Working Capital Advisors (UK) Ltd. Acquires Significant Stake in Funko Inc

On August 24, 2023, Working Capital Advisors (UK) Ltd. made a notable addition to its portfolio by acquiring 6,277,409 shares in Funko Inc. This transaction has significantly impacted the firm's holdings, with Funko Inc now accounting for 26.67% of its portfolio. The shares were traded at a price of $6.06 each.

Funko Inc, a pop culture consumer products company based in the USA, is known for creating unique and fun products that allow customers to express their affinity for their favorite movie, TV show, video game, musician, or sports team. The company holds licenses and rights to create tens of thousands of characters from popular franchises such as Game of Thrones, Walking Dead, Disney, Marvel, Harry Potter, Fallout, and others. Its products are sold through a diverse network of retail customers across multiple retail channels, including specialty retailers, mass-market retailers, and e-commerce sites.

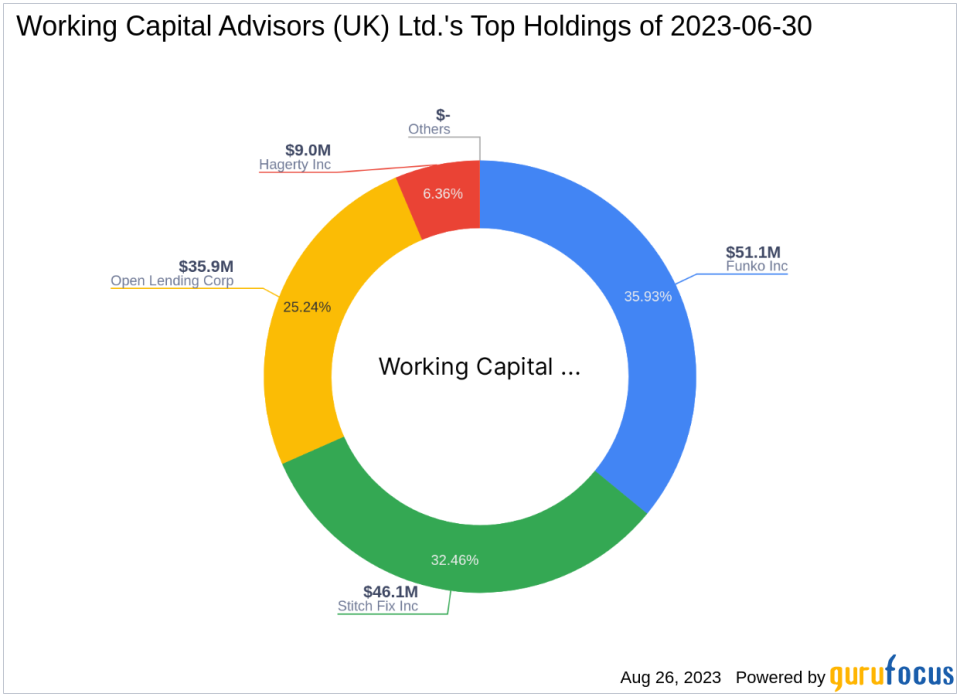

About Working Capital Advisors (UK) Ltd.

Working Capital Advisors (UK) Ltd., a firm based in London, UK, is known for its strategic investment decisions. The firm's top holdings include Funko Inc(NASDAQ:FNKO), Stitch Fix Inc(NASDAQ:SFIX), Open Lending Corp(NASDAQ:LPRO), and Hagerty Inc(NYSE:HGTY), with a total equity of $142 million. The firm primarily invests in the Consumer Cyclical and Financial Services sectors.

Transaction Details

The transaction saw a trade change of 1.46, with a share change of 90,185. This acquisition has increased the firm's holdings in Funko Inc to 12.12%. The transaction has had a 0.38 impact on the firm's portfolio.

