Working Capital Advisors (UK) Ltd. Increases Stake in Funko Inc

On August 25, 2023, Working Capital Advisors (UK) Ltd. added 63,131,108 shares of Funko Inc (NASDAQ:FNKO) to its portfolio. The firm purchased the shares at a price of $6.11 each, making a significant impact of 0.15% on its portfolio. The transaction resulted in a share change of 35,699, representing a trade change of 0.57%. Following the transaction, Working Capital Advisors (UK) Ltd. now holds a 27.11% position in Funko Inc, accounting for 12.19% of the company's total shares.

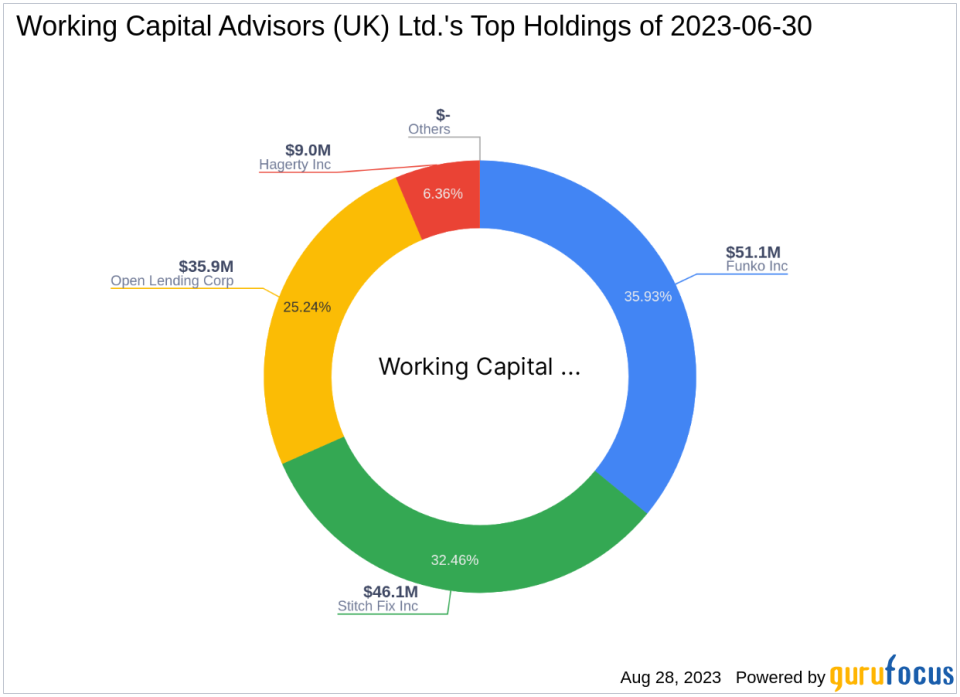

About Working Capital Advisors (UK) Ltd.

Working Capital Advisors (UK) Ltd. is a London-based investment firm with a focus on value investing. The firm currently holds four stocks in its portfolio, with a total equity of $142 million. Its top holdings include Funko Inc (NASDAQ:FNKO), Stitch Fix Inc (NASDAQ:SFIX), Open Lending Corp (NASDAQ:LPRO), and Hagerty Inc (NYSE:HGTY). The firm's investments are primarily concentrated in the Consumer Cyclical and Financial Services sectors.

Overview of Funko Inc

Funko Inc, a pop culture consumer products company based in the USA, creates unique and fun products that allow customers to express their affinity for their favorite movie, TV show, video game, musician, or sports team. The company operates in several segments, including Core Collectible, Loungefly, Other, and Loungefly Branded Products. As of August 28, 2023, the company has a market capitalization of $331.527 million.

