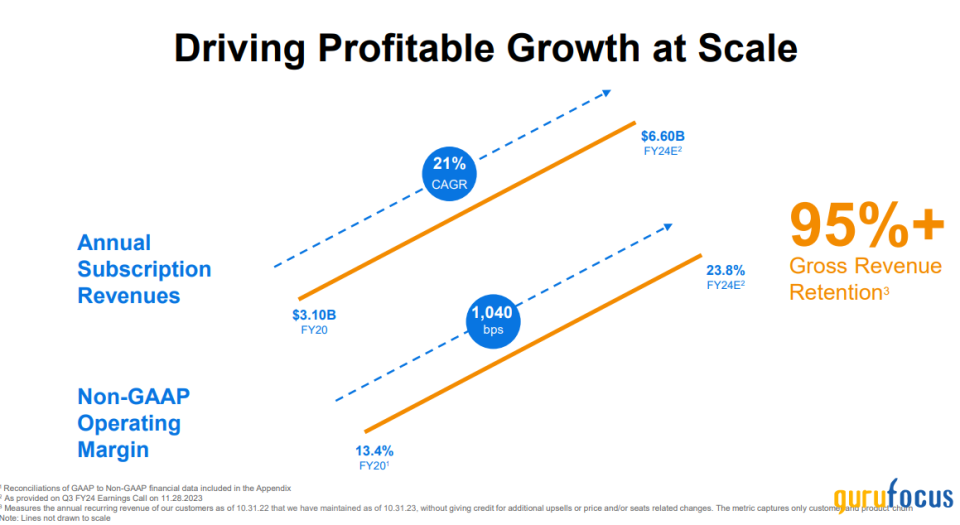

The company continues to drive margin expansion as well. During the third quarter, Workday produced non-GAAP operating income of $463 million with a margin of 24.80%. This represented a year-over-year growth rate of 510 basis points. For the full year, management is guiding for a non-GAAP operating income of $1.72 billion, representing a margin of 23.80%. Over the last 4 years, Workday's management has continually improved operational efficiency, as can be seen below. While part of it is driven by optimizing operating expenses, the company has also expanded its partner ecosystem in order to grow more efficiently while improving its operating leverage.

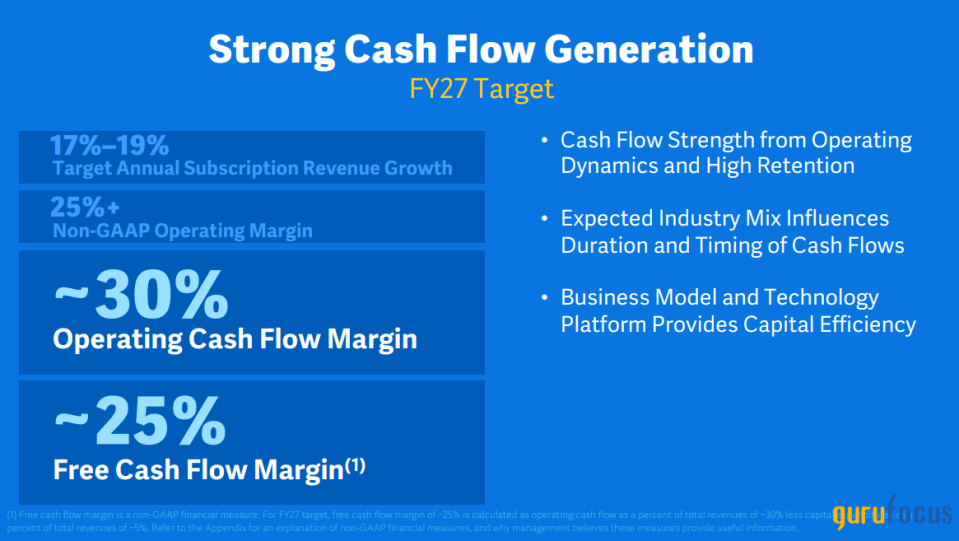

Looking further ahead, Workday's management believes it will be able to continue to grow the non-GAAP operating margin to 25% by fiscal 2027, as per its investor presentation, as it continues to drive focused go-to-market strategies, efficiently grow its research and development investments and further optimize its marketing spend.

