Working Capital Advisors (UK) Ltd. Acquires Additional Shares in Funko Inc.

Working Capital Advisors (UK) Ltd., a London-based investment firm, has recently increased its stake in Funko Inc. (NASDAQ:FNKO), a leading pop culture consumer products company. This article provides an in-depth analysis of the transaction, the guru's profile, and the traded stock's performance.

Transaction Details

The transaction took place on September 12, 2023, with the firm adding 112,886 shares to its holdings. The shares were traded at a price of $7.04 each. This acquisition has increased the firm's total holdings in Funko Inc. to 6,818,797 shares, representing 13.16% of the company's outstanding shares. The transaction had a 0.56% impact on the firm's portfolio, making Funko Inc. a significant holding, accounting for 33.6% of the portfolio.

Profile of the Guru: Working Capital Advisors (UK) Ltd.

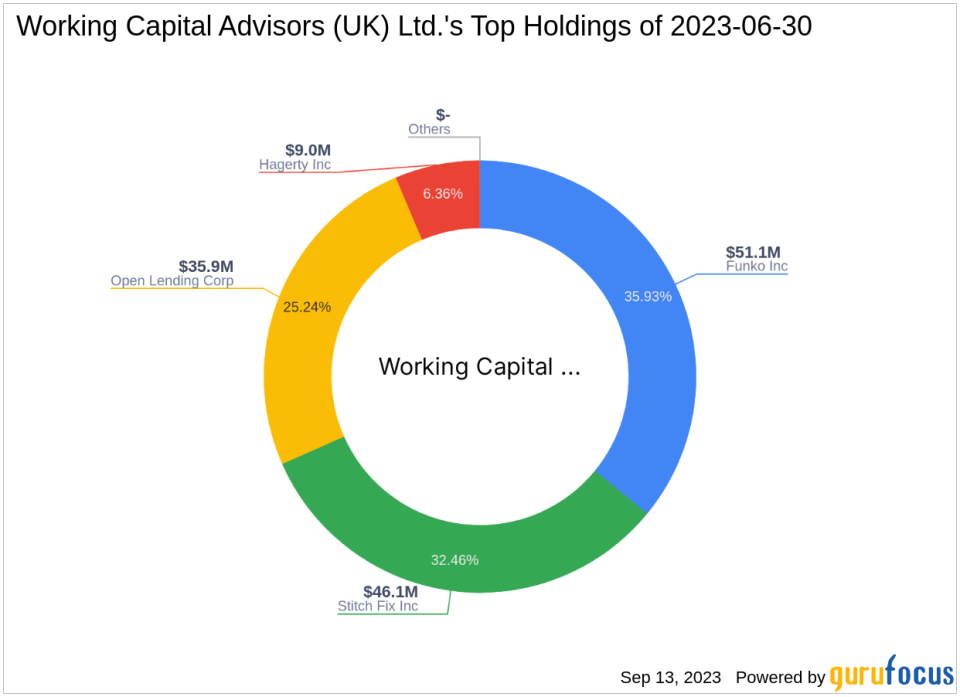

Working Capital Advisors (UK) Ltd. is a London-based investment firm with a focus on value investing. The firm currently holds four stocks in its portfolio, with a total equity of $142 million. Its top holdings include Funko Inc. (NASDAQ:FNKO), Stitch Fix Inc. (NASDAQ:SFIX), Open Lending Corp. (NASDAQ:LPRO), and Hagerty Inc. (NYSE:HGTY). The firm's investments are primarily concentrated in the Consumer Cyclical and Financial Services sectors.

Overview of the Traded Stock: Funko Inc.