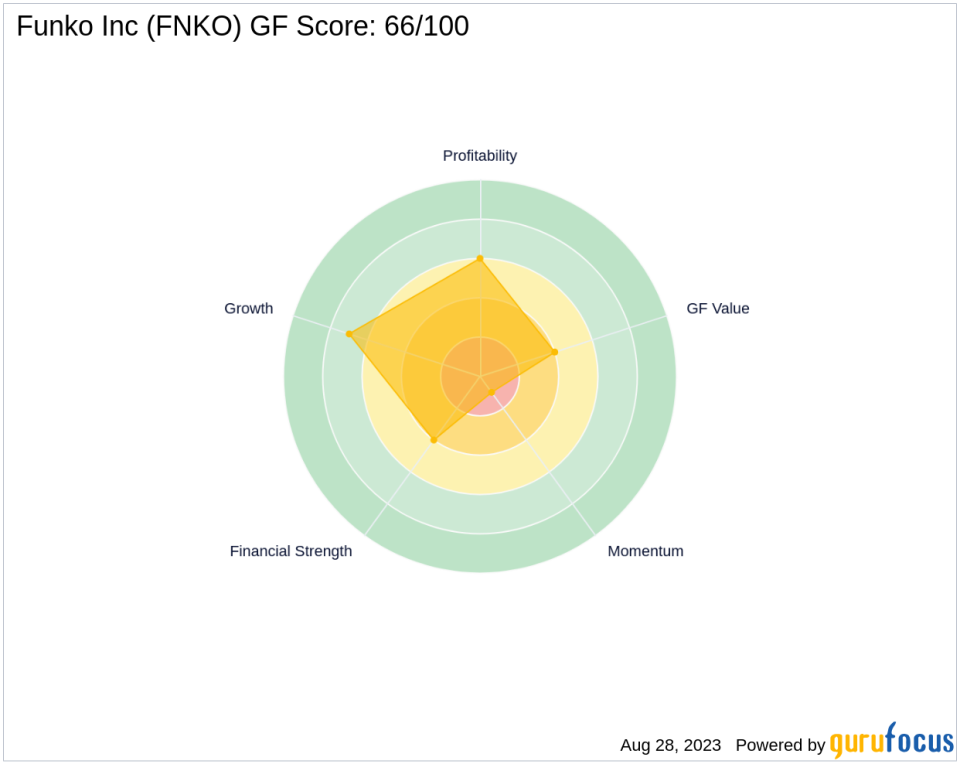

The stock is currently trading at $6.4, with a PE percentage of 0.00, indicating that the company is at a loss. According to GuruFocus's GF-Score, the stock has a score of 66/100, suggesting a potential for average performance. The company's financial strength is ranked 4/10, while its profitability rank is 6/10. The growth rank stands at 7/10.

Performance and Financial Health of Funko Inc

Since its IPO on November 2, 2017, Funko Inc's stock has decreased by 20%. The year-to-date price change ratio is -40.96%. The company's Altman Z score is 1.38, and its Piotroski F-Score is 3, indicating a weak financial position. The cash to debt ratio is 0.09, ranking 665th in the industry.

In terms of industry performance, Funko Inc operates in the Travel & Leisure sector. The company's ROE is -46.32, ranking 724th, and its ROA is -15.11, ranking 758th. The gross margin growth is -2.10, while the operating margin growth is 0.00. Over the past three years, the company has seen a revenue growth of 7.10%, an EBITDA growth of -34.20%, and an earning growth of 0.00%.

Momentum and Relative Strength Index (RSI) of Funko Inc

The 5-day RSI for Funko Inc is 58.93, the 9-day RSI is 45.97, and the 14-day RSI is 38.93, ranking 276th. The momentum index for the past 6 - 1 month is -34.63, ranking 821st, and for the past 12 - 1 month, it is -68.43.

Largest Guru Holding Funko Inc

As of the latest data, the largest guru holding Funko Inc is Hotchkis & Wiley Capital Management LLC. However, the exact share percentage held by the company is not available at the moment.

Conclusion

In conclusion, Working Capital Advisors (UK) Ltd.'s recent acquisition of Funko Inc shares represents a significant addition to its portfolio. Despite the company's current financial challenges, the firm's investment suggests a belief in its potential for future growth. This transaction could have a significant impact on the stock's performance and the firm's portfolio in the future. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.