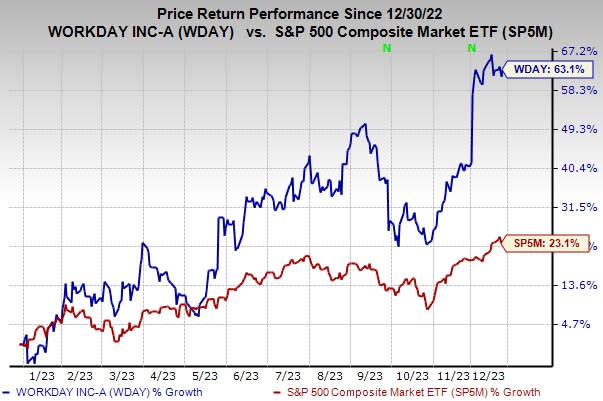

Workday (WDAY) Soars 63% YTD: Is There More Room to Run?

Shares of Workday, Inc. WDAY have climbed 63.1% year to date, driven by improved market demand across its portfolio on the back of a flexible business model and solid cash flow. Earnings estimates for the current and next fiscal year have increased 22.5% and 12.2%, respectively, since December 2022, implying robust inherent growth potential. With healthy fundamentals, this Zacks Rank #2 (Buy) stock appears primed for further appreciation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in Pleasanton, CA, Workday is a leading provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system that makes it easier for organizations to provide analytical insights and decision support. Apart from Financial Management and Human Capital Management (HCM) solutions, the company offers applications related to Payroll, Time Tracking, Recruiting, Learning, Planning, Professional Services Automation and Student.

Workday’s revenues continue to be aided by high demand for its HCM and financial management solutions. The company’s cloud-based business model and expanding product portfolio have been the primary growth drivers. Moreover, the growing clout of Workday Prism Analytics and Adaptive Insights business planning cloud offerings holds promise. Based on its expanding product portfolio, we believe that Workday has strong growth prospects.

Workday’s HCM suite of applications demonstrates solid growth momentum, driven by the transition of organizations to the cloud. A steady flow of customers portrays a high customer satisfaction rate, which bodes well for its long-term business model. Workday is also gaining traction in the international market, driven by higher digital transformation initiatives across Finance and HR domains, in tune with the evolving market conditions.

The company is expanding its portfolio beyond core HCM solutions into the financial domain. It is customizing them for diverse industries and verticals, such as education and public and financial services, among others. This has helped it witness strong renewals and expand its customer base as business enterprises aim to consolidate spend and improve efficiency levels. This augurs well for the long-term growth of the company.

With solid demand trends, the company is confident about its growth opportunities in fiscal 2024. It plans to focus on higher investments in key industries and innovation efforts to expand its footprint within the partner ecosystem. For fiscal 2024, the company raised its guidance for subscription revenues to the range of $6.570-$6.590 billion from the previously estimated $6.550-$6.575 billion, indicating growth of 18% year over year. Professional services revenues are expected in the range of $630-$650 million.

It has a long-term earnings growth expectation of 26.5% and delivered an earnings surprise of 13.2%, on average, in the trailing four quarters. Workday has a VGM Score of B.

Other Key Picks

United States Cellular Corporation USM, sporting a Zacks Rank #1, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve the efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

InterDigital, Inc. IDCC: Headquartered in Wilmington, DE, InterDigital is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #1 stock has a long-term earnings growth expectation of 17.4% and has surged 122.6% over the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. Apart from a strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report