Working Capital Advisors (UK) Ltd. Acquires Significant Stake in Funko Inc.

Working Capital Advisors (UK) Ltd., a London-based investment firm, has recently expanded its portfolio with the acquisition of a substantial stake in Funko Inc. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications of this investment.

Profile of Working Capital Advisors (UK) Ltd.

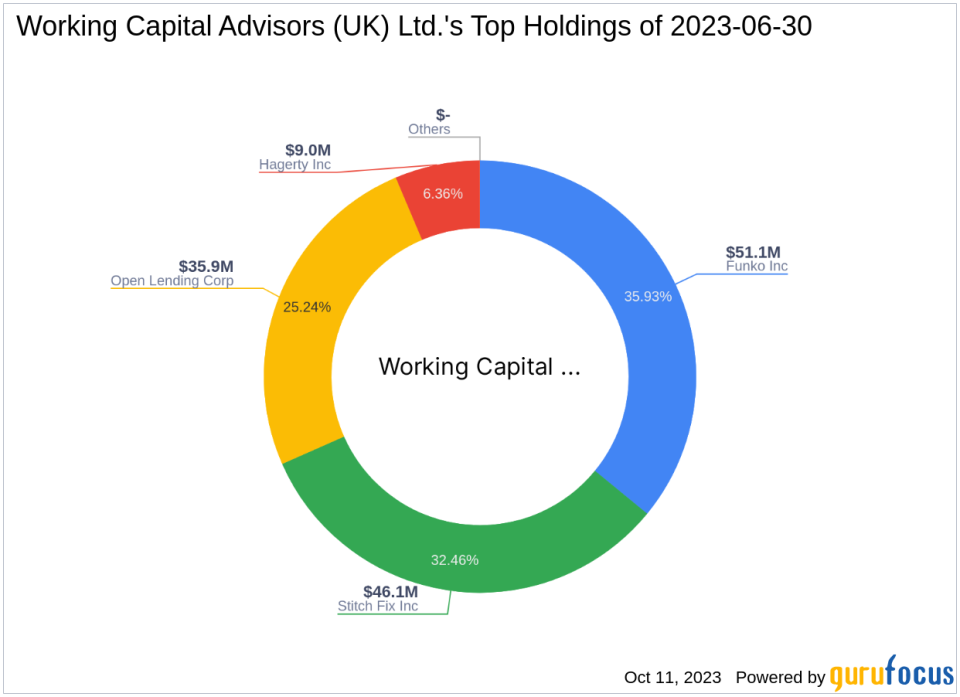

Working Capital Advisors (UK) Ltd. is a prominent investment firm located at Queripel House, Unit 2, London. The firm's portfolio primarily consists of four stocks, with a total equity of $142 million. Its top holdings include Funko Inc(NASDAQ:FNKO), Stitch Fix Inc(NASDAQ:SFIX), Open Lending Corp(NASDAQ:LPRO), and Hagerty Inc(NYSE:HGTY). The firm's investment philosophy is primarily focused on the Consumer Cyclical and Financial Services sectors.

Details of the Transaction

On October 9, 2023, Working Capital Advisors (UK) Ltd. added 225,782 shares of Funko Inc. to its portfolio at a trade price of $6.84 per share. This transaction increased the firm's total holdings in Funko Inc. to 7,092,677 shares, representing 33.78% of its portfolio and 13.69% of Funko Inc.'s total shares. The trade had an impact of 1.08% on the firm's portfolio.

Profile of Funko Inc.

Funko Inc., a USA-based company, is a leading pop culture consumer products company. Since its IPO on November 2, 2017, the company has been creating whimsical, fun, and unique products that allow customers to express their affinity for their favorite movie, TV show, video game, musician, or sports team. The company operates in four segments: Core Collectible, Loungefly Branded Products, Other, and Loungefly. As of October 11, 2023, the company has a market capitalization of $387.99 million.

