Working Capital Advisors (UK) Ltd. Boosts Stake in Funko Inc

Working Capital Advisors (UK) Ltd., a London-based investment firm, recently made a significant addition to its portfolio by acquiring 1,334,005 shares in Funko Inc. (NASDAQ:FNKO). This article provides an in-depth analysis of the transaction, the firm's profile, and an overview of Funko Inc. It also examines the financial health and market position of Funko Inc, as well as the largest guru holding the company.

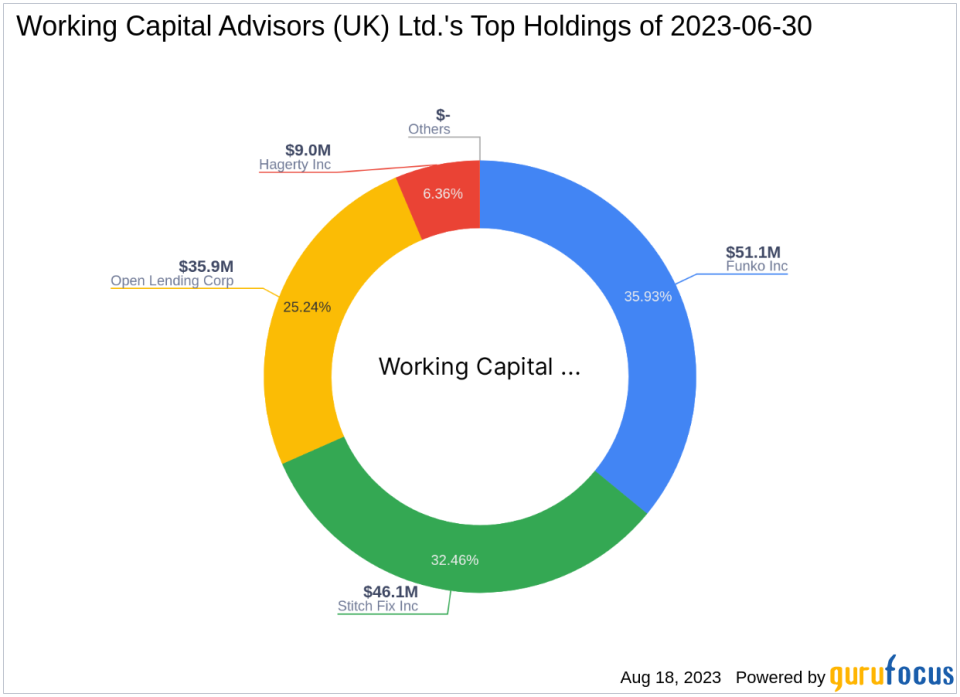

Profile of Working Capital Advisors (UK) Ltd.

Working Capital Advisors (UK) Ltd. is a renowned investment firm based in London. The firm's portfolio primarily focuses on the Consumer Cyclical and Financial Services sectors. With an equity of $142 million, the firm holds stocks in four companies, with Funko Inc(NASDAQ:FNKO), Stitch Fix Inc(NASDAQ:SFIX), Open Lending Corp(NASDAQ:LPRO), and Hagerty Inc(NYSE:HGTY) being its top holdings.

Details of the Transaction

The transaction took place on August 15, 2023, with Working Capital Advisors (UK) Ltd. adding 1,334,005 shares of Funko Inc to its portfolio at a trade price of $5.32 per share. This acquisition has significantly impacted the firm's portfolio, with Funko Inc now accounting for 21.58% of its holdings. The firm now holds 12.48% of Funko Inc's total shares.