The bad: Competitive forces remain robust and the stock valuation has fully priced in growth

The competitive landscape is something to watch out for. Although Workday has established itself as a leader in the cloud-based HCM and financial management solutions industries, I believe the competitive landscape will continue to evolve with advancements in technology and strategic acquisitions in the enterprise software industry.

Most importantly, Workday competes with a lot of deep-pocketed competitors, such as SAP (NYSE:SAP), Oracle (NYSE:ORCL) and Microsoft (NASDAQ:MSFT), who have extensive distribution partners that they can leverage to beat out the competition. Furthermore, it is becoming increasingly clear that generative AI will play a major differentiation factor for cloud-based services, where Workday and its peers are already taking advantage of this opportunity.

So far, Workday has introduced new generative AI capabilities to help their customers increase productivity, grow and retain talent, streamline business processes and improve decision-making. The company has rolled out new AI features within Workday HCM to enhance managers' experience by providing tools and insights to help them effectively lead and foster the career growth of their team members based on skills and interests. At the same time, Workday has also implemented AI across its financial management solutions, where the technology identifies repetitive manual tasks and automates them.

However, the quality of generative AI models depends on the amount of data available to train them, and although Workday has vast amounts of data, it is undoubtedly much smaller in size compared to the larger players in the industry, which could ultimately prove to be a major competitive disadvantage.

Workday's stock is priced to perfection, leaving little to no upside for long-term investors

Finally, let's turn our attention to Workday's valuation. While the company's management has guided for subscription revenue to grow 17% to 19% and non-GAAP operating margins to improve to 25% by 2027 in its Investor Day presentation, I believe the current valuation of the stock has already priced in the expected growth rate, offering no upside for a long-term investor at current levels.

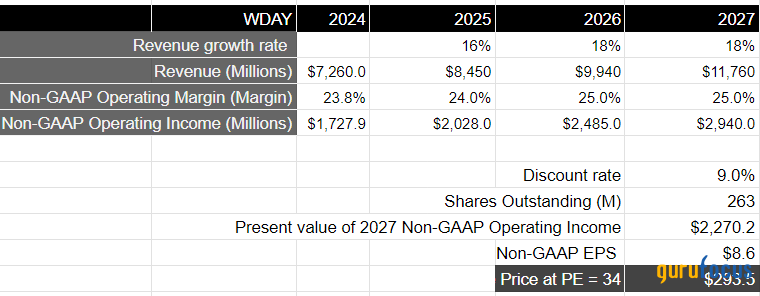

Let me explain why. Taking a three-year investment horizon into fiscal year 2027, the company should produce total revenue of $11.76 billion if it continues to grow 18% annually every year over the next three years. I believe that Workday should be able to accomplish that as it expands internationally and drives robust product innovation on its platform in order to deepen existing custom relationships while acquiring new ones. Meanwhile, if we assume the non-GAAP operating margin improves to 25% by 2027, the company will produce a total non-GAAP operating income of close to $3 billion, which will translate to $2.30 billion if discounted at 9%.

Taking the above assumptions into consideration, I believe the forward price-earnings ratio for Workday in 2027 should be around 32 to 34. Taking the S&P 500 as a proxy, where it has grown its earnings by 8% on average over the last 10 years, as per Factset, with a forward price-earnings ratio in the range of 15 to18, I believe Workday should be trading at a forward earnings multiple that is 2 times the S&P 500 in 2027, as the company gradually sees its earnings grow more in line with revenue growth in the mid to high teens. This will result in a price target of $293, which is where the stock is currently trading.

In other words, the current stock price has fully priced in the future growth rate and is leaving no room for further upside for long-term investors when looking at a three-year investment horizon.

Conclusions

Workday currently operates in a large and growing TAM, with it set to expand internationally. At the same time, management has thus far executed exceptionally on both its top and bottom lines. Plus, the plans to integrate AI into its product portfolio are very promising. Unfortunately, I believe the stock is currently priced to perfection, with optimism around its future growth trajectory fully baked in, leaving no attractive entry point for a long-term investor.

This article first appeared on GuruFocus.