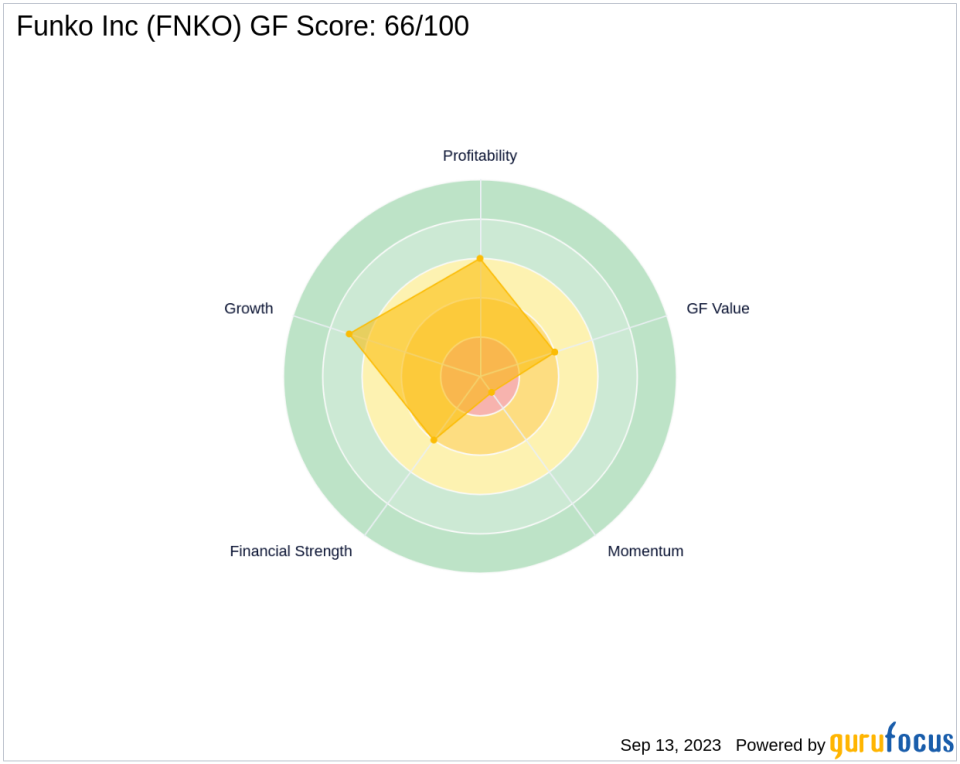

Funko Inc., based in the USA, is a pop culture consumer products company known for its whimsical and fun products. The company holds licenses for tens of thousands of characters from popular movies, TV shows, video games, musicians, and sports teams. Its products are sold through a diverse network of retail customers across multiple retail channels, including specialty retailers, mass-market retailers, and e-commerce sites. The company's market capitalization stands at $372.45 million, with a current stock price of $7.19. The GF-Score of the stock is 66/100, indicating a potential for average performance.

Performance and Ranking of the Stock

Funko Inc.'s financial health and profitability are reflected in its Financial Strength and Profitability Rank. The company has a Balance Sheet Rank of 4/10 and a Profitability Rank of 6/10. Its Growth Rank is 7/10, indicating a moderate growth potential. The GF Value Rank of the stock is 4/10, suggesting that the stock might be overvalued. The Momentum Rank is 1/10, indicating a weak momentum in the stock price.

Financial Health of the Stock

The company's financial health can be assessed by its interest coverage and Altman Z score. Funko Inc. has a Cash to Debt ratio of 0.09, ranking 668th in the industry. The company's Return on Equity (ROE) is -46.32, ranking 723rd, and its Return on Assets (ROA) is -15.11, ranking 759th.

Growth and Momentum of the Stock

The company's growth and momentum can be evaluated by its Gross Margin Growth, Operating Margin Growth, and Revenue Growth over the past three years. The company has seen a Revenue Growth of 7.10% over the past three years, ranking 221st in the industry. However, its EBITDA Growth over the same period is -34.20%, indicating a decline in earnings before interest, taxes, depreciation, and amortization.

Largest Guru Holder of the Stock

The largest guru holder of Funko Inc. is Hotchkis & Wiley Capital Management LLC. The exact share percentage held by the firm is not disclosed.

Transaction Analysis

The recent acquisition by Working Capital Advisors (UK) Ltd. has further solidified its position in Funko Inc. The transaction has not only increased the firm's stake in the company but also its influence on the stock. The firm's continued investment in Funko Inc. indicates its confidence in the company's future prospects. However, investors should also consider the company's financial health, growth potential, and current market valuation before making investment decisions.

All data and rankings are accurate as of September 13, 2023.

This article first appeared on GuruFocus.