Overview of Funko Inc

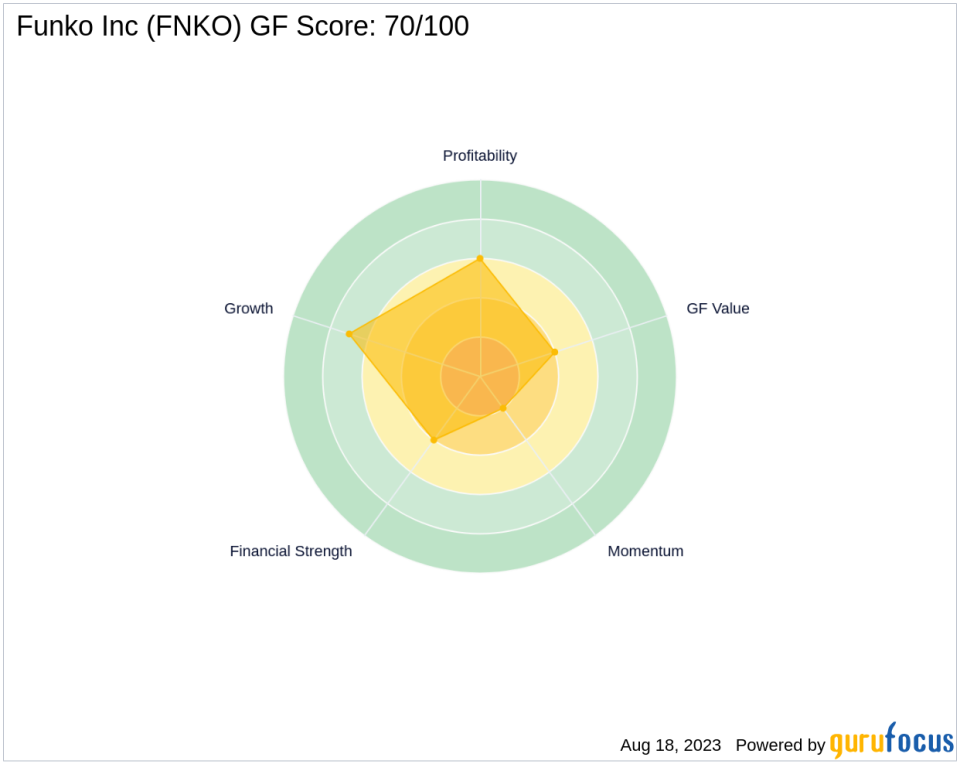

Funko Inc, a pop culture consumer products company based in the USA, creates whimsical, fun, and unique products that allow customers to express their affinity for their favorite movie, TV show, video game, musician, or sports team. The company, which went public on November 2, 2017, has a market capitalization of $315.469 million and a current stock price of $6.09. Despite its promising business model, Funko Inc's performance since its IPO has been less than stellar, with a price change ratio of -23.88%. The company's GF Score stands at 70/100, indicating a poor future performance potential.

Funko Inc's Financial Health

When it comes to financial strength, Funko Inc has a balance sheet rank of 4/10, a profitability rank of 6/10, and a growth rank of 7/10. The company's cash to debt ratio stands at 0.09, and it has a ROE of -46.32 and a ROA of -15.11. Furthermore, the company's five-year gross margin decline is approximately 2.10% per year on average, and its interest coverage is 0.00 (at loss), indicating potential financial challenges.

Funko Inc's Position in the Market

Funko Inc's GF Value Rank is 4/10, and its Momentum Rank is 2/10. The company's Piotroski F-Score is 3, and its Altman Z score is 1.34. The company's RSI 14 Day Rank is 39, and its Momentum Index 6 - 1 Month Rank is 791. These rankings suggest that Funko Inc's position in the market is relatively weak.

Largest Guru Holding Funko Inc

The largest guru holding Funko Inc is Hotchkis & Wiley Capital Management LLC. The significance of their share percentage in Funko Inc is currently not available.

Conclusion

In conclusion, Working Capital Advisors (UK) Ltd.'s recent acquisition of Funko Inc shares is a significant addition to its portfolio. However, given Funko Inc's financial health and market position, the implications of this transaction for both the firm and Funko Inc remain to be seen. It is crucial for investors to keep a close eye on these developments and make informed decisions accordingly.

This article first appeared on GuruFocus.