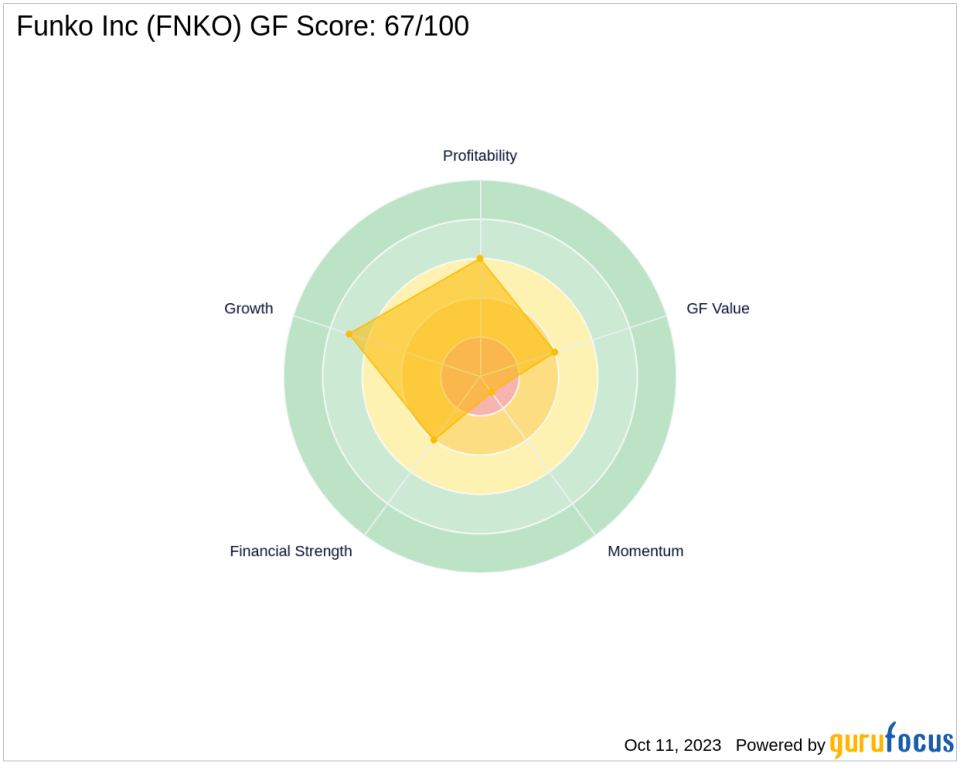

Despite a PE percentage of 0.00, indicating a loss, the company's GF Value is 18.08, suggesting a possible value trap. The price to GF Value is 0.41, and the stock has gained 9.5% since the transaction. However, the stock's performance since its IPO has been negative, with a decrease of 6.38%. The year-to-date price change ratio is -30.9%. The company's GF Score is 67/100, indicating a potential for average performance.

Stock Performance Analysis

Funko Inc.'s financial strength is reflected in its Balance Sheet Rank of 4/10 and Profitability Rank of 6/10. The company's Growth Rank is 7/10, while its GF Value Rank and Momentum Rank are 4/10 and 1/10, respectively. The company's Piotroski F-Score is 3, and its Altman Z score is 1.41, indicating potential financial distress.

Industry Comparison and Momentum Analysis

When compared to the overall Travel & Leisure industry, Funko Inc.'s performance is relatively weak, with a ROE Rank of 723 and a ROA Rank of 753. The company's RSI 14 Day Rank is 691, and its Momentum Index 6 - 1 Month Rank is 769. The company's momentum, as indicated by its RSI 5 Day of 43.55, RSI 9 Day of 48.79, and RSI 14 Day of 50.43, is relatively low.

Conclusion

In conclusion, Working Capital Advisors (UK) Ltd.'s recent acquisition of Funko Inc. shares represents a significant addition to its portfolio. Despite Funko Inc.'s current financial challenges, the firm's investment could potentially yield substantial returns if the company's performance improves. This transaction underscores the importance of thorough analysis and strategic decision-making in investment management.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.