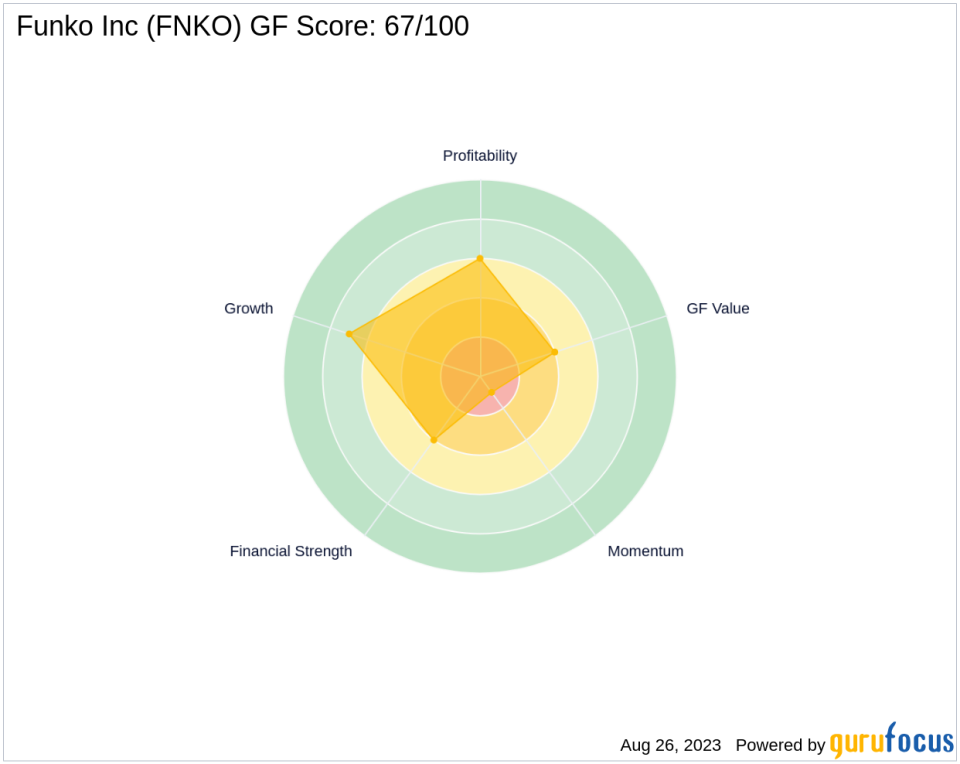

Funko Inc Stock Analysis

Funko Inc, listed under the symbol FNKO, went public on November 2, 2017. The company has a market cap of $322.203 million and a current stock price of $6.22. However, the company's PE percentage is currently at 0.00, indicating that the company is at a loss. The GF-Score of Funko Inc is 67/100, suggesting a poor future performance potential.

Performance of Funko Inc Stock

Since its IPO, Funko Inc has seen a price change of -22.25%. The year-to-date price change ratio is -42.62%. The company's financial strength is ranked at 4/10, while its profitability rank is at 6/10. The growth rank is at 7/10, indicating a moderate growth potential.

Financial Health of Funko Inc

Funko Inc's Piotroski F-Score is 3, and its Altman Z score is 1.38. The company's cash to debt ratio is 0.09, ranking it at 663. These figures suggest that the company's financial health could be a concern.

Industry Position of Funko Inc

Funko Inc operates in the Travel & Leisure industry. The company's ROE is -46.32, and its ROA is -15.11. The gross margin growth is -2.10, while the operating margin growth is 0.00. These figures indicate that the company's industry position is relatively weak.

Largest Guru Holding Funko Inc

Hotchkis & Wiley Capital Management LLC is the largest guru holding Funko Inc, further demonstrating the stock's appeal to savvy investors.

In conclusion, the acquisition of Funko Inc by Working Capital Advisors (UK) Ltd. is a significant move that has greatly impacted the firm's portfolio. However, the financial health and industry position of Funko Inc suggest that investors should exercise caution when considering this stock.

This article first appeared on GuruFocus.